Gift tax (Gift Tax)

Gratuitous transfer of property (cash, shares, shares in the company, the property) may be taxed on gifts.

The rate can go up to 40%. However, in the vast majority of cases, you will not have to pay gift tax.. The main thing is to use the benefits correctly, stipulated by tax legislation. The annual non-taxable minimum is 15 thousand. dollars. Ie. for this amount a person can make gifts to absolutely any person during the year.

But even if the gift to one person is more than this amount, it doesn't mean at all, that the tax will have to be paid. The legislation provides for one more non-taxable amount throughout life - 11,4 million. dollars (as of 2019 year). Therefore, for donated, eg, 50 thousand. dollars you will need to fill out a declaration, but the excess in 35 thousand. dollars can be credited to the lifetime limit.

Tax minimization in the United States is possible only in the case of thorough knowledge of the legislation, as well as his law enforcement practice. That is why tax advice is widespread in America.. Do not neglect consulting a tax attorney, especially when planning to move to the United States or start a business in that country.

This article is for informational purposes only and is not a consultation on individual issues.. To implement specific solutions, we suggest contacting our experienced tax attorneys and CPA.

Lottery taxes in other countries

Let's start with European lotteries. The tax laws on lottery winnings vary from country to country. Below is a summary of the tax rates for lottery winnings.

In Spain before 2013 Years lottery winnings were not taxed at all. However, under the influence of the crisis, from 1 january 2013 year tax was introduced. It should be noted, that the winnings are less 2500 euros are not taxed. Otherwise, the tax rate will be twenty percent. This applies to all, not just Spanish citizens. That is, if you win online, you still have to pay.

Lottery winnings are tax-free in the UK and Germany. Also zero tax rate on lottery winnings in Finland.

Italy has a tax on lottery prizes of 6%. In this case, the amount must exceed five hundred euros. In Bulgaria, lottery winners pay ten percent, in the Czech Republic - twenty percent.

At all, we will try to answer the question below, what tax will the Russians have to pay, who decided to play not in Russian lotteries, and in foreign.

Let's repeat, what if between Russia and the country, where was the ticket purchased, there is a double taxation treaty, then the winner pays tax only in that country, where won. But if there is no such agreement, then the tax must be paid twice.

Australia also has no taxes on lottery winnings.

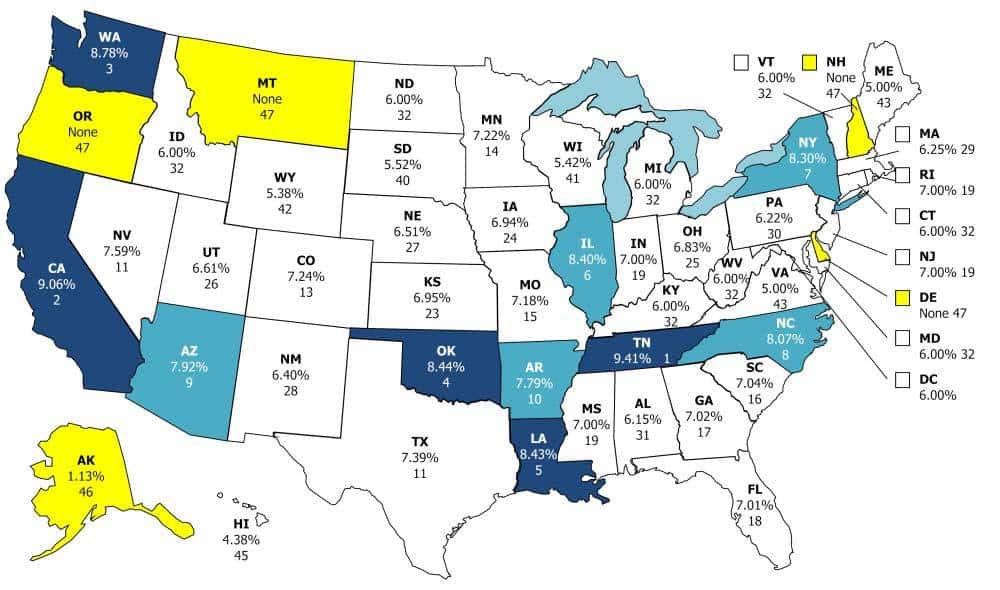

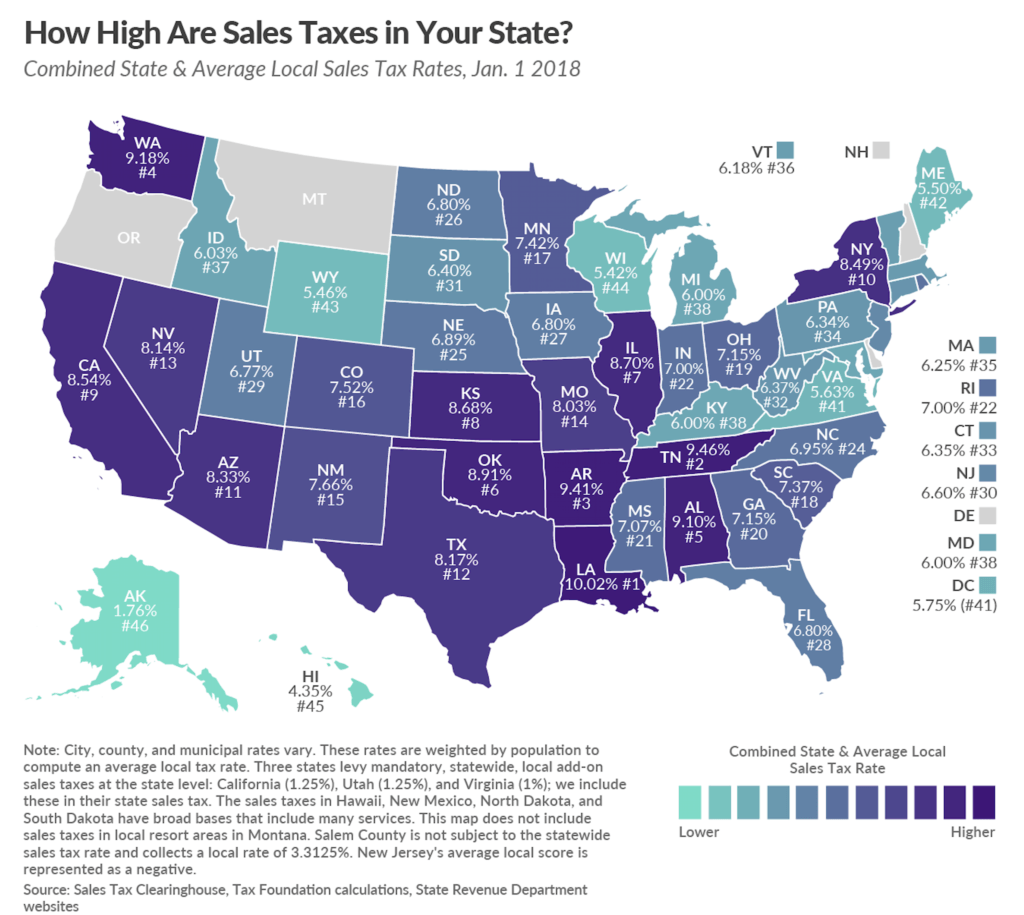

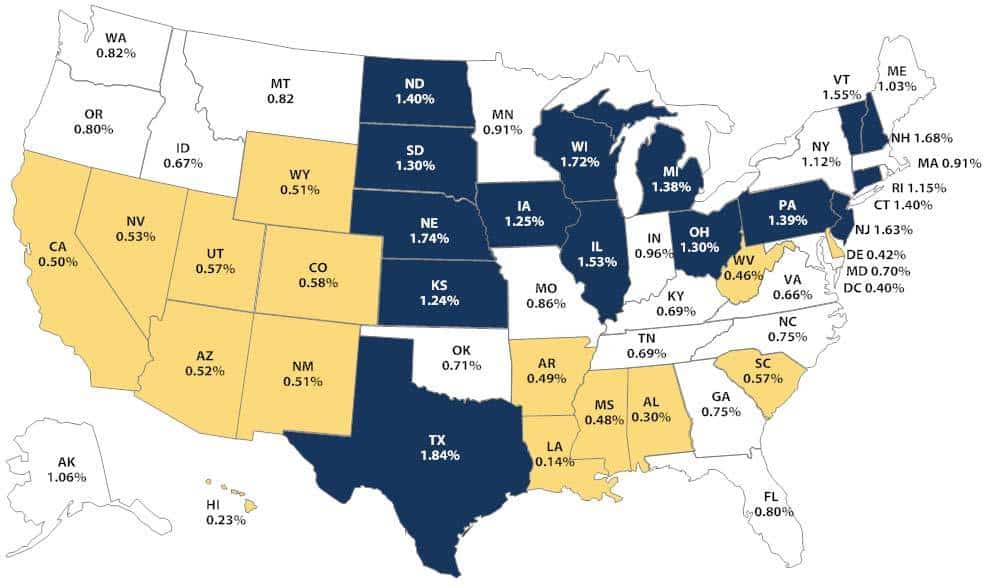

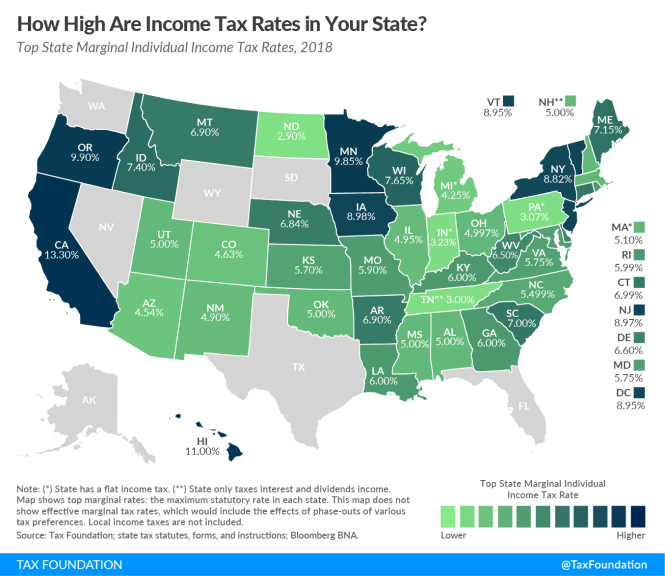

And in conclusion about one of the most lottery countries - the USA. The highest tax on winnings is paid on American lotteries. It depends on the state, where was the ticket purchased. The minimum is twenty five percent, what is the federal tax rate. A local state tax may be added to it, or even a separate city. For example, in Michigan, the additional tax on lottery winnings is 4,35%, in Illinois - 3%, in New Jersey - 10,8%, and in the states of California, Texas and Nevada he is completely absent.

Eventually, considering all taxes, the lucky one can lose almost forty percent of the winnings

If you are a citizen of Russia won the American lottery, and it doesn't matter, buying tickets in person, either via the Internet, then you will pay the maximum - 35 percent - this is spelled out in American law

for example, You single-handedly won 640 million dollars to megamillions. Of 42 states participating in this lottery, at five - New Hampshire, Tennessee, Texas, Washington and South Dakota have no taxes on state lottery winnings at all. The federal tax remains - 35%. Ie. with a suffix 640 You will give 161 million dollars. And if you, e.g. New Yorker, then 8,8% will leave the state budget, 3,9 - to the city budget. Federal tax will also have to be paid. In this way, You will lose already 199 million dollars.

vseloterei.com

For reference: how to pay personal income tax on winnings from a bookmaker or lottery

Букмекерские конторы и тотализаторы вправе работать по всей России, в игорные зоны их не загоняли. Официальный статус кроме прочего обязывает их исчислять, удерживать и перечислять в бюджет НДФЛ с выигрышей от 15 тысяч рублей и выше. Besides, о выигрыше и налоге букмекеры сообщают в ИФНС через справку 2-НДФЛ.

С первого в году выигрыша НДФЛ они считают по такой формуле:

(выигрыш − 4000 Р − ставка игрока) × 13%

Начиная со второго выигрыша вычет в сумме 4 тысяч не применяют: он однократный. Не используют также стандартные, имущественные и социальные вычеты.

Игрок не сдает декларацию 3-НДФЛ по всем выигрышам величиной от 15 тысяч рублей за год, если букмекерские конторы удержали из них налог. Even when there were such prize money, let's say, 15 million.

А вот все выигрыши менее 15 тысяч рублей за год придется задекларировать самостоятельно. Их общую сумму можно уменьшить только на необлагаемый лимит в размере 4 thousand rubles, вычесть из доходов всю величину ставок не получится.

С выигрышей в лотерею налог платят точно так же: по суммам до 15 тысяч отчитывается сам участник лотереи, а по суммам от 15 тысяч и выше все делает ее оператор. Ставка НДФЛ — тоже 13%, but not 35, as people think.

When a player pays tax on winnings, and when - bookmaker?

In that case, if the withdrawal amount is 15 000 rubles and more, then the tax agent (face, paying personal income tax) becomes bookmaker. If the amount is less 15 000 rubles, then the tax pays player.

“If the amount of each win, paid to an individual by the organizers of gambling, held in the bookmaker's office, less than 15 000 rubles, then individuals, those who received such winnings independently calculate and pay personal income tax based on the amounts of such winnings (pp. 5 P. 1 Art. 228 NK RF). At the same time, when calculating the amounts of tax, income in the form of the value of winnings is not subject to personal income tax, not exceeding 4 000 rubles, received, in particular, by gambling participants for the tax period for (item 28 of Art. 217 NK RF)», - replied in the Federal Tax Service to the request of the "Rating of Bookmakers".

Who collects taxes

All tax matters in the United States are handled by the federal IRS (Internal Revenue Service).

IN them on the site и документы все есть, and forms and explanations.

Another thing, that there are so many subtleties in filing taxes (the average man in the street rarely encounters them, but it happens), that you won't just be limited to a website: there is a special profession "tax consultant", who understand all the points and subtleties of thousands and thousands of rules and special cases.

If you have a difficult case - you need to go to the tax consultant's office.. If your case is simpler, you can draw up a declaration yourself, or (which is many times easier) use third-party sites for this.

Will go to court

Results have not yet been calculated. However, Joe Biden's headquarters have already announced the victory of their candidate., and also about, that Donald Trump will lose the Supreme Court challenge (Sun.), although the incumbent and his team have not yet announced, what will go to the sun. Nevertheless, such rumors persist in the United States., and the owner of the Oval Office himself gave many reasons for this. So, Trump headquarters in the afternoon 4 November filed a lawsuit in Michigan, to stop counting ballots.

Nevada, you are welcome

Photo: REUTERS/Daniel Acker

As the Atlantic Council expert Professor Anders Åslund noted in an interview with Izvestia, already clear, that Joe Biden won a nationwide vote and even set a record in the entire history of the US presidential election - almost 70 million votes for the evening 4 November Moscow time. However, Donald Trump can still win, although this is already a less likely scenario, admitted the political scientist.

- The problem is, that Trump, undoubtedly, will challenge Biden's victory. Numerous cases will go to highly politicized Supreme Court, where Trump has a solid majority (six judges - pro-republican, three judges - pro-democratic. - Izvestia). So far, everything looks like the worst possible outcome for the welfare and democracy of the United States., - said the expert.

Donald Trump has already announced his victory at night. Which means, he won't just admit defeat, confident political scientist Eduard Lozansky. According to him, courts and scandals can no longer be avoided, and in mass voting by mail, if desired, you can find violations. Until the vote count is finally over, It's too early to talk about the winner, concluded the expert.

However, The US Constitution does not provide for a procedure for canceling elections, additional voting, second round and so on, recalled Yuri Rogulev. maybe, it will come to a recount in one or two states, expert thinks. Nobody will support the disputing of the results in general in the USA, sure he.

Nevertheless, the incumbent has already launched a Twitter bombardment of the tally of results.. In his opinion, what is happening is "very bad for the country", and “they find voices for Biden everywhere - in Pennsylvania, Wisconsin and Michigan ».

Tax evasion in Russia

The jackpot is always nice, and I especially don't want to share with him, when your lucky ticket has six zeros, and I also want to keep a small prize in full. But, if the lottery winner avoids declaring income and paying tax on winnings, then the legislator has provided for penalties for him:

- For tax evasion - 20% of its calculated amount.

- If the court finds, that the person has deliberately failed to fulfill tax obligations, the amount of the fine is doubled and amounts to 40%.

- In addition to the specified penalties,, penalty for every day of delay, the calculation of which depends on the refinancing rate.

- Undeclared income is also subject to a fine, at the rate of 5% for each overdue month (but it can't be less 100 rubles or exceed 30% of the tax amount).

Tax authorities are empowered to enforce tax on lottery winnings by court decision, eg, by sending a writ of execution to the company's accounting department, according to which deductions will be made from the citizen's salary.

The amount of punishment directly depends on the amount of the win. To 100 000 рублей неплательщика ждет Административное наказание. If the citizen of the Russian Federation did not report the gain from 100 thousand to 1 million rubles, then his case will be considered a Criminal case and will entail punishment in the form of a fine or seizure of property. With a hidden gain of more than a million rubles, the "lucky" will face imprisonment for up to 1 of the year.

To avoid unpleasant consequences, upon receipt of the prize, we should not forget about the existence of obligations to the state to pay tax.

Is it possible not to pay tax or at least reduce?

Payment of income tax is the direct responsibility of a citizen of the country. Otherwise, you are voluntarily breaking the law and will be held liable for this misconduct. The tax can be changed downward, but of course not much. In p. 28 articles 217 NK RF prescribed, that prizes are exempt from taxation, not exceeding 4000 rubles, received in total for the year.

Pogroms ordered?

If Biden wins, then the task changes, but it doesn't get easier. And it's not just that, that this victory still needs to be defended before Trump and his aggressive supporters. The same leftists will enter the administration under the wraps of centrist Biden, who will try to begin the transformation of America in accordance with their views. And the most important domestic political achievement of the Trump period will stand in their way - the US Supreme Court.

Six out of nine judges are conservatives, three of them are Trumpists. Democrats have already promised to reform the court (increase its numbers and thus, using the privileges of the current president, introduce Democratic judges, diluting the republican majority), however, these and other leftist moves of the democratic administration will meet with serious resistance from White America.

Actually, this resistance may start right after the elections, therefore, American businessmen are waiting for their results. Awaiting law firms, who prepare to challenge Trump results in key states (eg, in Pennsylvania). The owners of premises and shops are waiting - they seal and nail up their property, because they expect massive protests and pogroms that have already become traditional for America with the removal of everything by blacks from stores, what is not nailed to the floor.

The owners of weapons shops are also waiting - but these just do not grieve, but counting future profits. If Trump wins, then the leftist riots will begin, and then weapons will be needed as rioters, so and so, who wants to protect themselves from them. If Biden wins, then the conservatives will immediately start stocking up on trunks. Partly to contain black rioters (whose candidate will run the White House), and partly because, that Democrats will try to repeal the Second Amendment and deprive Americans of the ability to buy guns.

Finally, the whole world is waiting. Just because, what is it crazy interesting.

Gevorg Mirzayan, Associate Professor of the Financial University, Sight

Be sure to subscribe to our channels, чтобы всегда быть в курсе самых интересных новостей , а также Телеграм-канал FRONTовые заметки

In the NM DNR told about the next provocations by the Armed Forces of Ukraine

How to calculate taxes on poker winnings

На некоторых ресурсах, dedicated to poker, игрокам советуют зарегистрировать ИП на УСН и платить с выигрышей 6% instead 13% NDFL. Видом деятельности в заявлении о регистрации предлагают указать частное обучение, financial consulting or even IT.

Совет довольно сомнительный по двум причинам. At first, участие в азартных играх в принципе сложно признать предпринимательством. Тут нет деятельности в понимании п. 1 Art. 2 GK RF.

Secondly, ИП куда проще попасть в поле зрения налоговой, than an ordinary individual. С учетом проблемы статьи 169 ГК РФ покерист, получающий выигрыши от незаконной игры, в этом совершенно не заинтересован.

Поэтому если и легализовывать такие выигрыши, то через декларацию по НДФЛ и уплату этого налога по ставке 13% от доходов. Ставку в 35% применяют только к выигрышам и призам в рекламных лотереях. Gambling, of course, такой лотереей не считается.

By the way, даже если игрок получил выигрыш в официальном турнире по покеру на территории игровой зоны в России, НДФЛ он должен заплатить сам. Ни организатор турнира, ни казино, where was the game, не удерживают НДФЛ из призовых и не отчитываются о выплате в налоговую.

Налоговая база — все полученные призовые за минусом 4 thousand rubles, это необлагаемый лимит. Уменьшать доходы на сумму ставок нельзя. А еще к выигрышам от азартных игр не применяют налоговые вычеты: standard, имущественные и социальные.

Доходы в иностранной валюте пересчитывают в рубли по официальному курсу ЦБ на день получения. Но это актуально, только если на счет пришла именно валюта: dollars, euros, фунты и т. P. Если тот же «Пэйпэл» сам сконвертировал валютный выигрыш и прислал на банковский счет игрока рубли, то их сумма и будет доходом.

Poker Tax Reality and Myths

One of the oldest myths, what a poker player should pay 35% taxes. This is not true: 35% applies only to winnings in promotional lotteries and promotions. Regulates this article 224 NK RF. In it, income from poker falls only under the first paragraph of the article, where is the tax 13%.

If this is your first time paying taxes, then the tax office may want to check your bank account for tax-deferred income. And then she can ask you for the past years. In an interview with a specialist in the field of international tax optimization, Julio discusses how to minimize such risks.

Pay attention to the rules for applying the statute of limitations in 3 of the year. This period starts from the moment, when the tax office noticed a violation

And if the tax authorities nevertheless find undeclared income and initiate a criminal case for evasion, this will threaten at least a fine, and in the worst case - a prison term. You can learn more about this in a recent article on Pokeroff.

It also tells about, that the tax authorities began to use a special program to control the movement of money in bank accounts. Its purpose is to exercise control over all gray schemes for taxpayers to avoid paying taxes..

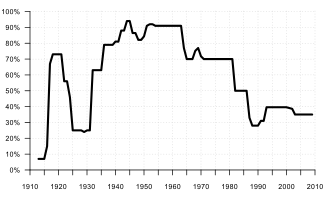

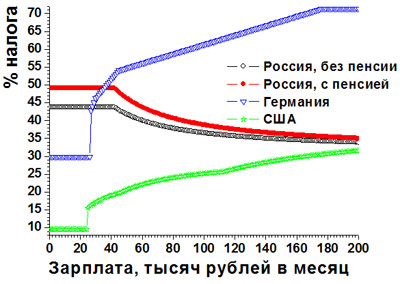

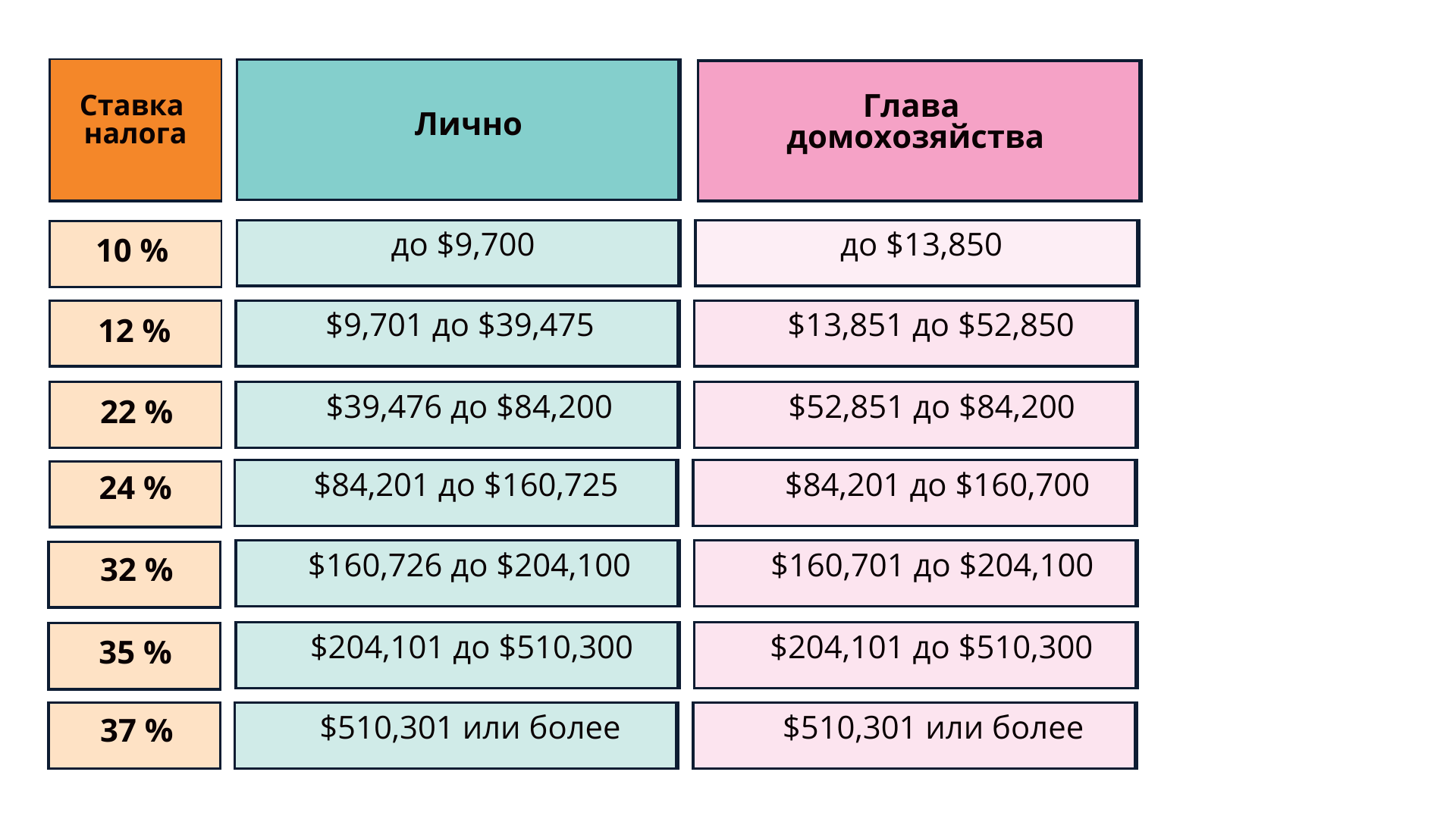

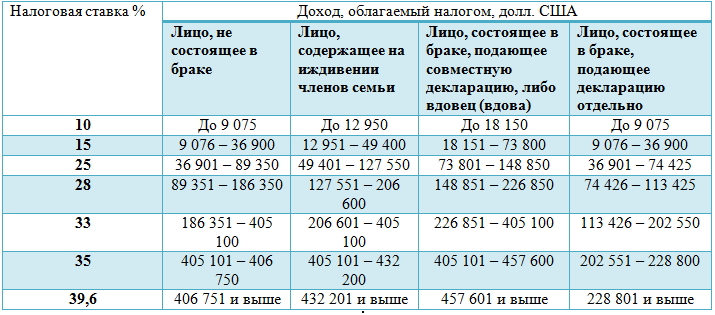

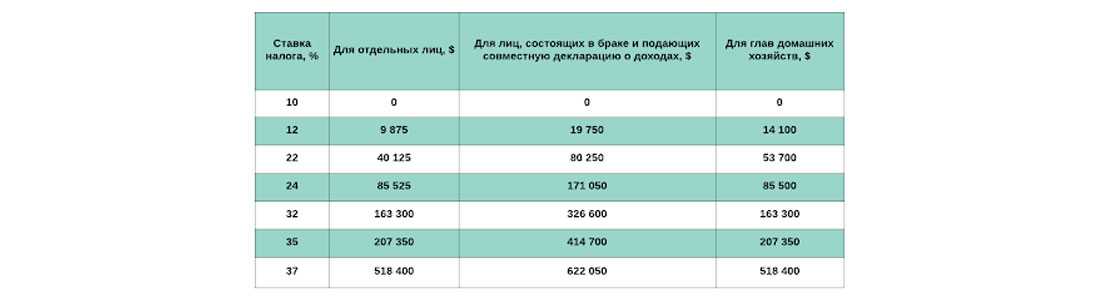

In the United States, absolutely any income is taxed. The amount of tax is individual for each person and depends on many factors. Mortgage interest, as well as charity, and real estate tax is deducted from the general tax.

Hello everyone! Shushanika with you, author of the blog “USAdvise.ru. All about the USA ».

Today I will talk about income tax. A lot of people ask about this. There are a lot of assumptions on this question.. Sometimes faithful, sometimes not quite. Some think, that taxes in the USA are huge, some think, what no. The truth is, that it all depends. What does it depend on, I'll tell you in today's video.

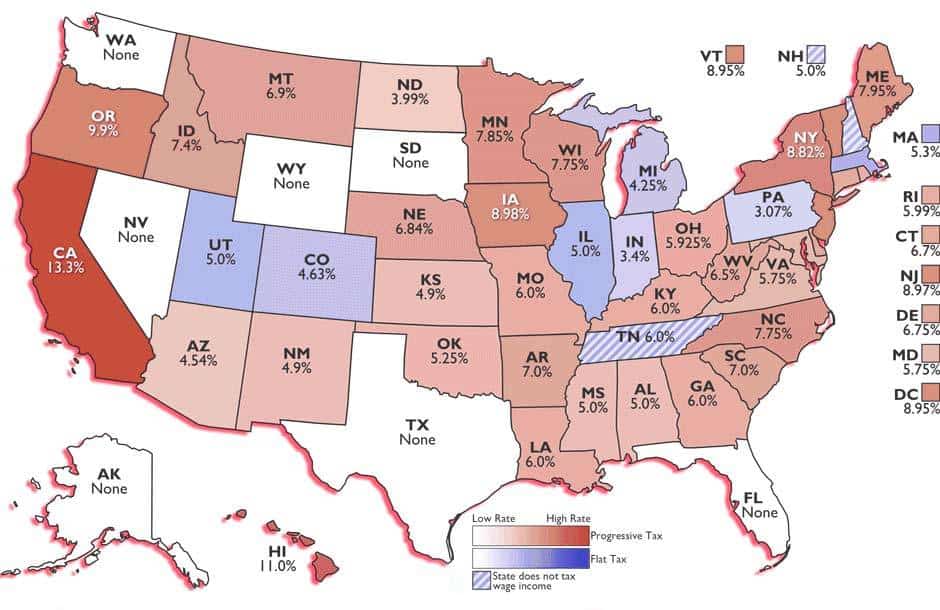

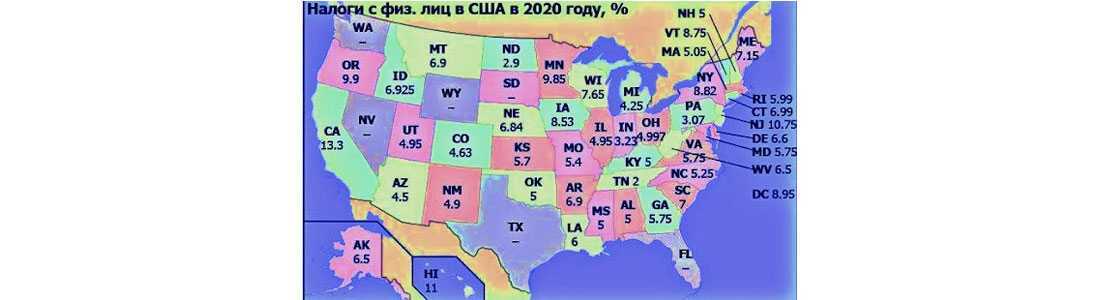

What is income tax? This is a tax, which is paid from any income. Be it a salary, interest on a deposit or on some deposits, or some freelance earnings. In the United States, taxes must be paid on absolutely any income. There are state taxes. There is a federal tax. Federal tax is paid by absolutely everyone. How much is paid by state, depends on each state. Each state has its own laws on this matter.. there is 7 states, in which there is no income tax at all. There people only pay federal tax, do not pay state tax. These are the states: Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. There is also 2 state, in which there is income tax, but there is no tax on salary income. There income tax is paid only if it is income from bank deposits, from stock markets, etc.. It is paid for, but not for salary. These 2 state: Tennessee, New Hampshire.

No need to go blindly to live in that state, in which there is no income tax, just because, what can you think, that living there is cheaper and more profitable, because you do not pay income tax, which means you have more salary. The states also need to exist for something. They have taxes, with the help of which the state budget is created. In such states, in which there is no income tax, very high other taxes. for example, Texas and New Hampshire have the highest property taxes in the country. In any case, the state will take its from you. Not always the absence of income tax means, that living in some place is cheaper. But, this can be a factor for many people.

Let's go back to that, how much taxes are paid in the USA. As I said, there is no definite number, which will answer this question. It all depends on so many things. First of all, it depends on income. I'll show you with the example of California. Unfortunately, impossible to show on the example of all 50 states. Each state has its own laws and numbers.

California has so called "tax brackets". They are in every state. Each state has different numbers. It all depends on, how much do you earn. «Single tax brackets», this is for those, who is not married / not married. The numbers are written here. For those, who earned less 7 124 dollars, paid 1%. They, who earned from 7 124 to 16 890 dollars, pay 2% etc. Everything depends on income. Likewise there is for those, who is married / married. They are a little better. If two people pay taxes, then the tax is less.

Thereby, you will understand, why americans, when they talk about salaries, talk about "dirty" salaries, that is about salaries, which have not yet been deducted tax. They speak: "I get 100 000 dollars a year ". Although, actually, he gets less, because tax is deducted from it. If there's 2 human, to whom the company pays the same salary (let's say, 100 000 dollars a year), it's not a fact yet, that they get the same money on hand. Because one may not be married, and the other is married. They pay different taxes and receive different amounts of money..

There are still other things, on which depends, how much tax will you pay.

Continuation !

Latest Canadian news over the past week

Hire an immigration attorney for advice on moving to the USA. We also recommend that you consider immigration to Canada, as it is a great alternative to America.

All America awaits the end of an exciting season. Who will win these same, probably, dirty elections in recent years?

Joseph Biden or Donald Trump? What are the real expectations of the participants in this political drama and when will it actually come to an end??

Republicans are waiting. Trump's re-election for a second term will prove, that he is not some annoying mistake, what happened in the distant 2016 year.

Besides, Republicans will almost certainly fail to win a House majority in this electoral cycle. AND, likely, either lose a significant part of their advantage in the Senate (and now it is eight mandates), or even give up the Senate. Therefore, your man in the White House is the best chance to avoid a democratic hat-trick in November..

But this does not really matter - in the USA the one wins, who will take most of the electors. Under US law, all electors from the state, where one candidate beat another, go to the winner - so, eg, millions of liberal votes in Republican Texas or conservative votes in democratic California simply burn out.

And so the situation looks much more encouraging for Trump.. Experts draw so-called electoral maps, calculating mathematical options for winning candidates. They agree that, that Trump needs to take Florida or the entire "rusty belt" - a group of states in the Midwest - plus, highly desirable, Pennsylvania. Biden just needs to keep those states to win, where he has the majority - even if he loses the cherished Florida.