How Can Players Bet on the Mega Millions Lottery?

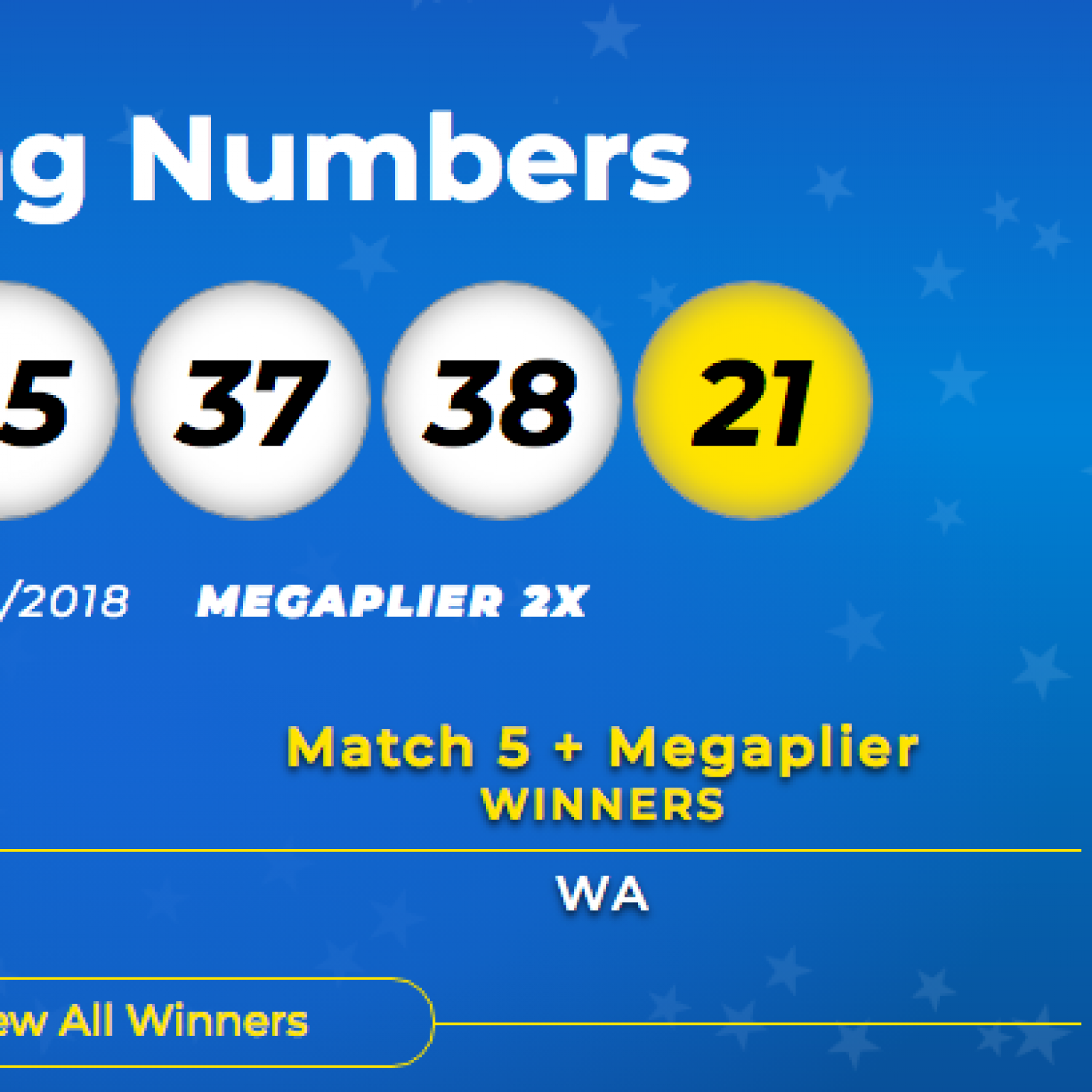

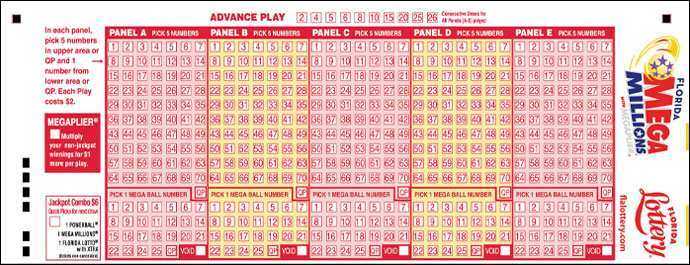

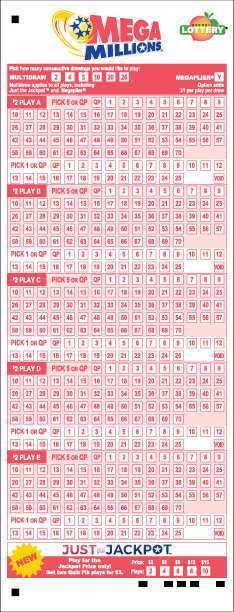

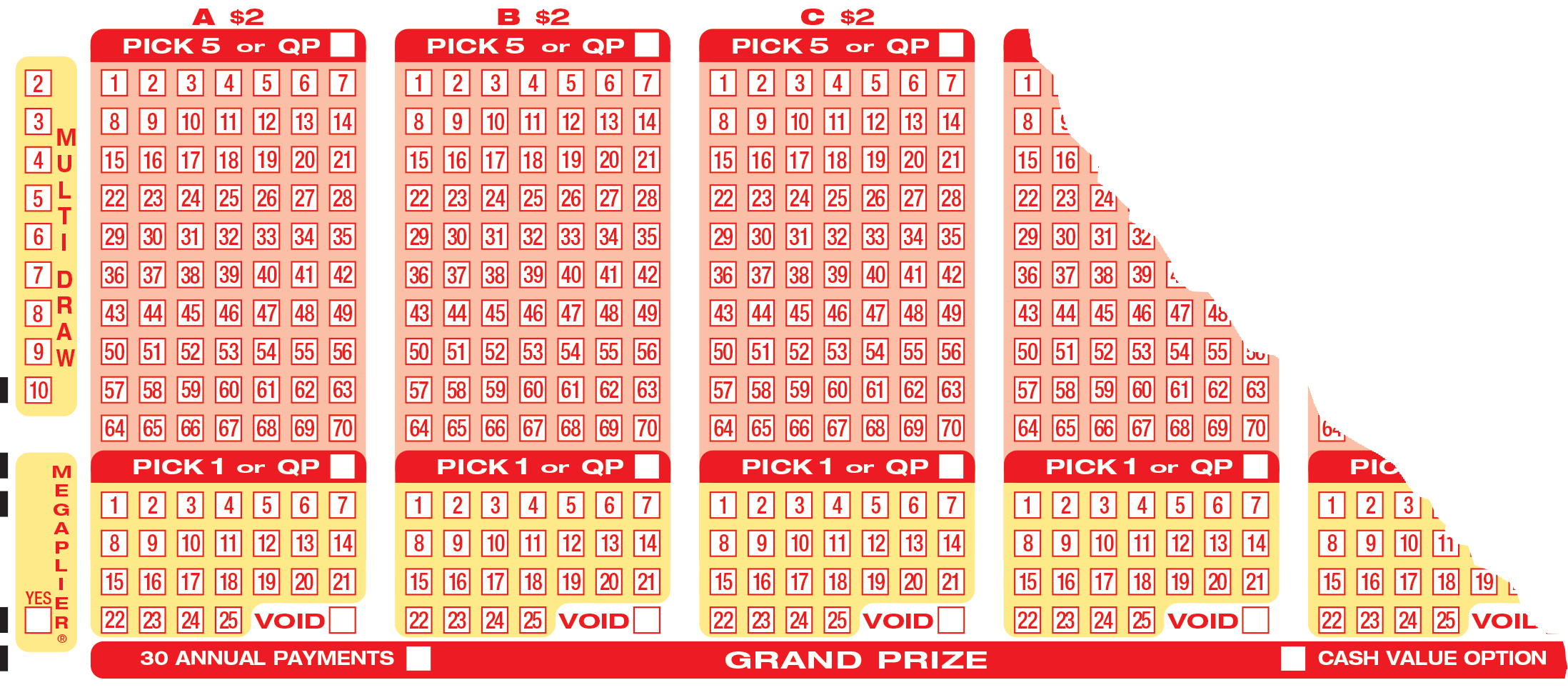

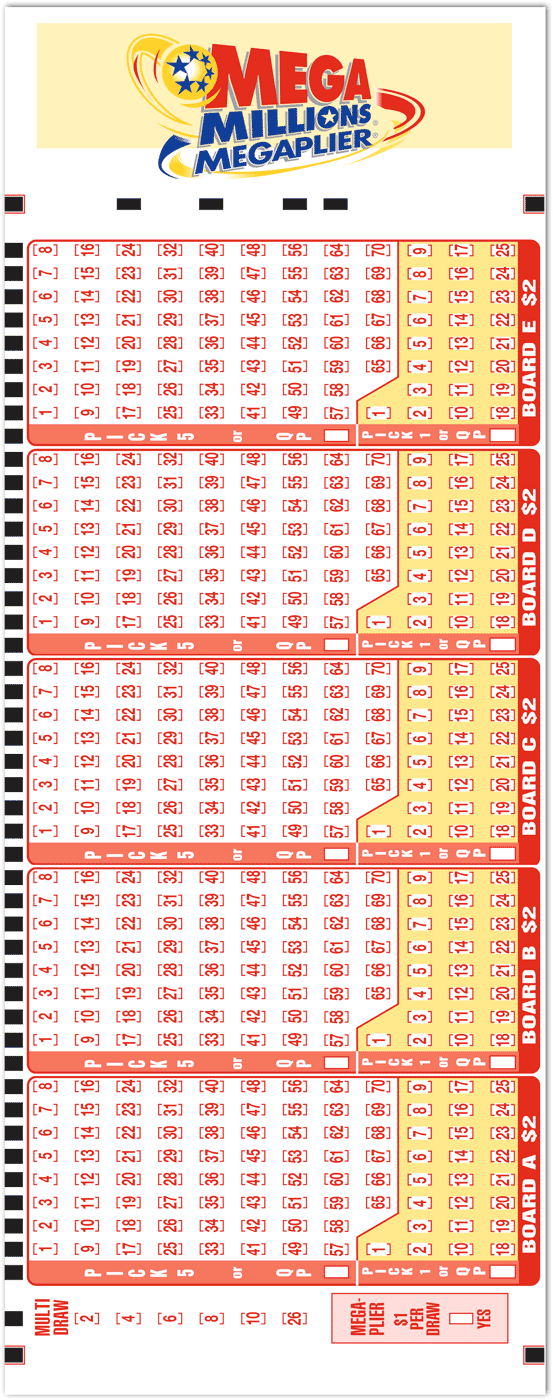

The Mega Millions lottery is one of America’s major draws with its massive jackpots. To bet on this lottery, players simply have to choose five main numbers from 1 to 70 and one Mega Ball number from 1 to 25 to enter the drawings. Draws are held every Tuesday and Friday at 23.00 EAST. All Mega Millions prizes, apart from the jackpot, have a fixed value; the only exception is in California, where non-jackpot Mega Millions prizes are pari-mutuel.

The minimum Mega Millions jackpot is $40 million and there is no maximum limit for the jackpot. There is the possibility that the jackpot rolls over, which means that it increases because it is not won by any of the players. Whenever this happens, the top Mega Millions prize will increase by a minimum of $5 million for the next drawing.

Mega Millions prizes can reach great amounts. In fact, the largest Mega Millions jackpot was an astounding $1.537 billion, which was won in October 2018. Other massive jackpots date back to March 2012 and December 2013, where three ticket holders shared a staggering prize of $656 million, and another two ticket holders shared the sum of $648 million respectively.

Megaplier Prizes

In all of the participating states except California, players can enjoy a supplementary game called Megaplier. This game is offered for just an additional $1 per line, and it can help boost the value of any non-jackpot Mega Millions prizes that are won. The Megaplier offers players the chance to receive a payout with a maximum of $5 million, without winning the jackpot. The prize chart below shows the various prizes that can be won with Megaplier, the payouts and the odds of a certain Megaplier number being drawn:

| Match | Base Prize | 2x (1 in 3) | 3x (1 in 2.5) | 4x (1 in 5) | 5x (1 in 15) |

|---|---|---|---|---|---|

| 5 Numbers | $1 million | $2 million | $3 million | $4 million | $5 million |

| 4 Numbers + Mega Ball | $10,000 | $20,000 | $30,000 | $40,000 | $50,000 |

| 4 Numbers | $500 | $1,000 | $1,500 | $2,000 | $2,500 |

| 3 Numbers + Mega Ball | $100 | $200 | $300 | $400 | $500 |

| 3 Numbers | $10 | $20 | $30 | $40 | $50 |

| 2 Numbers + Mega Ball | $10 | $20 | $30 | $40 | $50 |

| 1 Number + Mega Ball | $4 | $8 | $12 | $16 | $20 |

| Mega Ball Only | $2 | $4 | $6 | $8 | $10 |

Just the Jackpot

In October 2017, the game ‘Just the Jackpot’ was introduced, giving players two chances at winning the Mega Millions jackpot prize for the price of $3. Players who choose the Just the Jackpot wager will only be eligible to win the jackpot prize, so they are only eligible for one of the nine tiers. Players cannot claim prizes in any of the other eight prize tiers, which range from $2 to $1 million.

To enter Just the Jackpot, players can simply pick up a play slip from an authorized retailer and select their preferred numbers. In certain states, such as Wisconsin, players’ numbers will be generated by the terminal.

For more information, players can ask their local lottery retailer or they can also contact their nearest lottery office.

Winners of thelotter

| Date | Winner | Winning at thelotter |

|---|---|---|

| 25.08.2020 |

Eugene G. |

189,77 EUR≈ 14 888,41 ₽ |

| 31.07.2020 |

Kaido P. |

169,78 EUR≈ 13 320,09 ₽ |

| 10.07.2020 |

aldo c. |

177,07 EUR≈ 13 892,03 ₽ |

| 19.06.2020 |

Elmar S. |

178,93 EUR≈ 14 037,95 ₽ |

| 17.06.2020 |

Oleksandr Z. |

188,14 EUR≈ 14 760,52 ₽ |

| 16.06.2020 |

Oleksandr Z. |

188,14 EUR≈ 14 760,52 ₽ |

| 02.06.2020 |

GUILLERMO J. |

126,00 USD≈ 8 888,95 ₽ |

| 02.06.2020 |

Omar A. |

180,26 EUR≈ 14 142,30 ₽ |

| 02.06.2020 |

Oscar G. |

500,00 USD≈ 35 273,59 ₽ |

| 02.06.2020 |

HORACIO R. |

126,00 USD≈ 8 888,95 ₽ |

| 02.06.2020 |

Francisco P. |

126,00 USD≈ 8 888,95 ₽ |

| 02.06.2020 |

Nay Tun N. |

200,00 USD≈ 14 109,44 ₽ |

| 02.06.2020 |

Dwight M. L. |

500,00 USD≈ 35 273,59 ₽ |

| 30.05.2020 |

Philipp H. |

180,10 EUR≈ 14 129,75 ₽ |

| 30.05.2020 |

Nelson D. |

400,00 USD≈ 28 218,87 ₽ |

| 30.05.2020 |

Wilbert G. |

202,00 USD≈ 14 250,53 ₽ |

| 30.05.2020 |

Valeria D. |

204,00 USD≈ 14 391,63 ₽ |

| 27.05.2020 |

Michael S. |

182,52 EUR≈ 14 319,61 ₽ |

| 27.05.2020 |

Katia T. |

483,40 CHF≈ 35 433,00 ₽ |

| 27.05.2020 |

Mayikama M. |

162,39 GBP≈ 14 129,74 ₽ |

| 27.05.2020 |

Ryan Milos Romeo G. |

200,00 USD≈ 14 109,44 ₽ |

| 27.05.2020 |

Ricardo G. |

426,00 USD≈ 30 053,10 ₽ |

| 27.05.2020 |

MOH MOH K. |

204,00 USD≈ 14 391,63 ₽ |

| 27.05.2020 |

MOH MOH K. |

336,00 USD≈ 23 703,85 ₽ |

| 27.05.2020 |

Shahin N. |

500,00 USD≈ 35 273,59 ₽ |

| 20.05.2020 |

M. |

500,00 USD≈ 35 273,59 ₽ |

| 20.05.2020 |

Chakgree P. |

220,00 USD≈ 15 520,38 ₽ |

| 20.05.2020 |

Jose Luis S. |

408,00 USD≈ 28 783,25 ₽ |

| 20.05.2020 |

Milena with. |

120,00 USD≈ 8 465,66 ₽ |

| 15.05.2020 |

dinie v. |

184,82 EUR≈ 14 500,05 ₽ |

If I should win the jackpot, do I have the option of remaining anonymous as far as the public and the media are concerned?

In most states, lottery winner information is public domain, therefore it is public information.

Publicized information normally includes the jackpot winner’s name, city, county, game in which they won,

date won, and the amount of the prize.

After you win the jackpot, we recommend seeking the professional guidance of a good lawyer and accountant to see if there are ways of maintaining as much privacy as possible— before contacting the lottery and/or claiming the prize, and possibly even before letting friends or family know. You may be tempted to yell to the rooftops in glee about your newfound fortune, but you will probably end up regretting that decision once the excitement of the win calms down, and you are left with a continuous stream of lawsuits and requests for money from those who want a piece of your win.

Incomplete systems

100% 2 – at 2 guessed:

Rooms: 6 – Tickets: 3

Rooms: 7 – Tickets: 3

Rooms: 8 – Tickets: 4

Rooms: 9 – Tickets: 5

Rooms: 10 – Tickets: 6

Rooms: 11 – Tickets: 7

Rooms: 12 – Tickets: 9

Rooms: 13 – Tickets: 10

Rooms: 14 – Tickets: 12

Rooms: 15 – Tickets: 13

Rooms: 16 – Tickets: 15

Rooms: 17 – Tickets: 16

Rooms: 18 – Tickets: 18

Rooms: 19 – Tickets: 19

Rooms: 20 – Tickets: 21

Rooms: 21 – Tickets: 21

Rooms: 22 – Tickets: 27

Rooms: 23 – Tickets: 28

Rooms: 24 – Tickets: 30

Rooms: 25 – Tickets: 30

Rooms: 26 – Tickets: 37

Rooms: 27 – Tickets: 38

Rooms: 28 – Tickets: 40

Rooms: 29 – Tickets: 43

Rooms: 30 – Tickets: 48

Rooms: 31 – Tickets: 50

Rooms: 32 – Tickets: 52

Rooms: 33 – Tickets: 55

Rooms: 34 – Tickets: 62

Rooms: 35 – Tickets: 63

Rooms: 36 – Tickets: 66

Rooms: 37 – Tickets: 68

Rooms: 38 – Tickets: 76

Rooms: 39 – Tickets: 78

Rooms: 40 – Tickets: 82

Rooms: 41 – Tickets: 82

Rooms: 42 – Tickets: 93

Rooms: 43 – Tickets: 95

Rooms: 44 – Tickets: 99

Rooms: 45 – Tickets: 99

100% 3 – at 3 guessed:

Rooms: 6 – Tickets: 4

Rooms: 7 – Tickets: 5

Rooms: 8 – Tickets: 8

Rooms: 9 – Tickets: 12

Rooms: 10 – Tickets: 17

Rooms: 11 – Tickets: 20

Rooms: 12 – Tickets: 29

Rooms: 13 – Tickets: 34

Rooms: 14 – Tickets: 43

Rooms: 15 – Tickets: 56

Rooms: 16 – Tickets: 65

Rooms: 17 – Tickets: 68

Rooms: 18 – Tickets: 94

Rooms: 19 – Tickets: 108

Rooms: 20 – Tickets: 133

Rooms: 21 – Tickets: 151

Rooms: 22 – Tickets: 172

Rooms: 23 – Tickets: 187

100% 4 – at 4 guessed:

Rooms: 6 – Tickets: 5

Rooms: 7 – Tickets: 9

Rooms: 8 – Tickets: 20

Rooms: 9 – Tickets: 30

Rooms: 10 – Tickets: 51

Rooms: 11 – Tickets: 66

Rooms: 12 – Tickets: 113

Rooms: 13 – Tickets: 157

$656 million won on March 30th 2012

The drawing on March 30th 2012 created not only the largest Mega Millions jackpot ever seen but also the second-largest jackpot in the world. The grand prize was worth an incredible $656 million and was the result of 19 draws without a top-tier winner. In the draw, three ticket holders from Maryland, Illinois and Kansas matched all six numbers to share the jackpot.

The winners were named as Merle and Patricia Butler from Red Bud, Illinois and three work colleagues dubbed ‘The Three Amigos’ from Milford Mill, Maryland. The third winner was from Kansas but, as winners in that state have the option to remain anonymous, they were never formally identified. Each winner received $218.6 million before taxes.

MegaMillions lottery rules

According to the terms of the game, participant chooses 5 main balls with numbers from 1 to 75, as well as an additional "Mega ball" with a number from 1 to 15.

Mega Million players from select states, have the right to take another extra ball, called Megaplier, in case of guessing his number, the amount of the win increases significantly.

Five main winning categories established. The jackpot is the maximum win, and for that, to get it, you need to predict five main numbers, and also the number on the mega ball. The smallest prize any MegaMillions player can win, who guesses 1 number.

For the lottery drawing procedure, apply 2 drum, the main balls spin in the first, with numbers from 1 to 56. Five balls from this mass drop out randomly. Mega balls are spinning in the second reel (them 46).

In all states, except California, set the standard size of the prize amount in any category. California is isolated because, that in this state, the size of the prize directly depends on the profit from ticket sales. If a MegaMillions member wins the jackpot, he has the right to take immediately the amount of the entire prize (notice, what is the prize amount in this case, will be less than the winning amount) or agree to receive the winnings in installments (for every million won, the winner should $38,5 thousand. in year).

Can non-US citizens play? What if a non-US citizen wins?

Yes, non-US citizens can legally play, and non-US citizens are eligible to win any prize offered in the game.

If a non-US citizen wins, they would claim their prize in the same manner that a US citizen would, but the taxes withheld would be different. For example, federal withholding for non-US citizens is a flat 30%. Also, individual states may have different tax structures for non-US citizens than they do for US citizens. Depending on which country the person is a legal resident of, there also may be tax treaties between the US and that other country which could be helpful in offsetting whatever the US tax liabilities are.

In short, non-US citizens can play and win Mega Millions. If a non-US citizen wins a large prize, they will be responsible for some amount of tax, which in the end will probably be an amount similar to what a US citizen would pay, but there are so many possible variations with international tax codes that you’ll need to consult with a local tax attorney if you need to know a precise amount of tax liability.

Rules and terms of the drawing

Lottery Megamillions passes 2 once a week. The rules of the game are not complicated. Balls of two categories participate in the drawing: basic and additional. The main 70 balls, additional 25. The player receives the amount depending on the number of matched numbers.

The yellow ball plays a big role in the game. The game originally had the big yellow ball logo, bringing good luck ". He soon became adorned with six stars..

The game proceeds as follows. Two counter-rotating blades stir the balls, they fall under the drum one by one. First, the presenter takes out 5 main balls, then 1 additional (this category of golden balls is called mega balls). Those lucky ones, which numbers match, will receive prizes. If all are the same 6 numbers - jackpot. If no one took the main prize for the game, it increases and goes on to the next edition.

One bet is worth 1$, and the ticket 5 dollars. Many are attracted by the distribution of funds in the Megamillions lottery, proceeds from the purchase of tickets by players. This money is distributed as follows:

- 50% goes to winnings to the winners;

- 35% goes to contributions to the US budget;

- 15% Is the income of ticket distributors.

How Are the Mega Millions Numbers Drawn?

Behind all the lights and TV cameras, a tremendous amount of behind-the-scenes work and security goes into ensuring that each Mega Millions draw is random and free from tampering, and that every ticket has an equal chance of winning.

US$ 142 Million

Play

Mega Millions eschews computers for mechanical, gravity pick machines which are still considered to be the most random and tamper-proof lottery draw machines to-date. Officials inspect and calibrate every piece of equipment, including the numbered balls, to ensure that there are no outside influences on the results.

Once the draw has concluded and the latest Mega Millions results are in, ticket holders rush to see if they’ve joined the ranks of the biggest Mega Millions winners! With a jackpot that starts at $40 million, Mega Millions has the power to make dreams come true with each and every draw.

US Mega Millions FAQ

-

Can non-US citizens play Mega Millions?

Yes, they can. According to the Mega Millions rules, the game is open for both American and non-American citizens over the age of 18. The legal age may vary from one state to another. In some states, the lottery is open to people over the age of 21.

-

Can I play Mega Millions outside the US?

Yes, you can play the US Mega Millions outside of the US if you play online. theLotter is the leading lottery messenger platform where you can enter the game from anywhere in the world.

-

If you win Mega Millions online, how much of the prize do you get?

If you win a Mega Millions prize online on theLotter, you get it 100%. theLotter does not charge commissions on the prizes won on their platform, so whatever you win is your entirely.

General information about the lottery

IN 2013 the game changed its format. Until that time, the number of winning numbers among the main and additional balls was 5/56 and 1/46. But after that, like a jackpot in size 37$ was played in 2012 year, the drawing has acquired a modern format 5/75 and 1/15. After these innovations, the chances of player success are slightly lower..

Not the whole country at the moment America plays the lottery. The game is not played in the following states: Alabama, Alaska, Hawaii, Mississippi, Nevada, Utah. According to the law, there are no lotteries in these states at all.

Is it realistic to win the Megamillions lottery?? And why is this game loved by so many people?? Let's consider this issue in more detail..

Are lottery prizes taxable?

Lottery winnings of $600.01 and over are subject to Federal Withholding tax. For

winnings of $600.01, up to and including $5,000, you will be issued a W-2G form

to report your winnings on your federal income tax form. For winnings of

$5,000.01 and over, your state’s Department of Revenue removes the 24 percent federal

withholding before you receive your winnings check (or, if it is

an annuity, from each winnings check). You then receive a W-2G form with each

check to submit with your 1040 form to show that the 24 percent federal

withholding already has been paid. In addition to federal tax, your state will

make additional withholdings for taxes, and most states will deduct other money that

you may owe to the state, such as back taxes, child support, loan payments, etc.

In addition, like the federal tax withholding, the state tax withholding at the time

of prize payout may not be the total state tax owed at the end of the year.

You must consult your state division of taxation for more information about the total

state tax requirements for lottery winners.

The state tax withholdings are as follows:

| Arizona | 4.8% state withholding (Arizona residents), 6% state withholding (non-Arizona residents) |

| Arkansas | 6.6% state withholding |

| California | No state tax on lottery prizes |

| Colorado | 4.63% state withholding |

| Connecticut | 6.99% state withholding |

| Delaware | 6.6% state withholding |

| Florida | No state tax on lottery prizes |

| Georgia | 5.75% state withholding |

| Idaho | 6.925% state withholding |

| Illinois | 4.95% state withholding |

| Indiana | 3.23% state withholding |

| Iowa | 5% state withholding |

| Kansas | 5.7% state withholding |

| Kentucky | 5% state withholding |

| Louisiana | 6% state withholding |

| Maine | 7.15% state withholding |

| Maryland | 8.95% state withholding (Maryland residents), 8% state withholding (non-Maryland residents) |

| Massachusetts | 5% state withholding |

| Michigan | 4.25% state withholding |

| Minnesota | 7.25% state withholding |

| Mississippi | 5% state withholding |

| Missouri | 4% state withholding |

| Montana | 6.9% state withholding |

| Nebraska | 5% state withholding |

| New Hampshire | No state tax on lottery prizes |

| New Jersey | 8% state withholding |

| New Mexico | 4.9% state withholding |

| New York | 8.82% state withholding, plus: 3.876% (NYC residents), 1.323% (Yonkers residents) |

| North Carolina | 5.25% state withholding |

| North Dakota | 2.9% state withholding |

| Ohio | 4.797% state withholding |

| Oklahoma | 5% state withholding |

| Oregon | 8% state withholding |

| Pennsylvania | 3.07% state withholding |

| Rhode Island | 5.99% state withholding |

| South Carolina | 7% state withholding |

| South Dakota | No state tax on lottery prizes |

| Tennessee | No state tax on lottery prizes |

| Texas | No state tax on lottery prizes |

| U.S. Virgin Islands | † Unknown State Tax Rate |

| Vermont | 6% state withholding |

| Virginia | 4% state withholding |

| Washington | No state tax on lottery prizes |

| Washington, D.C. | 8.95% state withholding |

| West Virginia | 6.5% state withholding |

| Wisconsin | 7.65% state withholding |

| Wyoming | No state tax on lottery prizes |

† This state/jurisdiction has not responded to our requests for this information.

Mega Millions Payouts

The US Mega Millions is a champion of the lottery world because the prizes it offers are out of this world! $40 million is only the starting amount for its first prize. Then, every time there is no winner, the Mega Millions jackpot gets even bigger. That is how it has reached the enormous amount of $1.537 billion in October 2018. That is the current record, but the next rollover streak could see it broken!

US$ 165 Million

Play

The Mega Millions does not feature a cap for its jackpot, which means that it can grow indefinitely. But that’s not all you can win when you play Mega Millions! There is a total of 9 prize categories in the game and they are all up for grabs on every single draw. The second prize is worth a full $1 million, so you don’t even have to match all the numbers to become a millionaire in this amazing American lottery!

American Mega Millions Lottery Review (Mega Millions)

Specifications

| Options | The values |

|---|---|

| rules | 5 of 70 + PB 1 of 25 |

| Participants | USA |

| Draw time | W. 20:00 Fri. 20:00 |

| Jackpot Payouts | Cash |

| Tax requirements | Tickets for this lottery are purchased in Oregon, New Jersey or New York. Lottery winnings are subject to withholding tax. Oregon Lottery Holds 38% (federal and state tax) with winnings, the amount of which exceeds $600. New Jersey Lottery Holds 38% (federal and state tax) from all winnings, the amount of which exceeds $600. New York Lottery Holds 44,17% (federal tax, state and municipal tax) from all winnings, the amount of which exceeds $600. |

| Prize Increase Ratio | Increase your secondary prizes in 2,3,4 or 5 times depending on the "Megaplier" number |

Chances of Winning

| Prizes | Conformity | Odds |

|---|---|---|

| 1 Prize | 5+PB | 1:302 575 350 |

| 2 Prize | 5 | 1:12 607 306 |

| 3 Prize | 4+PB | 1:931 001 |

| 4 Prize | 4 | 1:38 792 |

| 5 Prize | 3+PB | 1:14 547 |

| 6 Prize | 3 | 1:606 |

| 7 Prize | 2+PB | 1:693 |

| 8 Prize | 1+PB | 1:89 |

| 9 Prize | 0+PB | 1:37 |

The American lottery "Megamillions" exists since 1996 of the year, but before that it had a different name "Biggame" (translated as "The Big Game"). It got its current name in the middle 2002 of the year. The smallest jackpot is twelve million, but since the fund is often transferred from one circulation to another, then in case of winning, the luckiest player can get several hundred million dollars in winnings. It is the size of the main prize that is the reason for the incredible popularity of this game..

Megamillions game rules

The player must choose five main balls (number range - 1-75) and one additional or "mega ball" (range of numbers 1-15). Also, players in some states can choose another ball, which is called "Megaplier", and if the number was guessed, the size of the prize grows significantly. Exists 5 main categories, the biggest of them is the jackpot (to get it you need to guess 5 numbers of the main balls of the draw and the number of the "mega-ball"), the smallest is a consolation prize (anyone gets it, who guessed at least one number).

Two lottery drums are used for the drawing: mixed in one 56 main balls, 5 of which drops with random numbers, and in the other - "mega-balls" in the amount 46 pieces.

All states (excluding California) each consolation category has a standard win rate. Why "excluding California"? The thing is, that in California itself, the size of the winnings actually depends on the percentage of sales. The player who wins the jackpot can either pick it up immediately (but at the same time he does not receive the entire amount), or receive your prize in parts according to the following scheme - from each won million the player is paid 38 and a half thousand dollars a year.

What can you win in the game "Megamillions"?

Smallest jackpot, possible in this game, is equal 12 million dollars. If after the end of the drawing there is more than one ticket holder with a winning combination, the reward is divided between these lucky ones.

It happens, that none of the players guesses any number 5 main balls, no "mega-ball" numbers. How to be in this case? In this case, the rules of the game provide for the possibility of transferring the entire amount of the jackpot to the fund, which will be drawn in the next draw.

And now some records from the game "Megamillions". Who won the highest amount? The largest amount in America was won by three (!) players. They divided among themselves just an astronomical amount - 656 million dollars!!! But sometimes people literally dig up treasures alone.. It happened, eg, with the player, who was able to buy a winning ticket in New York and receive as a reward 319 000 000 dollars. This momentous event happened 25 Martha 2011 of the year.

What are the prize categories, and what are the chances of winning?

As, according to the rules, players need to guess the numbers of five balls from the range "1-75" and one ball from the range "1-15", then the probability of a player winning in one of the prize categories is 6,8%

"Megaplier" - what is it?

Do not forget about such an element as well., like a ball called "Megaplier". This is the name of a special ball, which can increase the winnings of especially lucky Megamillions lottery players.

As mentioned above, this ball is played in all states, except California. By the rules of the game, the ball is chosen from the numbers "2", "3" or "4" and gives a strong increase in the player's monetary reward. For clarity, let's give an example: if you managed to guess four numbers of the main balls and the number of the additional ball "Megaplier", then in this case the size of your winnings may grow, eg, from one and a half hundred dollars to six hundred dollars.

Why is the cash option different than the advertised jackpot?

The Mega Millions jackpot is an estimated 29-year annuity value, with a total 30 payments (the first payment happens right away, followed by 29 annual payments). When players choose

the annuity option for their prize, the state lottery pays the prize out over 29 years (30 payments) by

buying U.S. Government Treasury Securities, which earn interest and mature annually over

the 29 years. That annual return is the amount the winners receive each year for the

29 year period. With the cash option, the state lottery will take the amount of

money that would have been invested and will pay it directly to the winner in one

payment. Both payment options have federal and applicable state taxes deducted

from them, although with an annuity option you pay taxes gradually on each annual payout, not all at once like with the cash option.

Is it legal to play the lottery over the Internet?

The state lotteries and MUSL (the organization that runs Powerball) are all very firm in their assertion that playing the lottery in any manner over the Internet is illegal. We are not lawyers and can’t provide legal advice, but we are not so sure about their position. Their absolute certainty that it is illegal may have more to do with not wanting to lose control of the player interaction, and less to do with a firm legal footing.

When we assess the legality, we look at what has actually happened in court cases. There have been people in the past who purchased a lottery ticket from an Internet Web site, subsequently won the jackpot, and the lottery attempted to block them from receiving the jackpot. In each case, the winners took the lottery to court and won. They received their jackpot as if they walked into a store and purchased a ticket.

You must keep in mind that any type of Internet-based lottery service is not risk-free. From a legal standpoint, the services are dealing in loopholes in the current law, and the US Congress has taken steps to make those loopholes tighter, particularly in trying to prevent banks and credit cards from allowing Internet payments for lottery services. But there is a much bigger threat when you use an Internet lottery service: getting ripped off.

By not making a purchase in a store, you may be doing something worse than throwing your money away: you may be helping to keep a scam operation running. Stay away from anything referring to a “syndicate”. We are not aware of any site using that terminology that is not a scam. Also beware of sites that state “Insured by ___” at the bottom. It is like saying “We don’t really buy lottery tickets, but trust us, you’ll get paid if you win.” Have you ever heard of an insurance company paying out a $200 million Powerball jackpot? We haven’t.

We do allow some advertising on USA Mega for lottery services. We recommend that USA residents stay away from such services, and make your purchases in a store. The ads are directed at non-USA residents, who may not have the online lottery restrictions that exist in the USA.

Why is the cash option always a different percentage of the annuity from draw to draw?

If you’re calculating what percentage the cash value is of the annuity, then you’re looking at it backwards. The cash value is the starting point, as it is a direct percentage of ticket sales. Then the annuity amount is calculated from that, based on prevailing interest rates. Since the interest rates are constantly changing, the annuity amount calculated on one day will be a different number than if it is calculated the next day. So when a drawing occurs and the lottery has to estimate the next annuity jackpot, they first estimate the number of tickets that will be sold for the next drawing, which determines what the cash value estimate is (because a fixed percentage of each ticket sold goes toward prizes). Then they finally calculate what the annuity will be based on the current interest rates.

How to play from Russia

Winning a big jackpot is everyone's dream, who buys the lottery ticket. The main question, exciting those, who liked the lottery Megamillions: as play from Russia, is it easy to buy a ticket and how to increase the chances of winning.

Certain foreign lotteries block access to their sites for residents of other countries. for example, Powerball site blocked in Russia. There is no such restriction in the Megamillions draw yet. The founders don't mind giving everyone a chance to win, even though, that the Americans themselves are not happy with this.

But buying a lottery ticket in Megamillions is a little more difficult., than in other draws. There is no official resource in Russian. The Megamillions website is only available in the national lottery language. Ways to purchase a ticket, giving hope of owning millions, not so much, namely:

Buy a ticket with an intermediary

Platform, providing intermediary services, should choose carefully, so as not to stumble upon scammers, who take money, but they don't send a scanned ticket. Мы рекомендуем для этого нашего горячо любимого партнера – Lotto Agent. It is always advisable to read reviews before buying a ticket., and also carefully study all the rules. But in this case, you can be sure, in Agent Lotto everything is more honest than honest.

Buy a ticket in America

This option is only suitable for those, who often visits this country, quite far from Russia. For the rest, it is not advisable. Better to find a decent site, which provides intermediary services.

To buy a ticket through such a web resource, you need to do the following course of action:

- register on the Lotto Agent website (Agent Lotto) →

- choose lottery;

- decide on the numbers;

- pay for a ticket.

If I live in a state that taxes prizes, but bought my ticket in a state with no tax on prizes, do I still need to pay state tax?

Yes, you do. Think of lottery prizes as regular earned income from a job. Just because you may work in a different state, that doesn’t permit you to get away with not paying state income tax in your state of residence. The lottery works the same way.

Whether it’s income from a job or income from gambling, the state where the money is won will tax the prize first at their out-of-state tax rate (assuming the state taxes lottery winnings). If your state of residence has the same or lower tax rate, then you won’t owe anything else. But if your state has a higher rate, you will get a credit for what you paid in the other state, and pay the difference to your state.

If the other state has no tax, you just pay the entire tax bill to your state.

The net result is that you end up paying whichever tax rate is higher between your state of residence and the state where you purchased the ticket. Of course, the tax law is quite complex and it’s possible that some condition or arrangement exists between the two states and a good tax attorney and/or accountant could discover a tax-saving loophole. That’s why we always recommend that major prize winners do not make any major decisions before first hiring a good legal and financial team.

One other option to consider, depending on how much in taxes you’re looking to save: the residency requirements as they relate to prize claims, state taxes, and income reporting. Since you aren’t responsible for paying taxes until you claim the prize, perhaps there is time to establish residency in the state where you purchased the ticket before the prize claim period expires. However, that is something you would definitely need to explore with an attorney before taking any action to assess the feasibility. You would also need to decide if it would be worth the risk of that important little piece of paper not getting lost, damaged, or destroyed in the time you spend arranging everything.

What is the Megaplier?

The Megaplier is an option that is currently offered in all states that sell Mega Millions tickets except California. For an extra $1.00 per ticket you can increase your non-jackpot prize winnings by 2, 3, 4, or 5 times.

The Megaplier is not available in California because of state law that requires all lottery prizes to be paid out on a pari-mutuel basis.

The Megaplier multiplier number is chosen at random by computerized drawing in Texas at around the same time the Mega Millions numbers are drawn in Georgia. The Megaplier was invented by the Texas Lottery as an add-on available only in that state, but was later available in all of the Mega Millions states except California starting in 2010. The Megaplier continues to be drawn in Texas.

A player must choose the Megaplier option when they buy their Mega Millions ticket, and then the ticket must match one of the 9 Ways to Win (except the jackpot) before the multiplier takes effect. Megaplier costs an extra $1 per play. See How to Play Mega Millions for more information.

What prizes can be won in the Mega Million lottery

The minimum jackpot is $15 million. At the end of the drawing, the number of lucky winners is determined, and the jackpot is divided among them into equal parts.

In a situation, when the MegaMillions lottery has no winners, proceed as follows: all the money, components of the jackpot,

are transferred to the prize fund of the next drawing. Вспомним самые громкие рекордные выигрыши в лотерее MegaMillions. The maximum prize in the USA was won simultaneously by three participants in the draw.

The prize was divided between the players in a mind-boggling amount - $656 million! There are also multiple facts of single big wins..

So, man, who bought a single ticket in the capital of New York, received after the drawing of the Mega Million a prize in the amount of $319 million, and it happened in March 2011 of the year.