Which banks support the cashback program for Mir cards?

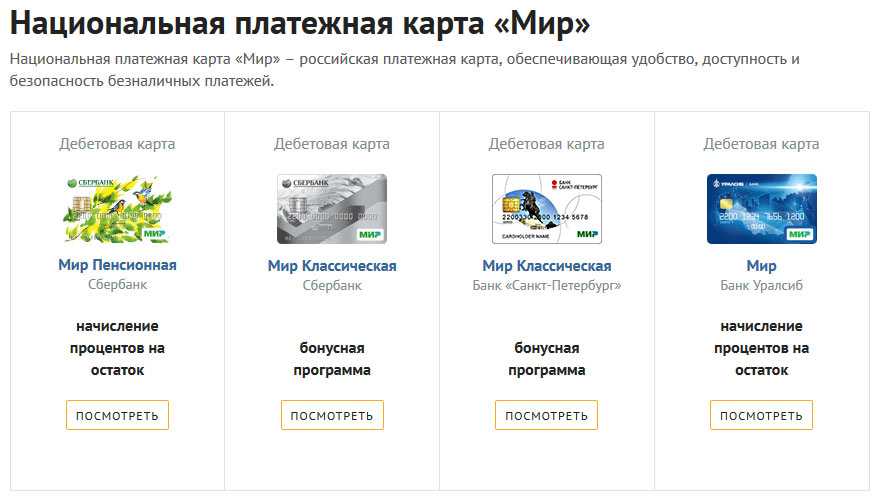

For, to start using the program you need a registered active card "Mir". You can get it in one of the banks of the Russian Federation - in Sberbank, VTB, Gazprombank and many others. To date, more than 350 banks. You can register in the cashback service cards of the following banks: AB RUSSIA, Avtogradbank, Asian-Pacific Bank, Ak Bars Bank, Acceptance, Almazergienbank, Altynbank, Alfa-Bank, Bank Venets, Bank "Revival, VTB Bank, VTB24 Bank, Bank Kuban Credit, Bank Levoberezhny, Bank Orenburg, Bank Primorye, Bank "Russia, Bank "Saint-Petersburg, Bank Saratov, SGB Bank, Bank Tavrichesky, Tinkoff Bank, Finservice Bank, Bank Khlynov, Volgo-Caspian Joint Stock Bank, All-Russian Bank for Regional Development, Gazprombank, GENBANK, Geobank, GLOBEX, Far Eastern Bank, Ekaterinburg Municipal Bank, Yenisei United Bank, Zhivago-bank, Izhkombank, Interprogressbank, KB Vostochny, KS Bank, Kuznetskbusinessbank, Lipetskkombank, MINB, Moscow Commercial Bank, Credit Bank of Moscow, MOSOBLBANK, Municipal Kamchatprofitbank, NIKO-BANK, Novikombank, Promsvyazbank, RNKB, Rosbank, Rosgosstrah Bank, RosEuroBank, Rosselkhozbank, Russian capital, RTS-Bank, Sarovbusinessbank, Sberbank, SDM-Bank, Sevastopol Marine Bank, SIAB, SKB-Bank, SMP Bank, Stavropolpromstroybank, UBRD, URALSIB, Uraltransbank, FC Otkritie, Khakassky Municipal Bank, FondServisBank, Center-invest Bank, Black Sea Development and Reconstruction Bank and Energotransbank.

Banks actively support Mir with their own incentive programs. This makes the use of this card even more profitable - after all, the card holder can earn with the loyalty service of the Mir payment system in addition to the bonuses of his bank.

There are also exclusive offers from banks only for Mir cards: eg, Tinkoff Bank offers the World Invasion program, B&N Bank - Russian Geographical Society, this also includes the "Thank you" program from "Sberbank".

So the advantages of the "World" card are quite obvious.. It remains only to connect the card to the cashback system. This can be done on the official website of the loyalty program.

Map types

At the moment, several debit plastic options have been developed for individuals, differing in terms of service and receipt.

Classic

Карта доступна гражданам РФ при достижении возраста четырнадцати лет. It is possible to independently receive or register as part of a salary project.

The card has a number of features and includes the following features:

- You can top up your balance in different ways: cash and non-cash. This applies to any transfers from various payment systems.

- You can pay for goods and services through special terminals, which are installed in organizations and stores. Contactless payment form available. Similar operations are available via the Internet.

- By connecting APP for mobile phones and tablets, as well as the Sberbank Online service, control of expenses and account management is carried out.

- Дополнительная услуга по автоматическому платежу обеспечивает своевременную оплату ЖКХ и пополнение баланса сотового телефона.

- The card user gets the opportunity to use the "Thank you" bonus program, which allows Sberbank customers to accumulate points and pay with them.

- Additionally, the "Piggy bank" service is available, which ensures the creation of separate savings.

- Registration for free, and the validity period is 5 years.

Using the classic card, you can perform standard operations, and also accumulate bonuses, which are used to get discounts in partner stores.

Gold

Карта Gold системы Мир от Сбербанка относится к премиальным, as it enables the client to emphasize his special status. May be a member of a special group for receiving budgetary charges, but only at the request of the user or employer.

Gold card has the following features:

- Available upon confirmation of registration on the territory of the Russian Federation. The client must be of legal age.

- Gold option gives an advantage, which consists in the release of additional plastic for users from 7 years, taking into account the binding to the main map.

- Thank you bonuses can be up to 20% from the purchase amount from partners and 0,5% from Sberbank.

- Remote system "Mobile Bank" and an online resource for individuals, which is available in the form of a personal account, allow you to exercise full control over all operations.

- You can pay by withdrawing cash or using a contactless transfer.

- When paying online with premium cards, additional security is provided by 3D-secure technology.

- Cashless transfers are valid at all ATMs and self-service terminals.

- Дополнительный кэшбэк для пользователей.

- The validity period is 5 years.

To receive increased bonuses Thank you on the MIR Gold card, you need to make transactions within a month, falling under the category of bonuses, more than 15 000 rub. The accrual will be made in the next billing period. Taken into account, that it is the bonus program from Sberbank that is an alternative to the popular cashback.

Pension

This option is available only to recipients of social benefits from a pension fund. The merit of this card is, that here interest is calculated on the balance up to 3,5% annual.

The possibilities of pension plastic are as follows:

- Full access to account management, which is provided using a mobile application and Sberbank-online.

- Convenient cashless payments via the Internet and in offline points of sale of goods and services, with the possibility of using MirAccept technology.

- Reduced commission for the "Autopayment" service when paying for housing and communal services.

- Interest-free cash withdrawal through bank terminals of Sberbank. Using self-service terminals, you can transfer received money to other accounts.

How to report new payment details

Если карта «Мир» или счет без карты оформлены в том же банке, где был открыт предыдущий счет для этих выплат, делать ничего не нужно. При поступлении денег из пенсионного фонда или соцзащиты банк сам проверит, подходит ли тот счет, что указан в платежке. Если нет — банк посмотрит, есть ли у получателя подходящие счета. И если такой уже открыт — выплаты попадут туда без дополнительных заявлений.

Если подходящего счета в банке нет, он сообщит о проблемах с зачислением и предложит все правильно оформить. Иначе деньги не зачислятся: банк не имеет на это права по закону.

Если нужный счет оформлен в другом банке — не там, где открыт указанный в заявлении на выплаты, — тогда нужно сообщить новые реквизиты в соцзащиту, Pension Fund, работодателю или в центр занятости. То есть в тот орган, куда подавали заявление на конкретные выплаты.

Пенсионеры могут сделать это электронно — через личный кабинет, с помощью заявления о доставке пенсии. The easiest way to transfer the details to the employer is: written statement.

Подавать новое заявление о назначении выплат с новыми реквизитами не нужно. Уточните в соцзащите или центре занятости, как передать информацию о счете в вашем случае.

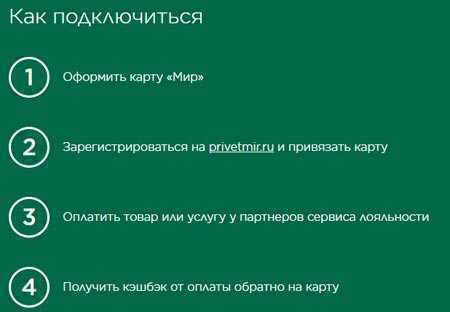

How to activate cashback on the MIR card

Initially, you must have a card. If there is no plastic yet, select bank, read its terms and conditions and all the benefits of cashback service. After that, fill out an application at the nearest branch or on the website of the financial institution. It remains to get a card and become a member of a unique program, which means the return of money.

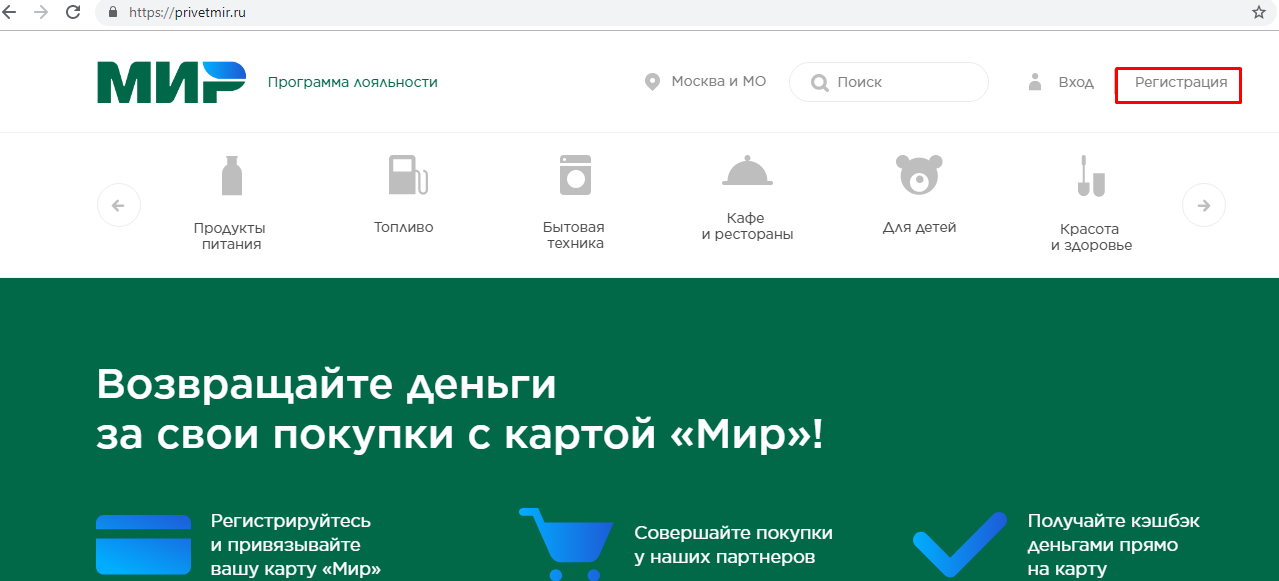

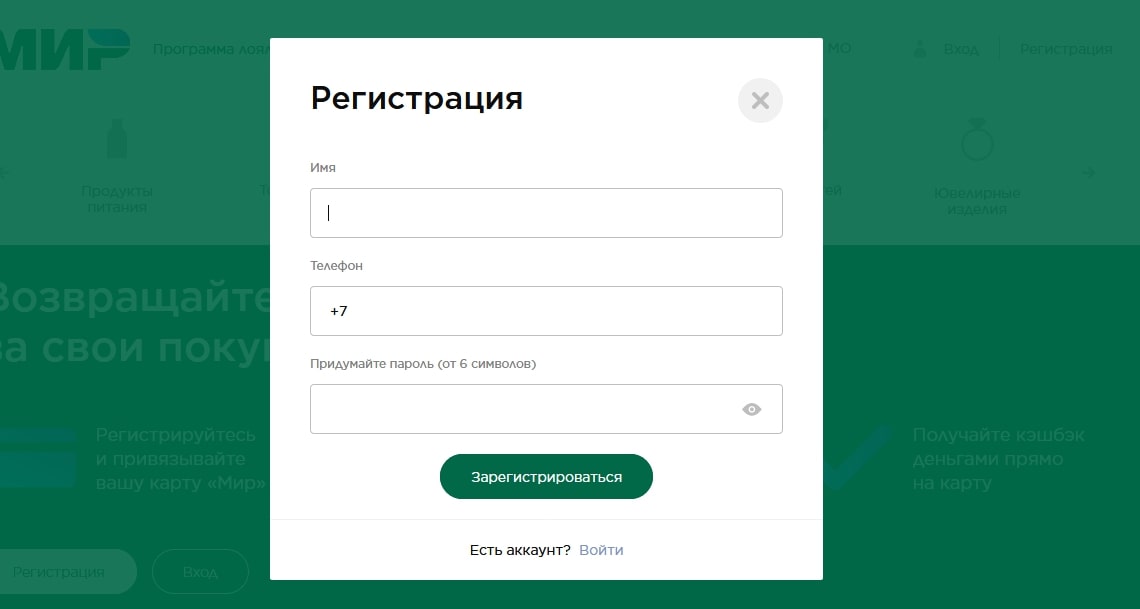

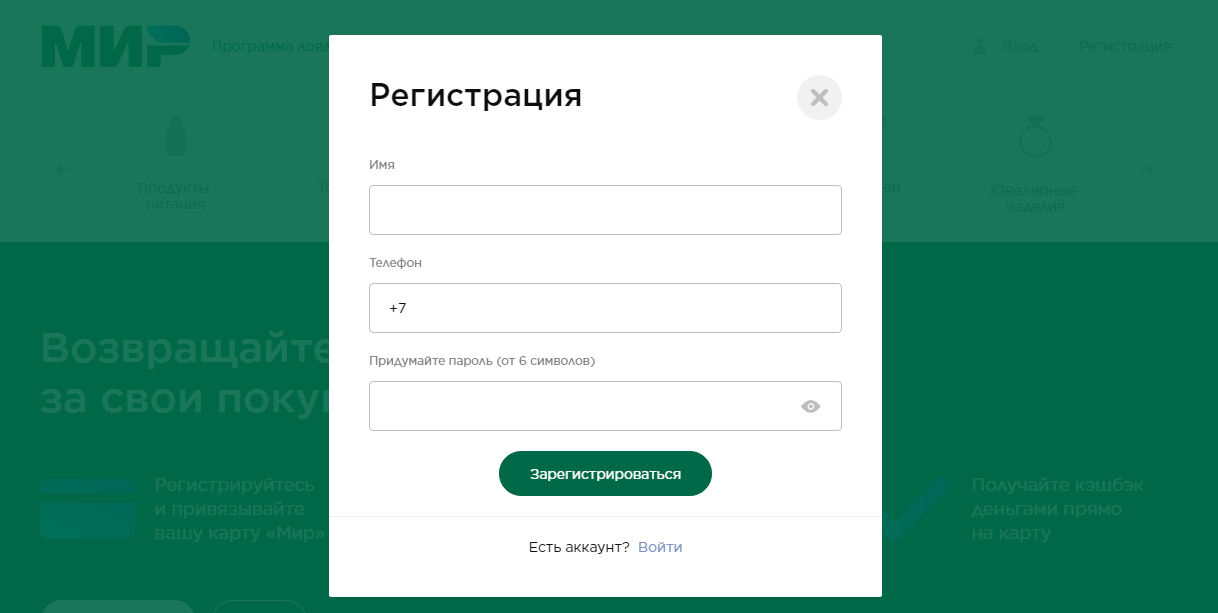

Registration on the official website

It won't take long to register a MIR card and receive cashback. You need to go to the https website://privetmir.ru and click in the upper right corner - "Registration".

In the form that appears, specify the name, phone and come up with a strong password, which will be at least six characters. Then you need to click on the green button "Register".

In just a couple of seconds you will receive a one-time code to the specified mobile phone number. It is intended to activate a personal account.

The next step is to provide an email address, gender and date of birth. To return money to your bank card, it must be linked to your account.

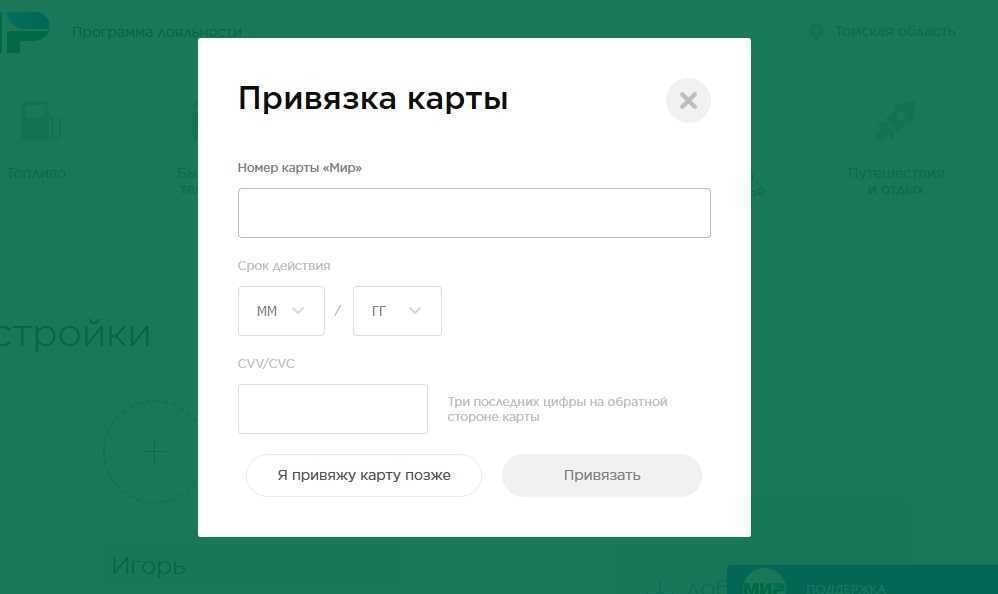

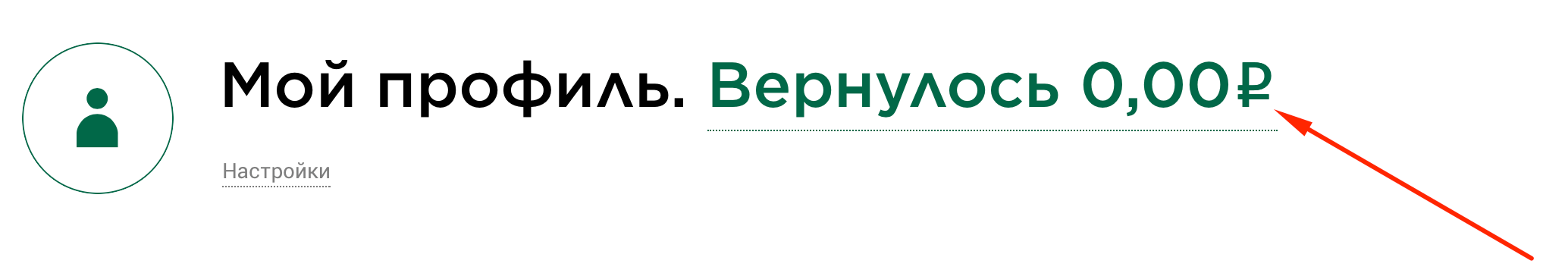

Linking a card in your personal account

First you need to enter your personal account. To do this, you need to click on the "Login" button, which is in the upper right corner, and in the form that appears, specify information for authorization in the system. Then find the "Settings" section and enter your bank card details.

Before connecting plastic to the cashback service, a verification request will be sent to the bank. Therefore, funds in the amount of one ruble are blocked on the card. When authorization is completed, the amount is unblocked. The program participant receives a notification that, that his card has been successfully linked to his account. This completes the registration of the MIR card for cashback.

Interesting about Russia

Together with the Russian Geographical Society, we tell about historical places and unexplored corners of our country. All-Russian public organization "Russian Geographical Society" - one of the oldest geographical societies in the world. Their main task is to collect and disseminate reliable geographic information..

-

Participants of the Steppe Expedition of the Russian Geographical Society assessed the condition of the giant trees of the Buzuluk pine forest

Read more

05.11.20 -

Их смогут увидеть участники турмаршрута РГО «Золотое кольцо Боспорского царства»

Read more

05.11.20 -

A group of cavers discovered the cave at the end of October

Read more

03.11.20 -

Малыш попал на фотоснимок вместе со взрослыми зубрами

Read more

27.10.20 -

Among them are slotted bone tools from the Paleolithic times and an ancient hearth

Read more

27.10.20 -

They prove, that the region was a major center of ancient civilization

Read more

13.10.20

-

В начале XVIII века множество картографов и геодезистов разъезжали по городам и весям, составляя по указу Петра I карты российских территорий. Первая попытка объединить их в атлас не увенчалась успехом, но создала основу для издания 1745 of the year, подготовленного стараниями учёных из Императорской академии наук. Так появился один из первых в мире географических атласов целой страны.

Read more

-

Наука может быть не менее азартным делом, than great sport. The winner is the one, who will be the first to discover, добраться до неисследованной географической точки, deduce a previously unknown pattern. Советские учёные держали марку не хуже наших олимпийцев, и Первая высокоширотная экспедиция 1935 года наглядно это подтверждает. 6 июля исполняется 85 лет с её начала.

Read more

-

«Плавание я расположил так, чтобы на пути принести возможную пользу Географии», Wrote Thaddeus Bellinshausen. Во время кругосветной экспедиции он и Михаил Лазарев не ограничились открытием Антарктиды, постаравшись заполнить как можно больше «белых пятен» на карте Земли. Ради этого они прошли по широте, which other captains preferred to avoid. The tactics paid off: in July 1820 года «Восток» и «Мирный» один за другим открыли 13 островов архипелага Туамоту. Five more atolls of the archipelago were discovered four years earlier by our navigator Otto Kotzebue, и Туамоту получил название «Острова Россиян».

Read more

-

Five reasons to visit the Lower Angara region

Площадь Красноярского края — 2 366 797 sq. km, what in 6,6 раза больше площади Германии. Изучить его полностью — всей жизни не хватит. Putorana Plateau, reserve "Stolby", природный парк «Ергаки» известны на весь мир. А есть и такие места, о которых знают единицы. Но именно они представляют большой интерес для любопытного исследователя. Одно из таких мест — Мотыгинский район, который находится в самом сердце Сибири на реке Ангаре. Здесь богатство таёжных лесов сочетается с чистотой быстрых рек, bizarre rocks keep the secrets of the ancient civilizations of Asia, о которых исследователи знают пока совсем мало. Тур «В гости к Усть-Тасеевскому идолу», organized by the Krasnoyarsk tour operator "Sibway Tour", входит в число «Путешествий с РГО».

Read more

Rates

It is necessary to use the selected type of World card taking into account the existing fees and charges for additional services.

| Rate | Card from Sberbank | ||

| Social | Classic | Gold | |

| Annual maintenance | Is free | 750 rub. - First year

450 rub. - further |

3 000 rubles |

| Additional maps | No | No | Yes

Service - 2500 rub / year |

| Re-release | Is free

In case of loss - 30 rub. |

Is free

In case of loss - 150 rub. |

Is free |

| Cash withdrawal through Sberbank | No commission

When the limit is exceeded - 0,5% |

No commission

When the limit is exceeded - 0,5% |

No commission

When the limit is exceeded - 0,5% |

| Receiving cash from third parties | 1%

(but not less 100 rub. through terminals and 150 rub. through cash desks) |

1%

(but not less 100 rub. through terminals and 150 rub. through cash desks) |

1%

(but not less 100 rub. through terminals and 150 rub. through cash desks) |

| Issuance limit | Сутки – 50 000 rub.

Month - 500 000 rub. |

Сутки – 150 000 rub.

Month - 1 500 000 rub. |

Сутки – 300 000 rub.

Month - 3 000 000 rub. |

| Payment by card | No commission | No commission | No commission |

| SMS informing | 2 months free, and then 30 rub. | 2 months free, and then 60 rub. | Is free |

Loyalty program MIR

The national payment system appeared just a few years ago as a response to the anti-Russian sanctions of the West. During this time, all social payments and salaries of budget employees began to come exclusively to MIR cards. Other categories of bank clients also have such plastic, but so far he is significantly losing to Wiese and Mastercard. What is the difference between them, we talked about in one of the previous articles. Transactions are processed on the territory of Russia in NSPK, so national cards will work, even if foreign services leave our country.

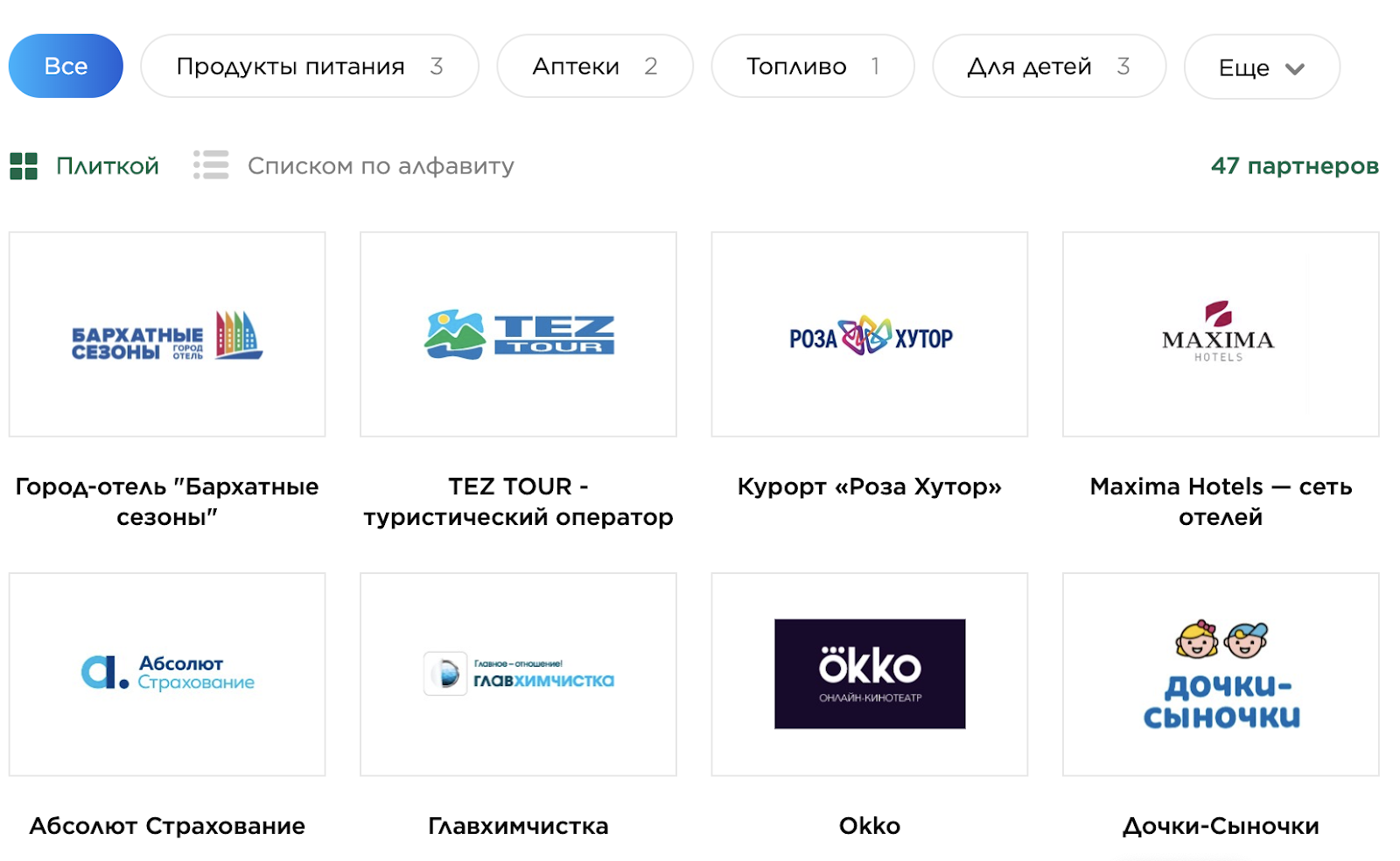

Similar to international payment systems, Russian cards allow you to participate in a profitable loyalty program. It differs from those bonuses, what the bank gives to its clients, and aims to popularize the national plastic. But unfortunately, few bank card holders are aware of this possibility.

so, what is the MIR card loyalty program? These are special conditions of service for plastic owners, regardless of the bank., who released it. Any client of the national payment system can receive bonuses. Be it salary, pension or social card. Refunds are not charged only for corporate accounts, because their owners should be individuals.

Cashback works throughout Russia, including on the Crimean peninsula. There is a list of partner banks on the website of the national payment system. Although usually not necessary to contact him, only if your card is issued by a little-known financial institution. Such giants, like Sberbank, VTB, Alfa-Bank, Gazprombank absolutely surely joined the bonus system.

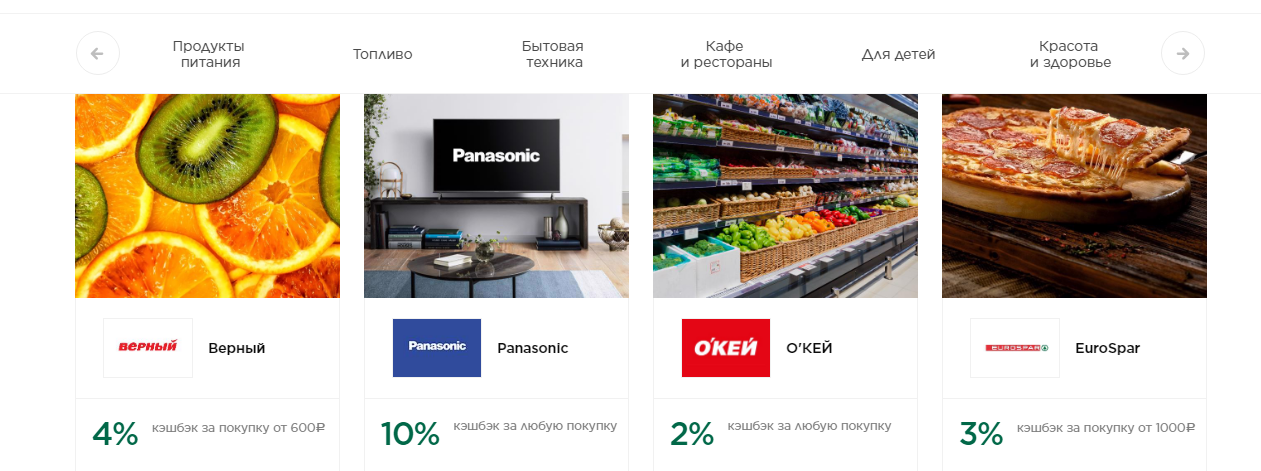

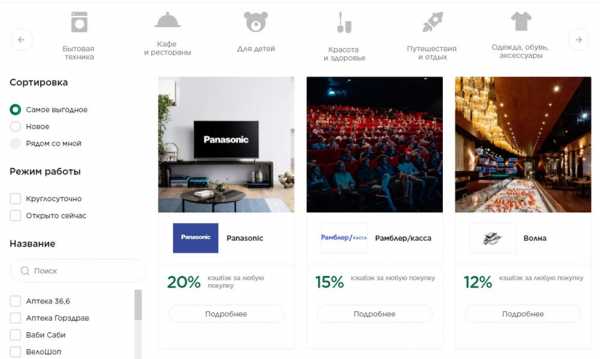

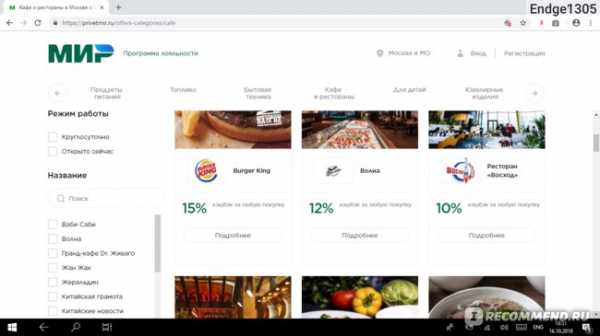

The main advantage of the program is the crediting of cashback for purchases, made from a card account. There are certain partners of the payment system, which give bank customers a good return on purchases. Sometimes it reaches 20% and even more. Each user can go to the MIR website and see, what bonuses are available to him at the moment.

This cashback has nothing to do with banking conditions and is used simultaneously. For example, you have issued a social card MIR from Sberbank. After you got her in your arms, go to the bank's website and enable the Thank you from Sberbank option. Then visit the portal of the national payment system and link the card in your personal account.

Disadvantages of the map

- Карта работает только на территории России. За границей этой картой вы расплачиваться не сможете. Although now Sberbank is working on, for this opportunity to appear. Но пока нет. (Это справедливо не только для золотой, но и для классической карты МИР.)

- Single currency, которая может лежать на карте, — рубли.

- Стоимость годового обслуживания очень высокая — 3 000 rubles. Единственный способ окупить эти затраты — ознакомиться со всеми партнерами-организациями из списка банка и расплачиваться исключительно в них. Тогда кэшбэк в 5 % может немного сгладить сумму ежегодной оплаты. We remind: кэшбэк для данной карты возвращается не деньгами, а бонусами СПАСИБО. Так что чисто технически это не совсем кэшбэк.

- Карта не поддерживает оплату с мобильных телефонов. И это в 2020 year, кто бы мог подумать!

- Картой МИР нельзя оплачивать покупки на иностранных сайтах. Only domestic manufacturer!

- Нет дополнительных начислений процентов на остаток на счете.

- В сутки нельзя снять с карты больше 300 000 rubles.

Conditions for obtaining

- Если вы работаете в бюджетной организации, то ваша зарплатная карта в любом случае будет дебетовая карта МИР. Будет ли она классической или золотой, the employer decides, хотя вы можете отправить запрос в бухгалтерию. У них есть возможность запросить у банка именно золотую карту.

- Если вы самостоятельно будете оформлять карту МИР, think a few times, нужна ли вам именно золотая. Потому что отличий от классической не много. Но при этом за обслуживание карты будете платить именно вы, а не работодатель. Стоит ли она того? Вот в чем вопрос.

- MIR card is issued to people, у которых есть постоянная или временная прописка в одном из субъектов Российской Федерации. Держателю карты должно быть больше 18 years.

- The term for issuing or replacing a card is 7-14 calendar days.

Cashback service for Mir cardholders

One of the most popular areas of development of the Mir payment system – refund of money to the client's card in the form of a fixed percentage, so-called cashback, or cashback. This English-language word has become an established term, который используется в сфере банковских услуг и уже прочно укоренился в повседневной речи. Если описывать в целом, then cashback is a kind of bonus program to attract customers and increase their loyalty. In the case of the Mir card, bonuses are returned to the client's account in the form of monetary amounts, moreover, the percentage of return can be very significant - 10%, 20%, 30%, and in some cases it can even reach 100%.

The size of the cashback is determined in accordance with the terms of the promotion of the partner company. Cafes and restaurants, магазины и сервисные центры сами определяют условия акции и указывают размер кэшбэка

Worth paying attention, that the size of the cashback is indicated either as a percentage of the purchase price, either in monetary terms, calculated for specific goods. for example, if, according to the terms of the offer chosen by the client, the card is returned 25% from the purchase price, and the purchase itself was made for the amount 10000 p., then the card will be credited with cashback in the amount of 2500 p

What is the difference between the World map and Visa and Mastercard?

Modern life dictates its own terms, therefore, plastic cards are becoming more and more popular and in demand, with the help of which various monetary transactions are made. Interaction between the bank and the client, which is the plastic holder, carried out at the expense of the selected payment system, providing fast money transfers and any settlements.

therefore, to understand, how the MIR card differs from MasterCard and Visa, should be considered, that the last two options relate to international payment systems, and the World - to the national. Еще имеются и другие различия:

- Visa - is an American PS, which performs dollar conversion processes. The popularity of Visa is due to its high prevalence, which allows you to carry out payment transactions around the world.

- Mastercard is also an American payment system, which performs conversion procedures through euros. The successful development of MasterCard is due to the fact, that many large banks on the territory of the Russian Federation developed active cooperation with PS. It is within this system that cards from Sberbank with the mark "Maestro" function.

- Мир – это часть НСПК России. The main features are, that all operations are carried out on the territory of the country, and for this the ruble is used.

Otherwise, all types of cards have a similar description and allow you to implement similar actions: make payment in online or offline stores, make translations, replenish, withdraw cash. There are also some similarities in payments, in service and commissions for performed operations.

Who can participate in the loyalty program

MIR payment cards are served by many banks. There are more than seventy. This is Sberbank, URALSIB, RUSSIA, Rosselkhozbank, RNKB, VTB, MinBank, Pochtabank, Газпромбанк и другие. Список финансовых учреждений возрастает с каждым годом. Customers use cashback service, which are holders of "classic" and "gold" plastic, cards for pensioners or salary.

What to do, if the bank is not a member of the program? In this case, you need to contact support, by calling or writing a message. Experts will promptly respond to the application and give an answer to the question of interest. А когда ваш банк будет присоединен к программе лояльности, they will inform you, by sending an SMS message to the phone number.