State taxes

In addition to federal taxes, your winnings may also be subject to local taxes

Important to remember, what tax, charged from your prize, depends not only on the state, but also on your individual circumstances

The following table shows the retention rate for each participating jurisdiction, and also the threshold, when prizes start to be taxed at the state level.

| State income tax | Jurisdiction |

|---|---|

| No tax on state winnings | California, Florida, New Hampshire, Pennsylvania, Puerto Rico, South Dakota, Tennessee, Texas, US Virgin Islands, Washington State, Wyoming |

| 2.9% | North Dakota |

| 0.03 | New Jersey |

| 3.07% | Pennsylvania |

| 3.4% | Indiana |

| 3.75% | Illinois |

| 0.04 | Colorado, Missouri, Ohio, Oklahoma, Virginia |

| 4.25% | Michigan |

| 0.05 | Arizona, Iowa, Kansas, Louisiana, Maine, Massachusetts, Nebraska |

| 5.75% | North Carolina |

| 5.99% | Rhode Island |

| 0.06 | Georgia, Kentucky, New Mexico, Vermont |

| 6.5% | West Virginia |

| 6.6% | Delaware |

| 6.9% | Montana |

| 6.99% | Connecticut |

| 0.07 | Arkansas, South Carolina |

| 7.25% | Minnesota |

| 7.4% | Idaho |

| 7.75% | Wisconsin |

| 0.08 | Oregon |

| 8.5% | Washington |

| 8.75% | Maryland |

| 8.82% | New York |

Questions

When calculating the tax on winnings yourself, numerous questions arise, which should be considered immediately to clarify the situation.

Is it possible to donate a car won in the state lottery?

Yes, can, since the registration of the car and the payment of taxes to the state treasury take place at the same time - the management and the winner solve legal issues together, defining the capabilities of the citizen.

The recipient will be able to get a car only after resolving issues with the lottery management about the payment of the tax amount.

Are there minimum and maximum amounts?, from which payment is not required?

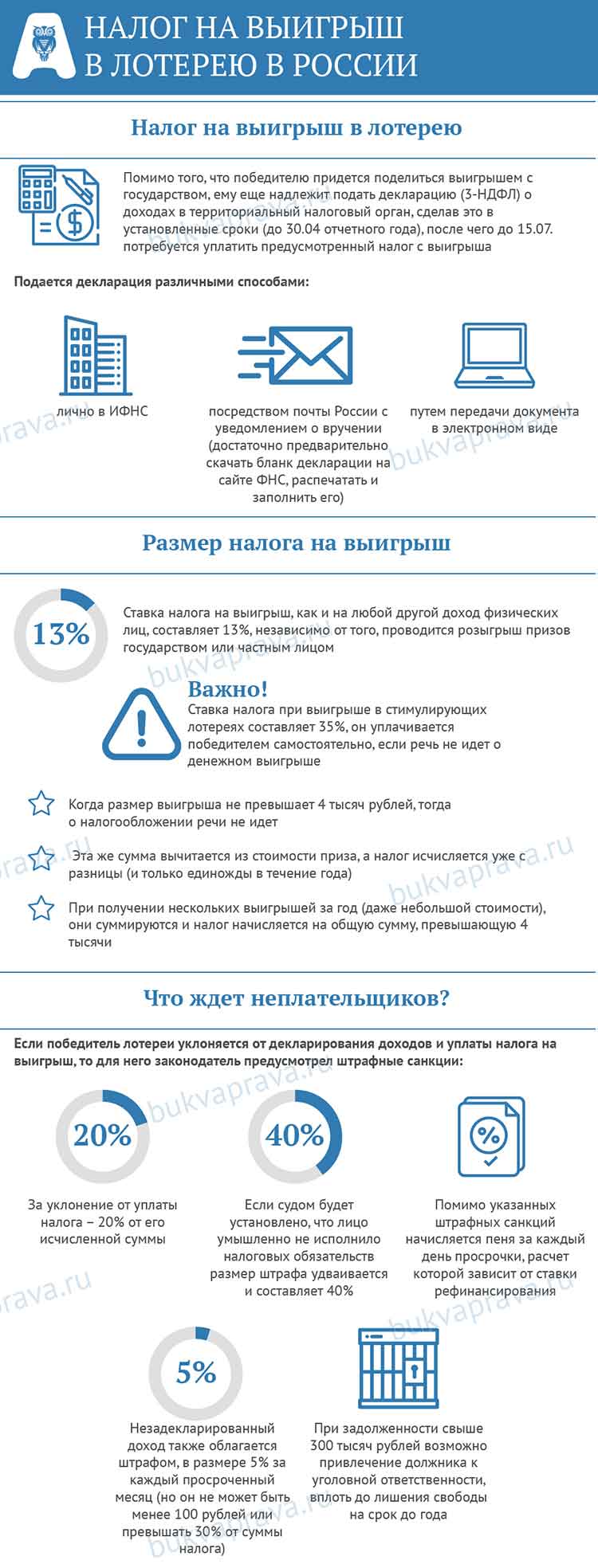

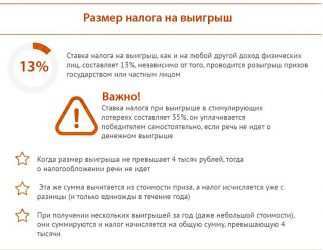

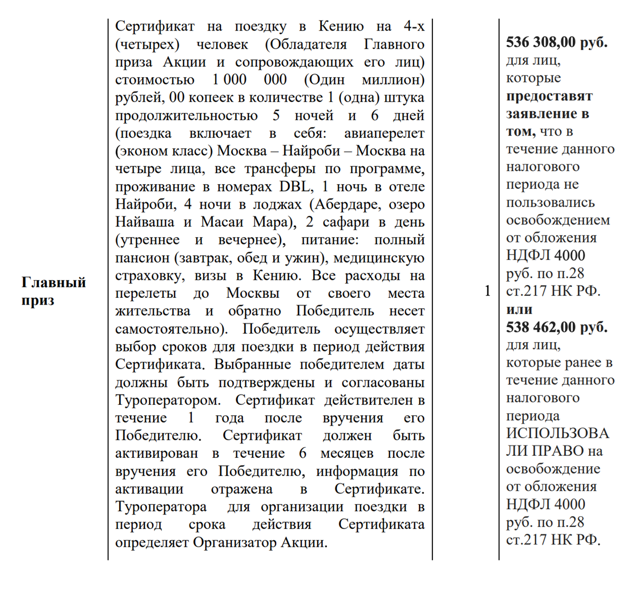

For incentive promotions, the amount of 4 thousand. rubles, which is not subject to the obligation to pay tax. This is the only amount, which acts as a limitation of the taxable base.

How can the amount to be paid be reduced?

The amount to pay taxes can be reduced, if you donate a part of the winnings to someone. Then the winner will only be liable for the remaining amount. Gift registration takes place with the involvement of a gift agreement.

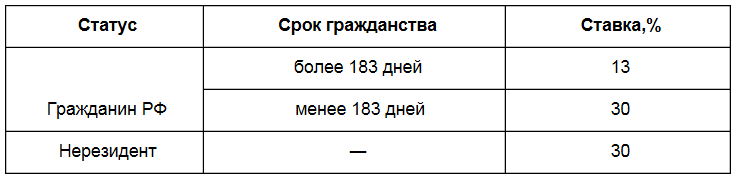

As a result, the gifted person has an obligation in accordance with Article 208 Tax Code of the Russian Federation on the payment of taxes on income received. Residents pay 13% from the sum, non-residents of Russia - 30%.

Do non-residents pay?

A citizen of Russia is recognized as a non-resident, if you have lived in the country for the last year less than 183 days. They also have a tax liability., but in size 30% and with the full winnings.

Does the rate depend on, who conducted the drawing?

Here you can highlight foreign companies, who ran the lottery - payment is made at rates, established in the state.

Only individual entrepreneurs or legal entities can conduct the drawing, have received appropriate permission in advance (license) - follows from the Federal Law of 11.11.2003 r. No. 138-FZ "On Lotteries".

If the winnings are received from a private person, not licensed to carry out such activities, the prize is invalidated and withdrawn from the winner.

What to do, if the value of the prize is initially overstated?

To determine the value of the prize and calculate the tax, the winner can use the services of an independent expert. You will have to pay for services yourself.

No money to pay tax. Can I donate the property I won and make a payment?

To give a win is to shift the responsibility for paying taxes to the person being gifted.

Accordingly, you will not be able to avoid payment. If there is no money, it is required to evaluate the property together with the company's management, from which the prize was received, and then sell it. The amount of taxes is subtracted from the proceeds, the rest is transferred to the winner's account.

After paying tax, will it be possible to get a property deduction?

Property deduction from the winnings cannot be obtained, since this is not an acquisition of property, and getting it.

The issue of paying tax on winnings is quite scrupulous and subtle in determining the key points.. therefore, taking part in any lottery, the consequences and obligations of a victory should be carefully examined.

What is the percentage rate of VAT in the USA

Formally, there is no value added tax in the USA and Australia., instead, sales tax is very common in the States. The interest rate of such tax may depend on the following factors:

- State. If consider, that each state has its own laws and procedures, which do not contradict the Constitution, then taxes, respectively, everywhere they pay differently. for example, Iowa's corn tax will be small (Iowa is the country's leading agricultural state), and the corn itself will be inexpensive, in the state of New York a shipment of corn will be subject to a higher tax.

- Product prevalence. If a product is not widely available in the United States, then it will be subject to a rather large sales tax.

- Whether the product was imported from abroad or was produced in America. If the goods are imported, then the tax on its sale will be higher.

The average interest rate for VAT across the country is 2-15%. Also worth considering, what in the USA, unlike RF, tax is not included in the price of goods, tax will only need to be paid after purchase, when will it be calculated at the checkout, which is not very convenient. Apart from sales tax, which the state established, sales tax may also apply, who established the city.

Receiving winnings as part of a promotion

Traditionally, citizens among themselves call the concept of a lottery not only risky events, providing for the purchase of tickets or other investment of funds for participation, but also various promotions and other type of draws, by participating in which you can get a prize.

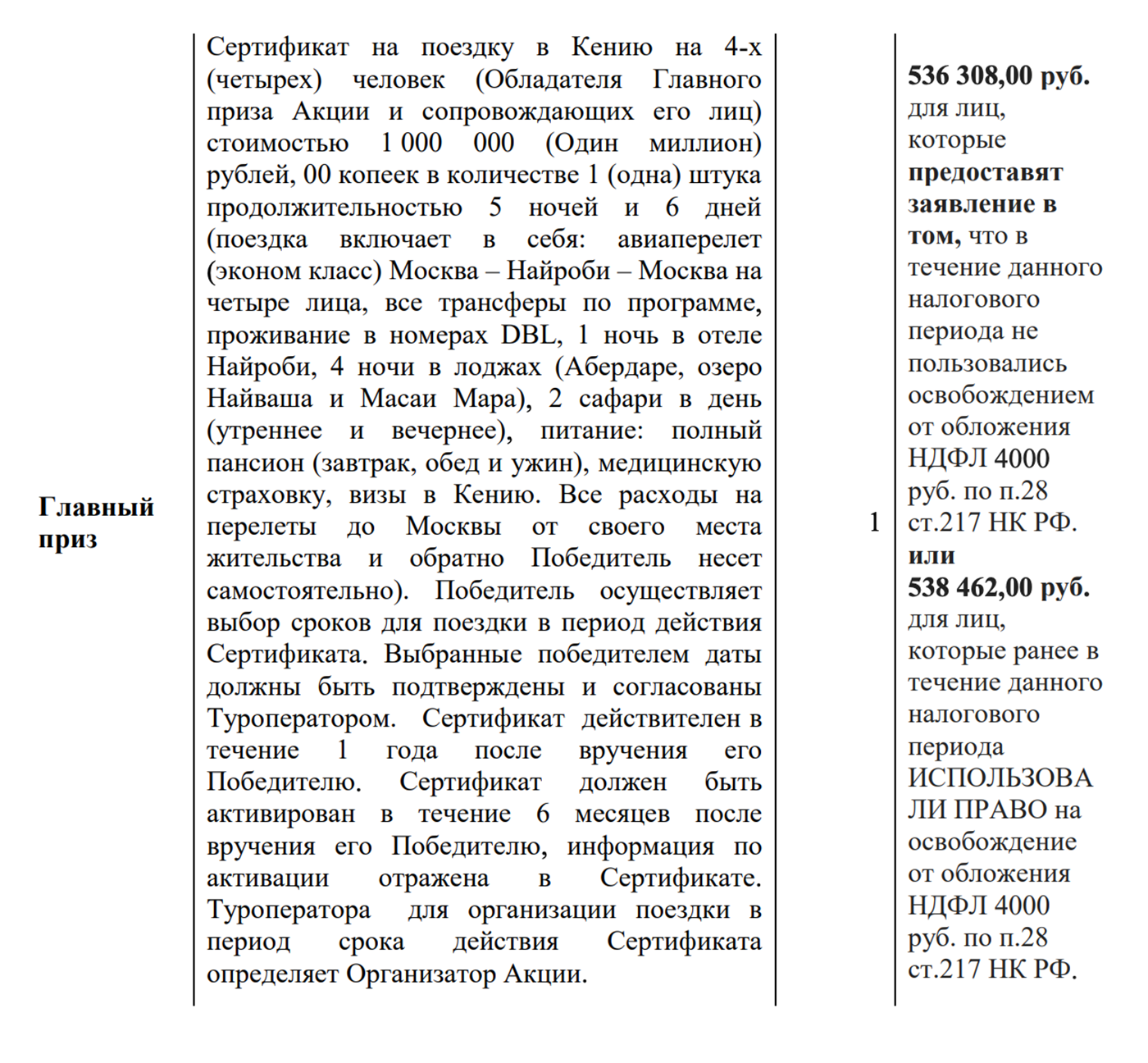

How to pay deduction from funds, received as a prize in the framework of the promotion

One of such events is a promotion. It's not run by lottery systems, most often the organizers are various shopping centers or hypermarkets, forming a prize fund from material or monetary gifts.

Such promotions are called incentive lotteries., since they are based on the following goal: gaining loyalty from customers, attracting new buyers.

Winnings, which is provided in this kind of promotions, also subject to taxation and transfer of part of the value of the received benefit to the country's budget.

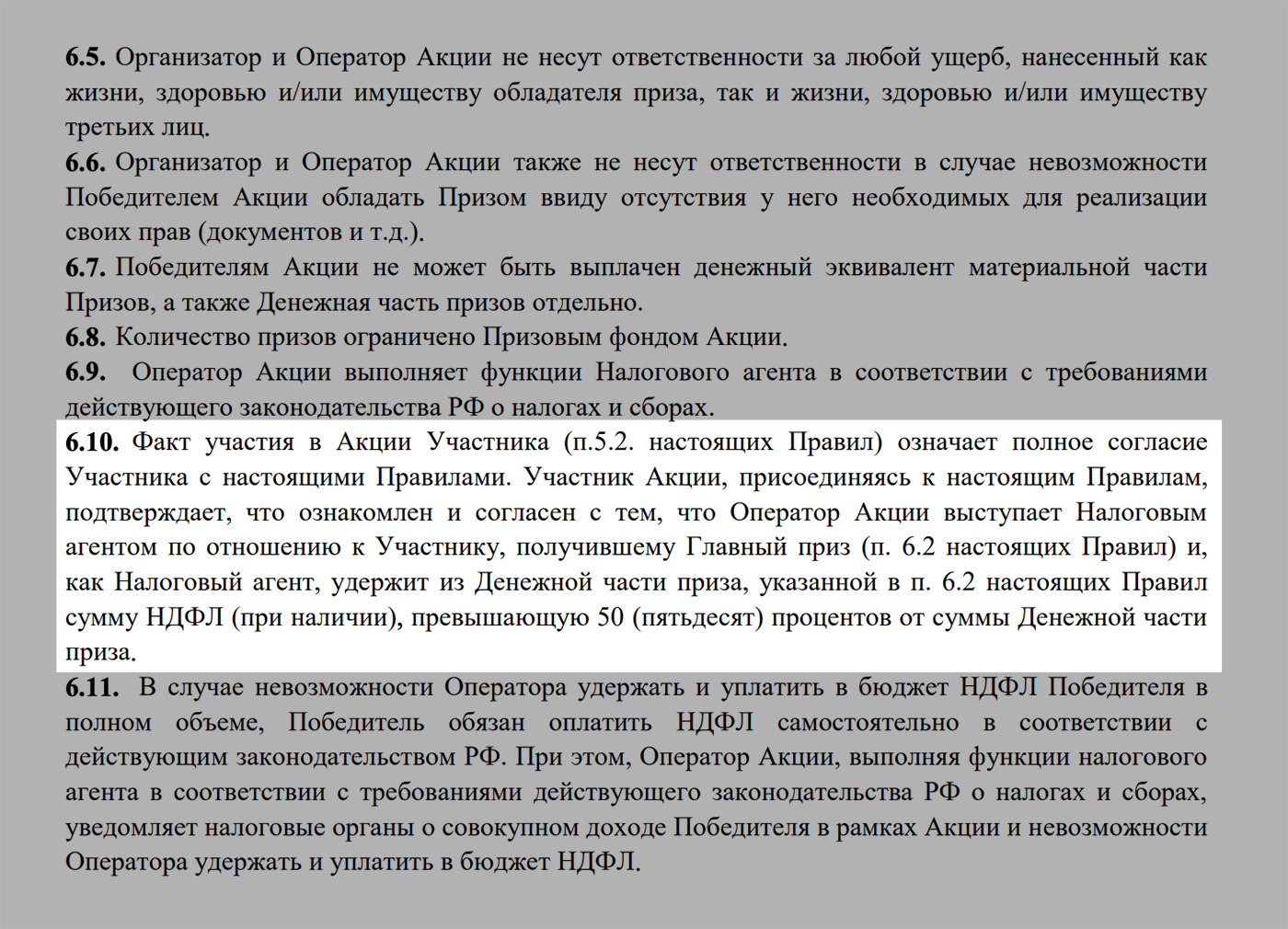

Taxpayers, participating in the action, can please a very important nuance: in this situation, the organizer of the action acts as a tax agent, and, if the prize is provided in cash, then she will independently transfer part of it to the state treasury and declare. It turns out, you just get it right away 65% from the estimated to the winning amount. Most often, its full size is not even indicated., so as not to mislead ignorant taxpayers and not cause a wave of dissatisfaction.

However, if as a result of participation in a promotion you receive a material name, you will have to declare income yourself. It doesn't matter, you won a microwave or a car.

You will definitely receive a certificate in your hands, in which the winning price is written, further intended to play the role of a taxable base. If you think, that the organizer of the action indicated the price incorrectly or it is too high, to confirm your guesses, you can make an independent paid cost estimate and draw up a new act.

If the result of the check suits you and the price is actually less, as evidence, you will attach it to the declaration form 3-NDFL

It is best to seek the help of an appraiser only if, if the prize you received is really worth big money, as, eg, apartment or car. In all other cases, the result may be, what means, paid to the appraiser, in size corresponded to the difference in the value of the object specified earlier and newly determined.

The deadlines for filing a declaration and sending the tax fee upon receipt of a prize for participating in a promotion correspond to the previously mentioned periods:

- declaration is submitted before 30 April next year;

- tax payment is due before 15 July also next year.

Example of receiving winnings in a promotion

Introduce, that you have a friend, a certain lucky Stepan Vitalievich. Last May, 2017 of the year, Mr. Vezuchy bought a smartphone in the department of the ElectroMir chain of stores. In June of the same year, the EleketroMir Network raffled off a prize between buyers of smartphones of a certain company - a TV. Our hero is the winner. Upon receiving the prize, Stepan Vitalievich was also given a certificate, in which the cost of the gadget he won was spelled out - 21 one thousand 300 Russian rubles. It is necessary to define, how the tax fee will be calculated.

Since Mr. Lucky is eligible for a tax deduction, you must first determine the size of the tax base. It will be: 21 300-4 000= 17 thousand 300 Russian rubles.

Since the rate, relevant for prizes from promotions, is 35%, we use it in the formula: 17 300*35%= 6 thousand 55 rubles - this is how much the fee will be, which Mr. Lucky will contribute to the state treasury after, how to properly fill out and submit for verification the declaration.

Differences in lottery and share tax

Percentage fees on lotto winnings and fees on promotion prizes will vary significantly. Agree, there is a difference, to give to the state 35% from the amount of the lucky ticket or only 13% from the lottery prize.

If you win a promotional prize from a chip maker, cigarette or home appliance store, this will count as a promotion win. In this case, the tax percentage will be 35% of the total value of the won lotto amount.

Besides, the promotion is often called the "incentive lottery". Participation in it can be completely free or almost free. You don't have to pay extra money, to participate in the raffle from the chip manufacturer, if you have already bought a pack of it.

Personal income tax for winning the lottery, unlike promotions, is only 13%.

IMPORTANT! If you are unable to pay interest to the state for too expensive and "suddenly fell happiness", you have every right to refuse to receive a "big jackpot" in favor of its cash equivalent. You can read more about tax rates in clause 1.2 of article 224 of the Tax Code of the Russian Federation

You can read more about tax rates in clause 1.2 of article 224 of the Tax Code of the Russian Federation.

Taxation system in the USA

The system has several levels: federal, regional, local. The list of taxes on each of them is different, while some are charged in parallel to several budgets.

The following are the most common types of US taxes:

| At the federal level | At the regional level | Cities and municipalities |

| For personal income | For personal income | At a profit |

| At a profit | At a profit | Inheritance and donation |

| Excise and customs duties | From sales | License Fees |

| Inheritance and donation | Excise taxes | Ecological |

| Capital gains | On transport | On transport |

| Contributions to the social fund. insurance | Capital gains | |

| For real estate |

All levels of government are completely separate. The federal government does not interfere in state tax affairs, region, municipality. Regional legislatures can decide to introduce only those taxes in the reporting territory, which do not contradict federal legislation. And local authorities can only set state-authorized fees..

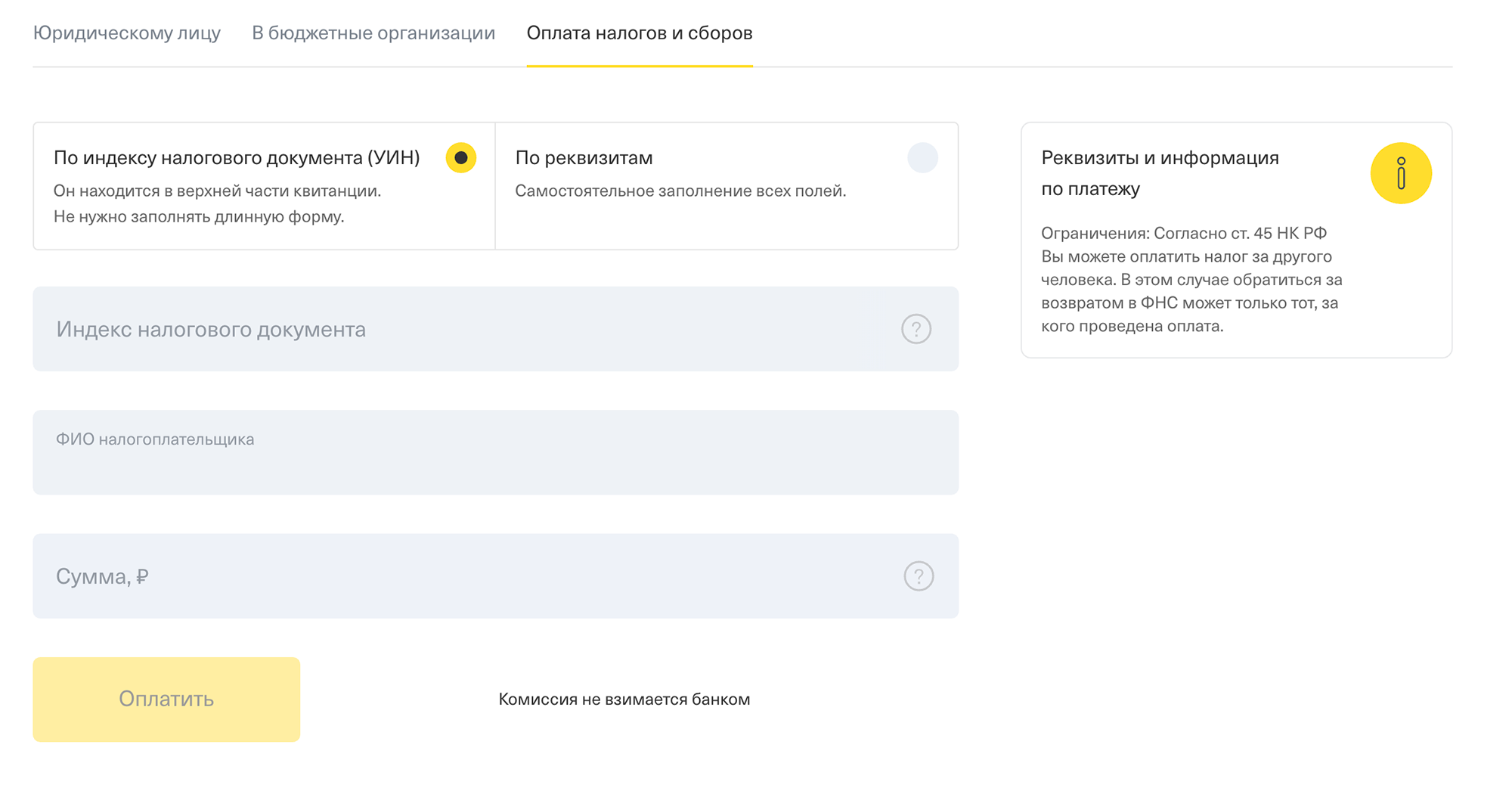

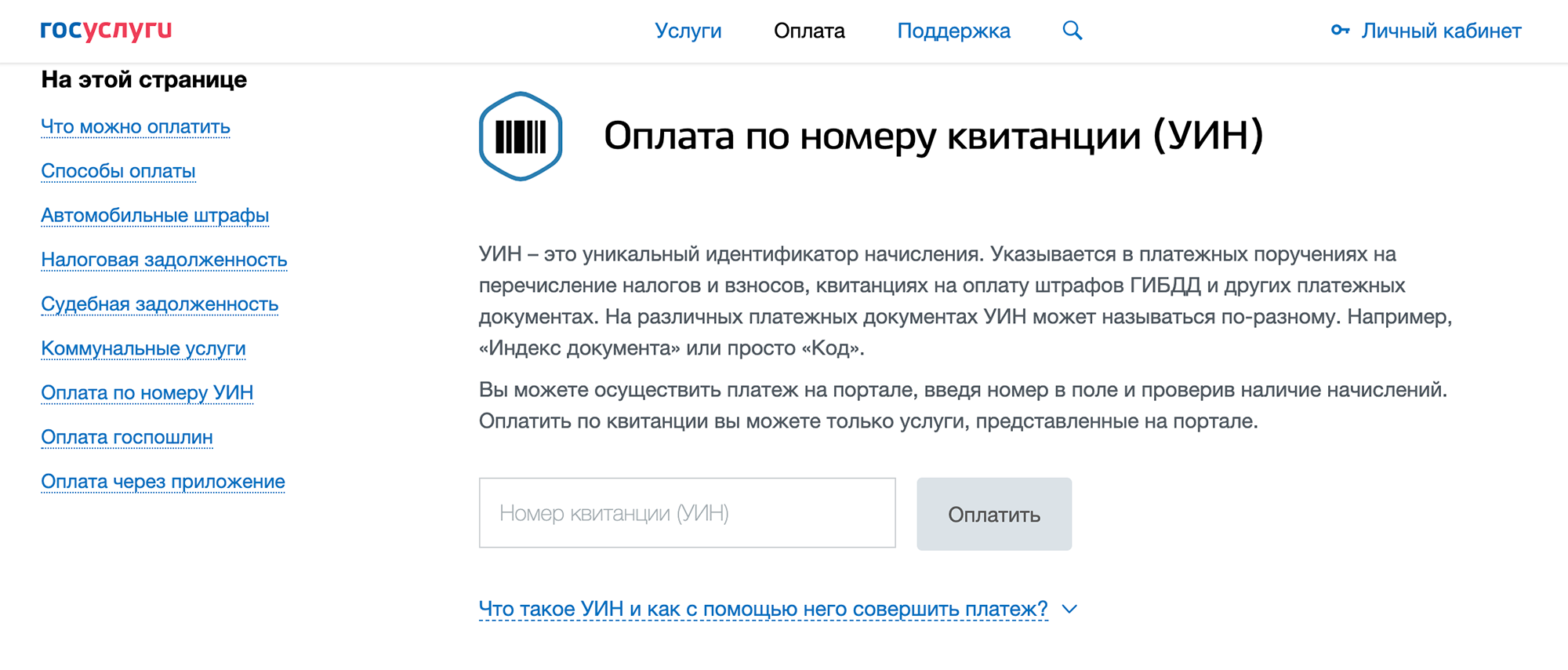

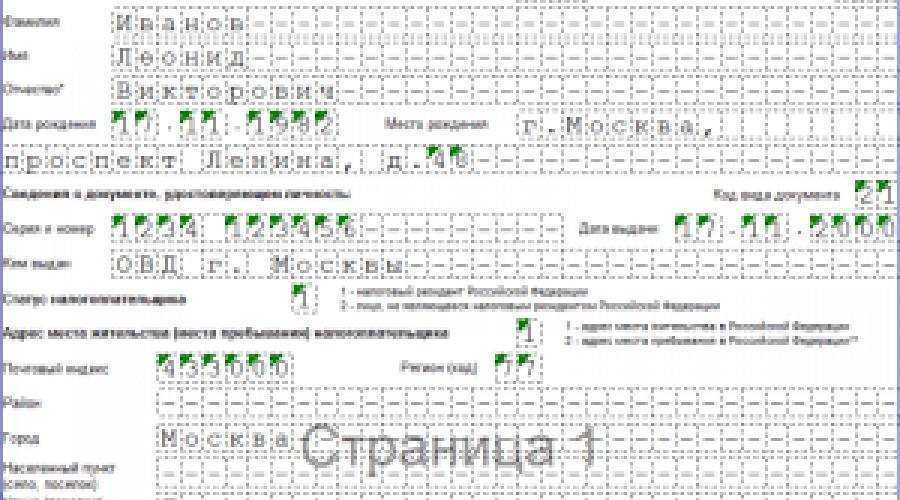

Terms and procedure for filing a tax return

Such a declaration is submitted on a general basis within the time limits established by law.. The declaration is submitted in the form 3-NDFL, if income is received in the current year, income must be declared before 30 April next year.

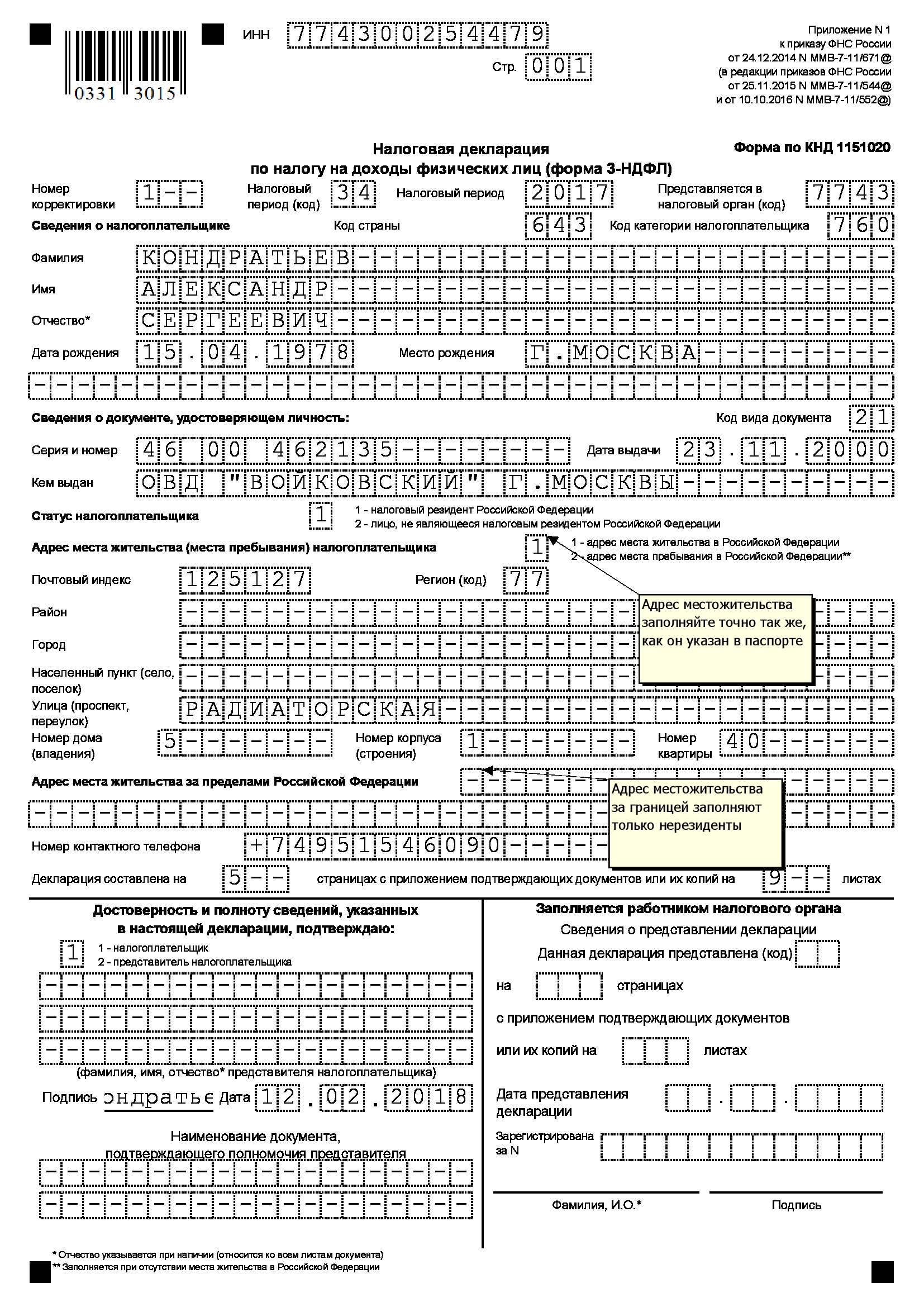

Sample declaration 3-NDFL

The declaration contains the following information:

- Winner's personal data: FULL NAME, passport data, INN.

- Total winnings.

- Amount, to be budgeted.

You can receive the declaration during a personal visit to the territorial division of the tax service or download it on the FTS website. When filing a tax return, you need to consider, that the relying contributions must go to the budget no later than 15 july. The declaration is submitted in paper and electronic form. In the first case, the form must not contain cross-overs and corrections. Perfectly, you need to fill out such a declaration on the spot, according to the established pattern.

You need to pay tax before 15 july

Features of the distribution of the lottery fund

At all, lottery – extremely beneficial, from the money side, for organizers action. And since the organizer is usually some state company, therefore, the profit from the sale of lottery tickets goes to improve the social sphere, eg: kindergartens are being built with the money received, hospitals, universities, museums, stadiums, etc.

In addition, a certain payment in the form of tax is sent to the state budget from each major win.. We took the lotteries of America especially for review, because in the USA the tax system is wiser, compared to Europe or Australia. Tax rates in some places can reach the level in 50 percent. Such tax rates naturally alert the player, but remember, that only USA lottery jackpots reach truly outstanding heights (absolute world record, presently, belongs to the American Powerball lottery – 13 january 2016 of the year was played 1,5 billion. dollars). So even after paying all tax deductions, hand winnings remain solid.

It turns out, the state has no reason to restrict foreign citizens' access to national lotteries. However, the founders stipulate one point: the participant is obliged to independently pay all statutory taxes in his country, this responsibility lies with him. You also need to consider, that there are countries, in which gambling is prohibited. This mainly applies to those territories, where the population is Muslim.

A non-resident of the United States has the right to play and receive winnings

On the Powerball lottery website, in the FAQ section, they ask: “Eligible for non-US residents to play and receive Powerball lottery winnings?”. The answer is yes with the only condition, that the participant is legally purchasing tickets, and he does not need to have a certain citizenship to acquire them. true, in some states, local authorities have adopted regulations, and according to them, the winner must present the papers during the award ceremony, confirming citizenship. If none were found with him, other ways of withholding tax payments are being sought under state law.