Bookmaker offices

One of the organizers of gambling are bookmakers. Их посетители могут сделать ставку на результат тех или иных спортивных состязаний. Winning sports betting, You do not have to burden yourself with filling out the declaration and transferring the fee. The bookmaker withholds and transfers funds to the budget from the amount 15 thousand. rub. and more. You get "net" income minus deductions. If the size of the win is less than 15 thousand. rub. the winner declares income and pays tax on his own. Since sports betting belongs to the category of risky games, winnings at the bookmaker's office are subject to a fee in the amount of 13%.

A feature of the taxation of such income is that, that the tax base is reduced by the amount of the rate made – this is the deduction. I.e 13% fees are not calculated from the total winnings, but from the difference between the bookmaker's winnings and the previously made bet.

Example №3: Vorobiev F.D.. is a client of the "Sport Game" bookmaker. In June 2019 r. Vorobiev made a bet on the result of the football match Russia - Wales in the amount of 324 rub. The result of the match was predicted by Vorobiev correctly, the poet he won 32.400 rub.

Let's find out, from what amount of winnings the tax will be calculated and how much Vorobyov will receive as income. Since not the entire amount of money won is taxed, and minus the rate, then 13% need to calculate from 32.076 (32.400 – 324). The Sport Game office will pay the tax in the amount 4.169 (32.076 * 13%). Vorobyov will receive 28.231 (32.400 – 4.169).

Car winnings tax

Sometimes citizens can win valuable prizes. Joke Of Cars Quite Often. Receiving the goods, not a cash prize, does not exempt citizens from the need to pay tax.

Estimate the amount, to be paid, can be done in two ways:

- The lottery organizer announces the market value of the car, from which you need to subtract 13% to transfer money to the state.

- If the operator has not provided such information, you can contact an independent company, which will assess the value of the vehicle.

Automobard

Its useful to note, that citizens do not always have the required amount. Then they can sell the car and pay tax on the amount received.. If the payment terms are "hot", then it is allowed to apply to car pawnshops. There, employees will quickly assess the cost of the car and offer up to 90% from market value. Payment usually takes place on the spot in cash. But before that, you need to register the car yourself, otherwise the transaction will be considered invalid.

Casino gambling

For the lucky ones, who managed to hit the jackpot in the casino, are obliged to pay a fee in the amount of 13% from the tax base. It is defined like this: the cost of casino chips is minus from the received payment.

The gambling establishment must provide the tax authorities with information about the value of chips and the winnings of a specific player in aggregate for the tax year. These data are recorded during cash transactions in the casino.

After that, the tax inspectorate will independently determine the amount of tax and send a notification to the citizen.

The taxpayer must pay no later than 01.12 of the year, next year, in which there were winnings.

A rather controversial situation is developing with income, received from playing at online casinos. One side, this type of gambling does not apply to territorial zones, provided by law, and consequently, banned. Но какая-либо административная или уголовная ответственность за игру в онлайн-казино для игроков не предусмотрена. А полученный доход должен быть задекларировать в общем порядке с последующей уплатой налога 13%. The receipt of income is not the date of the win, and day, when the funds were received on the electronic wallet (bank card) winner.

Example №4: 21 December 2019 r. Kondratyev S.T. won the amount of money at the Split online casino 74.613 rub. The money was credited to Kondratyev's account 13 january 2020 r. How is this winnings taxed??

Since Kondratyev received money 13.01.2020 g., then he is obliged to file a declaration for 2019 year. Kondatiev must fill out and submit a document to the IFTS before 30.04.2021 r. Кондратьев обязан перечислить сбор до 15.07.2021 r. in total 9.699 rub. (74.613 * 13%).

Example №5: Visitor to the casino "Oracle" Khomyakov D.L. made a bet 1.840 rub. and won 1.420.600 rub. Since the size of the rate made does not affect the tax base, then Khomyakov must pay the fee in full 184.687 (1.420.600 * 13%).

Ticket purchased online or by SMS

The ticket distribution system is designed like this, to minimize the possibility of fake coupons on sale. An extensive network of stationary points and online sales allow organizers to fully control the process. One of the ways to get tickets is to buy them in the official app, on the company's website or via SMS code.

Prize to 100 thousand rubles

The complexity of the withdrawal procedure depends on the size of the win. The simplest algorithm for receiving rewards up to 100 thousand rubles:

- Create a personal account and log in to it.

- Open ticket information.

- Order withdrawal of funds to the wallet.

- In a few seconds, receive the declared amount to your personal account balance.

When, when the amount does not exceed 5 thousand rubles, you can get a ticket winnings at the faculty of the bookmaker "Baltbet". Prize to 100 thousand rubles can be cashed out at Balt-Lotto branches. To order funds, at the point of issue, you must provide a passport of a citizen of the Russian Federation or a residence permit in the country, ticket code, exact information about the winning coupon.

View the results of the draw

Prize from 100 thousand rubles

Big prizes, whose equivalent is equal to or greater than 100 thousand rubles, cannot be obtained in your personal account. In this case, the user creates a request for a wire transfer to his bank account. If the amount does not exceed 300 thousand rubles, then the withdrawal request can be sent to one of the inpatient departments of "Stoloto". Before, how to withdraw money in this way, check the limits at the selected ground point.

By prior call, you can apply for the withdrawal of the amount up to 180 thousand rubles in the head lottery center "Stoloto". Larger prizes are issued only after examination of the ticket for authenticity.

Prize from 1 million rubles

If you are faced with the need to withdraw a large amount, then congratulations. Only a few become millionaires at Stoloto, but miracles happen sometimes. Transfer request will be approved only after examination of the lottery ticket. Payouts of big winnings are made only at the head office of the company. The client must first call the responsible employee. Amounts up to 10 million rubles can be paid in cash, and for larger winnings, only wire transfer is possible. During a visit to the office, you must present an identity document.

How to declare poker winnings and pay taxes

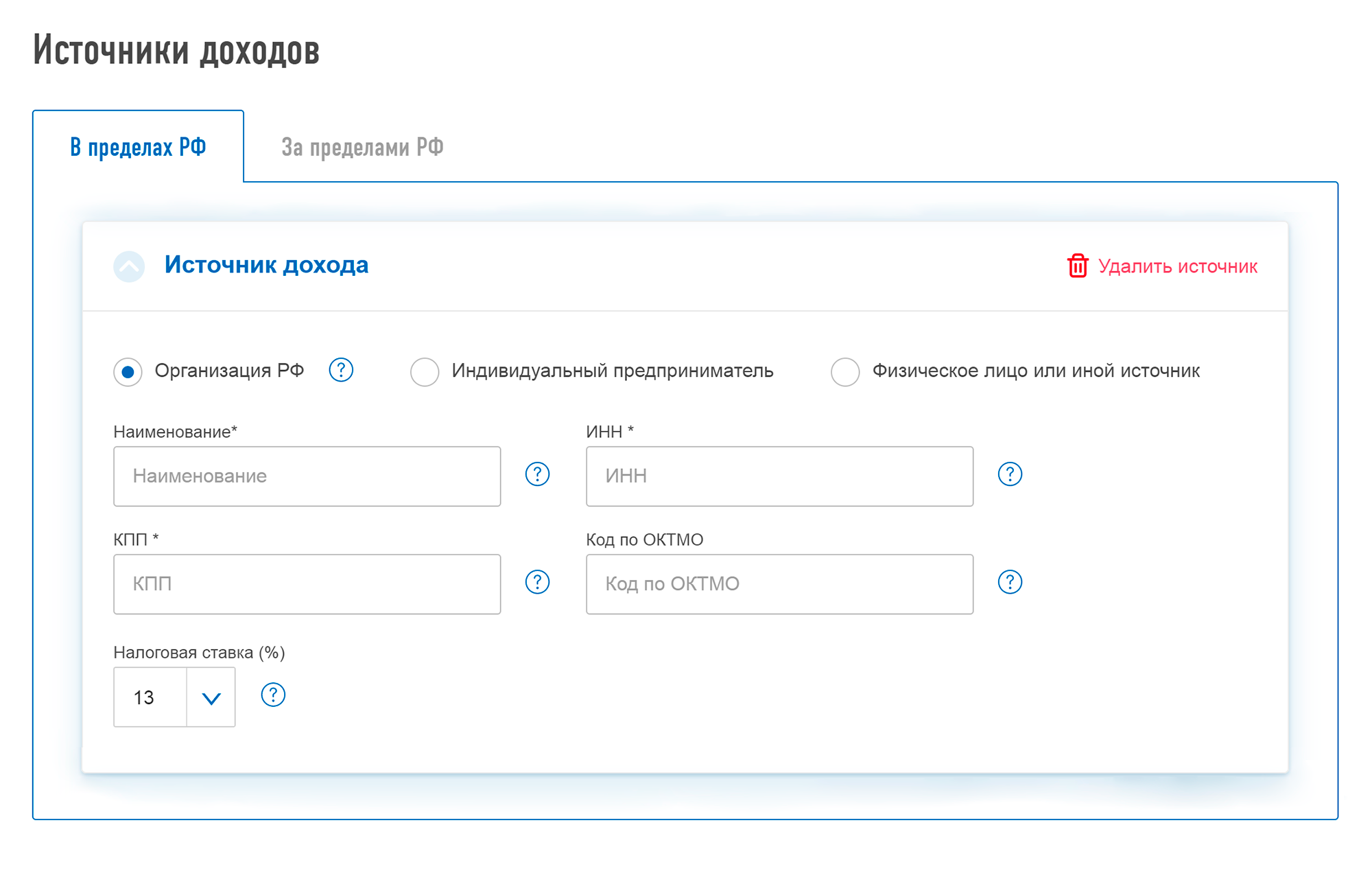

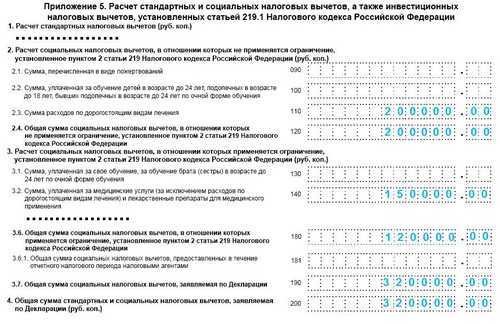

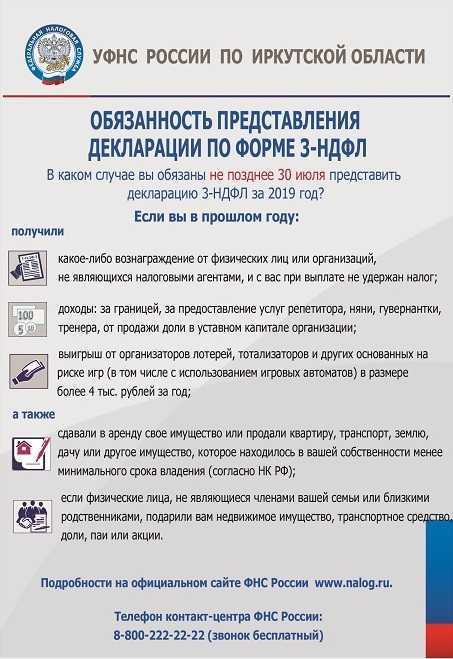

Выигрыши на официальных и неофициальных офлайн-турнирах в России следует показать в приложении 1 к декларации 3-НДФЛ, а поступления из-за рубежа от игры в интернете или в офлайне — в приложении 2.

Проблема в том, что в обоих приложениях по умолчанию нужно указать источник дохода: как минимум ФИО физлица или название фирмы. If it's difficult, it is permissible to enter the type of operation instead of the source, от которой получен доход.

В случае с нелегальной азартной игрой очевидно, that the source cannot be indicated. The type of operation remains. Если не врать, то придется так и написать: выигрыши в азартные игры. If you lie ... However, это не к Т—Ж: мы за соблюдение закона.

Также в приложениях 1 and 2 к декларации 3-НДФЛ следует указать четырехзначный код дохода. However, your code, 3010, есть только у выигрышей в азартные игры, организатор которых — букмекерская контора или тотализатор. Для остальных призовых придется использовать код 4800 — иные доходы.

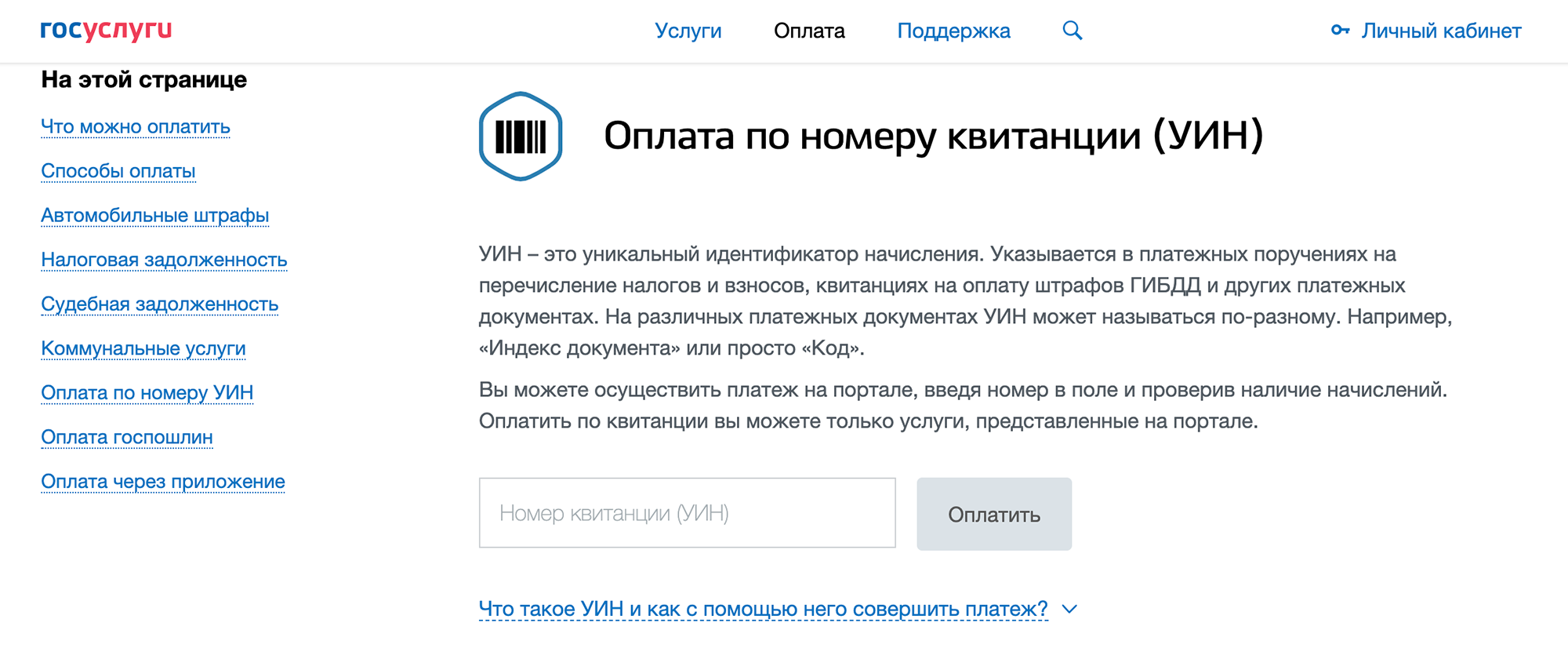

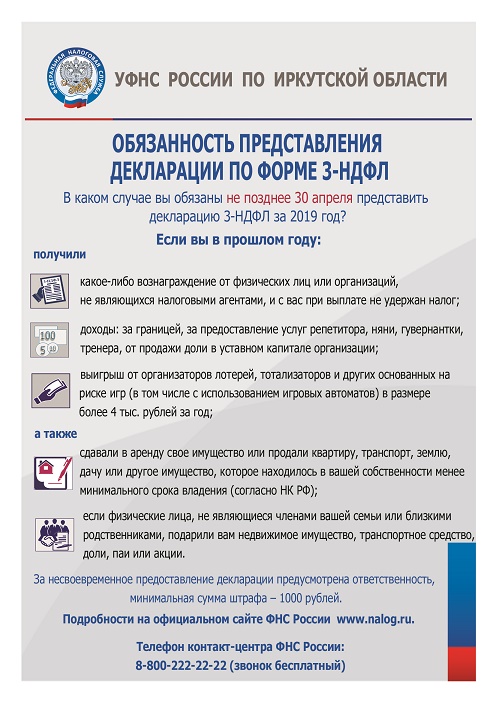

Представить декларацию по НДФЛ надо не позднее 30 April of the year, следующего за годом получения выигрышей, а заплатить налог — не позднее 15 июля того же года. То есть в случае с призовыми за 2018 год — не позднее 30.04.2019 and 15.07.2019 respectively.

In other countries

Lottery winnings are not taxed everywhere. In Canada, Austria, Australia, Great Britain, France, Finland, Germany, Ireland ,Турции и Белоруссии выигрыши выплачиваются в полном объеме. In Spain winnings up to 2500 euros are not taxed, over this amount - the tax is 20%.

Самая сложная система налогообложения в США — по законодательству лотерейный выигрыш расценивается, as additional income. Therefore, upon receipt, the winner pays two types of taxes.: federal income tax (the rate depends on the annual income) and state tax, resident of which he is.

В результате обладатели многомиллионных джекпотов в американской лотерее, почти половину суммы отдают качестве налога.

Until 2018

* To 2018 года граждане были обязаны самостоятельно уплачивать налог с выигрыша, regardless of its size. Considering, что нижний предел выигрыша не регламентировался, most of the players actually violated the law, так как никто не подавал декларацию на мелкие выплаты. On the one hand, such a massive violation is unlikely to ever be revealed. On the other hand, isolated cases of fines for this also happen:

2016 year. Won 300 rubles, got a fine 1000 rubles (for not submitted declaration). Случай упоминался в интервью заместителя начальника отдела налогообложения доходов физических лиц ФНС России по Свердловской области Сергея Барышникова

2016 year. Won 4 622 ruble, did not submit a declaration and did not pay tax. As a result, the Tax Inspectorate went to court, было заведено административное дело, the judge ordered to bring the violator to justice, with payment of a fine (a source)

***

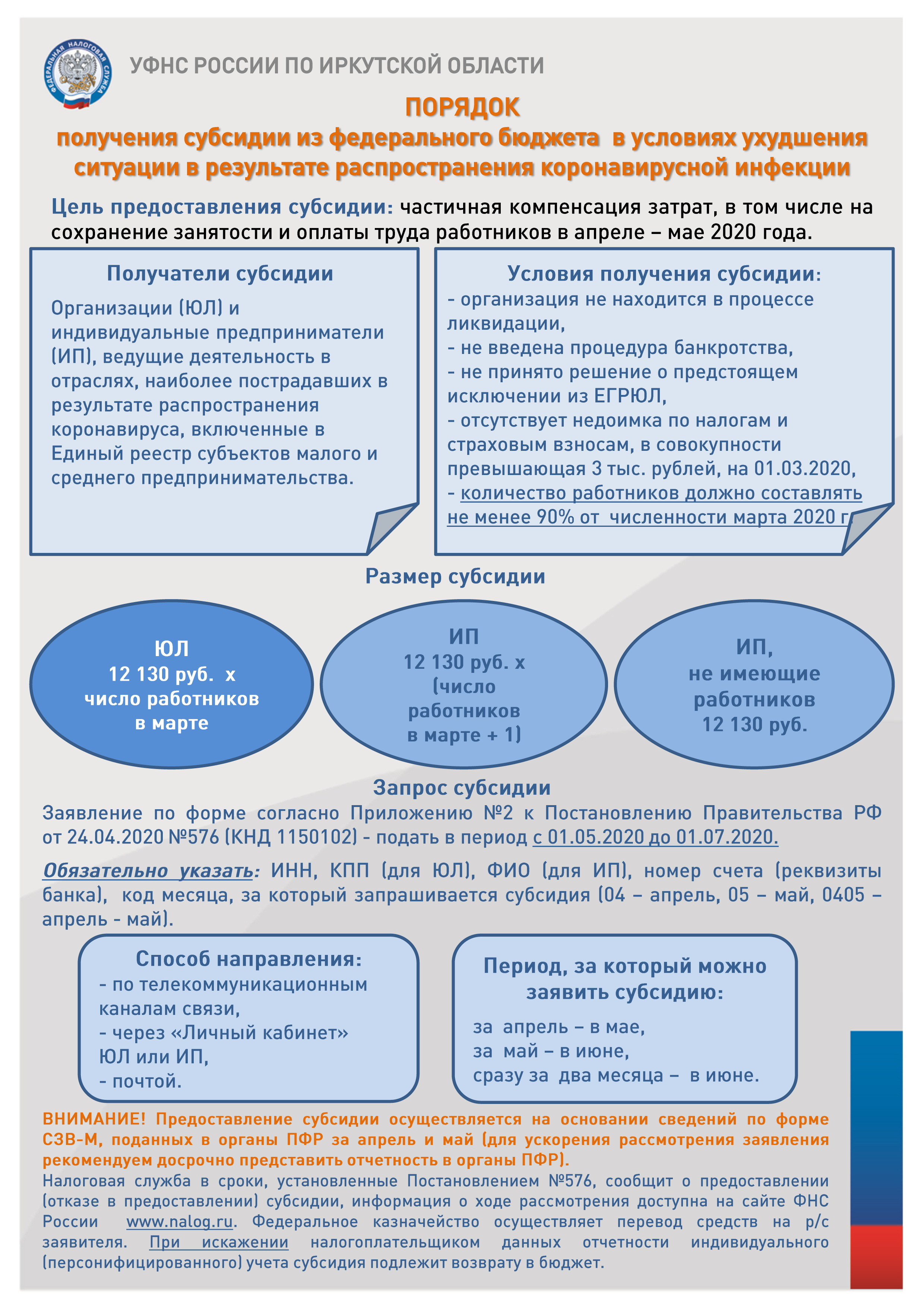

In a letter from 27 june 2018 r. № 03-04-05/44417 The Ministry of Finance spoke about the peculiarities of paying personal income tax from the amount of winnings, obtained from participation in gambling, carried out in the bookmaker's office and the totalizator.

So, according to paragraph 1 articles 214.7 NK RF (as amended by the Federal Law of 27.11.2017 № 354-FZ) tax base for personal income tax with winnings, equal or exceeding 15 000 rubles and received from participation in gambling, carried out in the bookmaker's office and the totalizator, determined by the tax agent by decreasing the winnings by the amount of the bet or interactive bet, serving as a condition for gambling.

In this case, the amount of tax in respect of income in the form of winnings is calculated by the tax agent separately for each amount of winnings.

The date of the actual receipt by the taxpayer of the specified income is determined as the day of its payment, including transfers to bank accounts or on behalf of the taxpayer to the accounts of third parties (subparagraph 1 paragraph 1 articles 223 NK RF).

What to do, if the win is too big

Налоговая ставка не зависит от размера выигрыша.

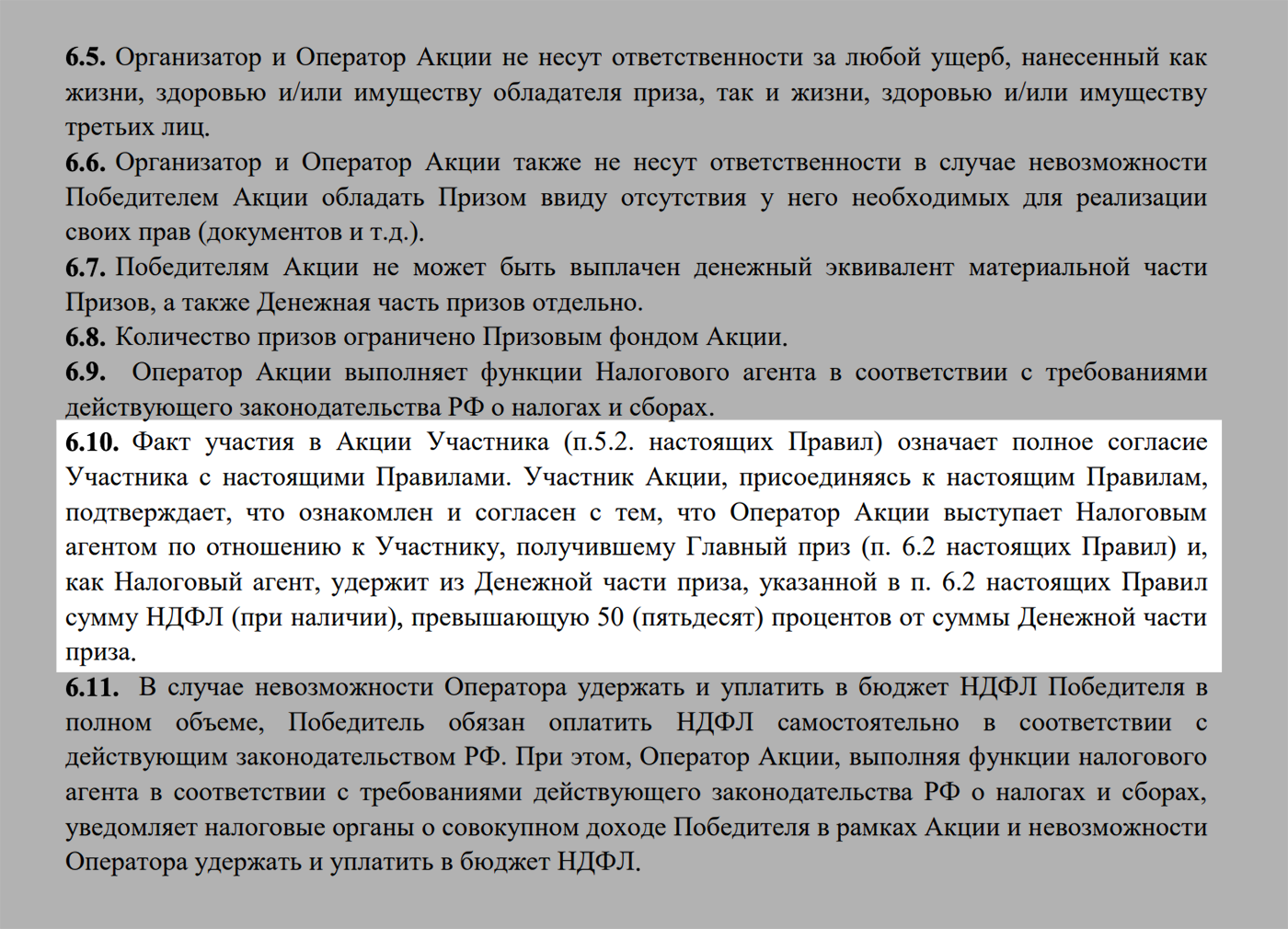

But, если выигрыш свыше 15 000 Р, perhaps, вам не придется за него отчитываться и платить налог самостоятельно. За вас отчитаются и заплатят, если вы выиграли в российскую лотерею или в легальной букмекерской конторе. Организаторы рекламных акций отчитаются и заплатят за вас независимо от размера выигрыша.

Вы выиграли в лотерею 1 000 000 Р. Сдавать декларацию и платить ничего не придется. В этом случае организатор лотереи является налоговым агентом. Он выплатит вам 870 000 Р и отчитается перед налоговой.

Вы выиграли джекпот в казино — 10 000 000 Р. To 30 апреля следующего года вы самостоятельно их декларируете, а до 15 июля платите 1 300 000 Р. Если проиграете деньги обратно — останетесь должны государству. Поэтому лучше сразу откладывать суммы налогов и не трогать до момента оплаты. for example, open a savings account: тогда еще подзаработаете на процентах.

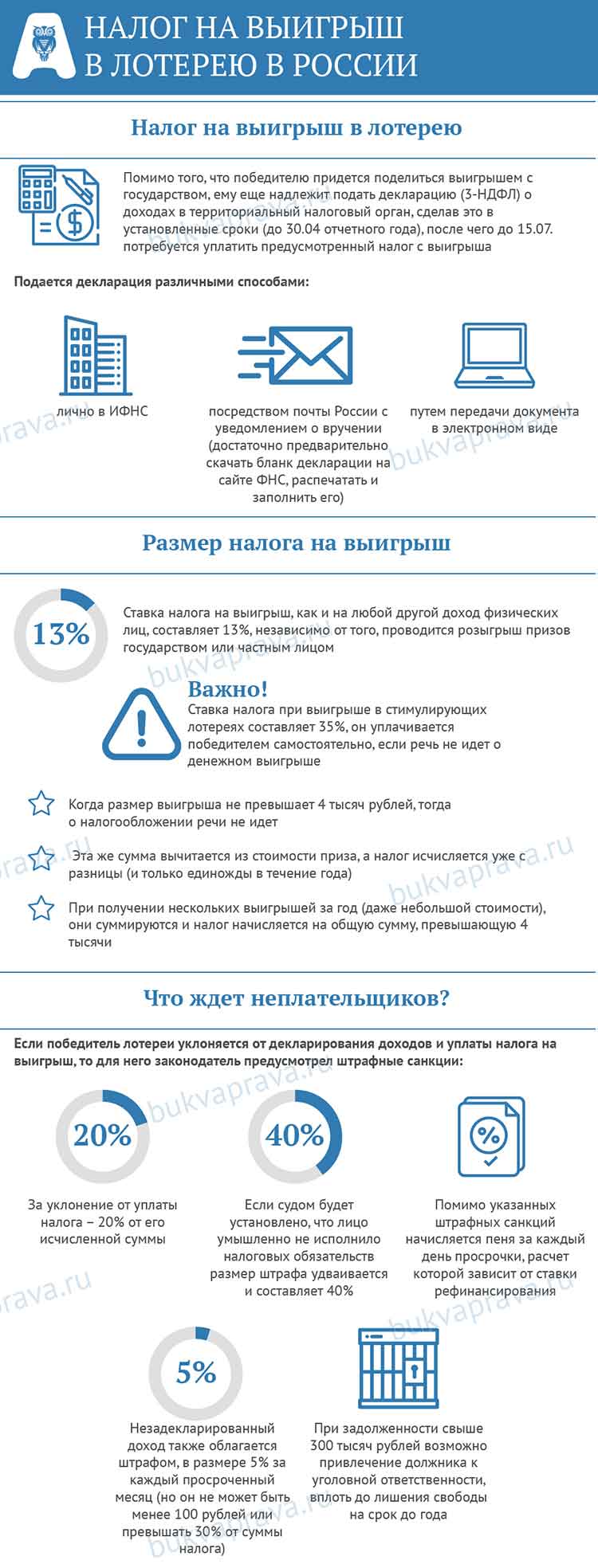

Tax on lottery winnings in 2018 year

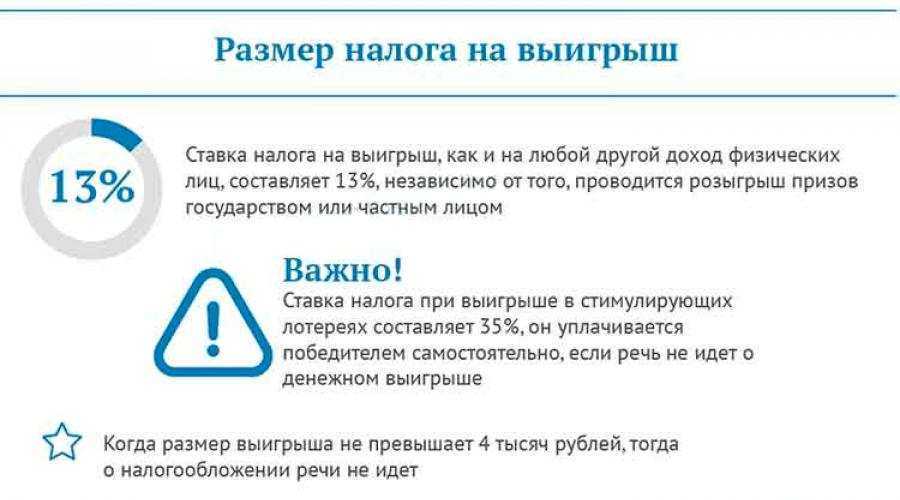

Currently, lottery winnings are income of an individual, for which you must report to the state and pay the appropriate tax. Tax rate for tax residents of Russia, lottery winners, is 13%.

By law, in case of winning up to 4 000 rubles, the winner is not required to report to the tax office and pay tax. But only on condition, that this money was the total winnings during the year. I speak otherwise, no matter how many people participate in the lottery in a year, if the total amount of winnings does not exceed 4 000 rubles, you don't have to pay taxes.

But those, who is fortunate enough to benefit from 4 000 to 15 000 rubles, You will have to pay personal income tax yourself. Moreover, you can not pay immediately, and at the end of the year, indicating the income received in the declaration

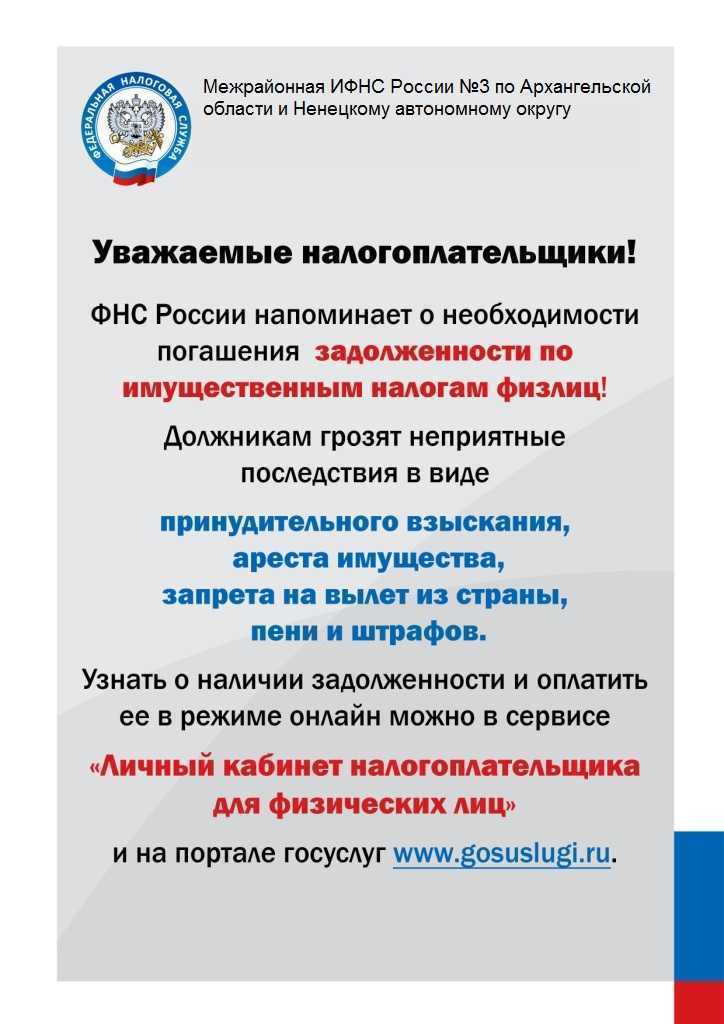

note, the lottery is public, which means, if you are lucky enough to win, the FTS, likely, already in the know and awaiting your further actions. Therefore, you should not take risks and miss the deadline for the payment of personal income tax.

For those citizens, who are really lucky in these games, and whose winnings exceed 15 000 rubles, the tax agent in accordance with the law is a person, which pays the winnings. For example, distributor, paying you a prize the amount of which is 15 000 rubles, withholds from them 13% – 1950 rubles and independently transfers this amount to the tax authorities, you get already tax-free 13 050 rubles.

Casino winnings

Tax rates, casino winnings, correspond to the rate of personal income tax, that is, make up 13% for residents, and 30% for persons, not belonging to this category.

Online casino games are also taxed

If you receive a win at one of the land-based points of the casino, then take the money, fill out the declaration form and transfer the information to the tax. Then pay the amount of the tax to the treasury and feel relieved of the obligation. As you can see, everything is pretty simple.

Fact, according to which the receipt of winnings is registered, is to transfer funds from the online casino to the owner's card. Only after their receipt, the winnings are considered received

note: regardless of the amount of your bets, the taxable base in the amount of the received winnings will not decrease

An example of receiving a prize in a casino

Introduce, that at the end of December 2015 of the year Mr. Karelin received a win at an online casino, the amount of which was 55 thousand Russian rubles. He received funds on the card only in January 2016 of the year. It turns out, filing a declaration is not provided for the year of receipt of the win (2014), and for the year of actual receipt of funds (2015). Karelin is obliged to submit a completed 3-NDFL form to the tax service for verification immediately before 30 April next year, i.e 2016. To 15 July of the same code, Karelin is obliged to transfer the fee in question to the balance of the state.

The tax amount will be: 75 000*13% = 9 thousand 750 Russian rubles.

Let's give another example. so, the hero of the previous example, Mr. Karelin, decided to visit the casino of his city. There he made a bet, equal 1 thousand 840 rubles. The value of the final gain of our hero was 1 million 420 thousand 600 Russian rubles. Since the rate in this case we do not deduct from the tax base, full tax payment must be made. It will be: 1 420 600*13%= 184 thousand 687 rubles.

Local taxes

In addition to federal and state taxes in many cities, US counties and municipalities are subject to local income tax. This can vary greatly depending on location., but in all cases it will apply on top of any other income taxes.

for example, New York City has a local tax of 3,876% in addition to the maximum state income tax rate in 8,82% and the highest federal rate in 37%.

It means, what a New Yorker, who will choose a one-time payment of the cash prize for the starting jackpot, as a result, he will receive a final payment of about 12 million dollars, which is only 30 percent of the declared jackpot in 40 million. Knowing these rules before, how do you apply for prizes, can protect you from shock, when will you find out, how much money will be cut from your account.

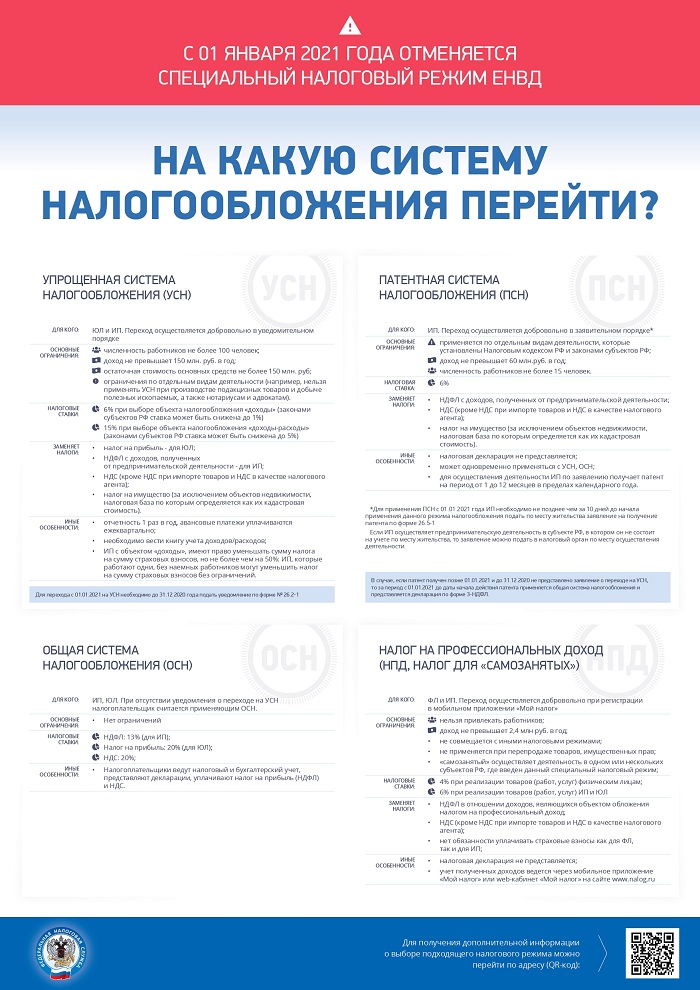

Taxation by type of draw

В настоящее время в стране проводится довольно много лотерей, где разыгрываются денежные и вещевые призы. Кратко рассмотрим основные варианты розыгрышей и налоговые ставки при получении выигрышей.

Online casino

this implies, that it is extremely difficult to track payments of winnings to players. Сделать это можно лишь запросив выписки по банковским картам, но российское законодательство запрещает это делать в отношении физических лиц без веских оснований.

В любом случае выигрыш в онлайн-казино облагается налогом в размере 13% от полученной суммы.

Bookmaker offices

Здесь ситуация напоминает вариант с онлайн-казино, discussed above. In particular, не все букмекерские конторы работают в рамках правового поля, но в отличие от казино, такие организации могут осуществлять свою деятельность не только в интернете, но и реальной жизни.

Выигрыш на тотализаторах также облагается налогом в размере 13%. This assumes, that the bookmaker's management independently makes the necessary deductions, if the winning amount exceeds 15 000 rubles. В остальных случаях подача налоговой декларации входит в обязанности игрока.

"Russian Lotto"

This is an analogy to the popular family game. Суть сводится к тому, that participants buy tickets, which are a copy of the home lotto cards. В день розыгрыша ведущий вытаскивает из мешочка бочонки, и тот из участников, which will fill in all fields, can hit the jackpot.

Considering, что билет для участия в «Русском лото» приходится приобретать на собственные деньги, такие розыгрыши нельзя отнести к разряду стимулирующих лотерей. Therefore, the tax rate for the winners is 13%.

Если в качестве приза предлагается автомобиль

- 13%

- 30%

- 35%.

Конкретная сумма зависит от статуса победителя (resident / nonresident) и способа проведения розыгрыша. Note, that the exact amount of deductions is usually announced by the organizers of the drawing. In this case, the winner can invite an independent expert, to confirm the declared value of the car.

Need to clarify here, что внести налог нужно до получения выигрыша, иначе забрать приз не получится. Если у победителя нет нужной суммы, по обоюдному согласию между победителем и организаторами, the car can be sold.

Overseas draws

In most cases, налог с выигрыша в лотерею уплачивается на территории страны, where the lottery was held. Это делается в рамках международных договорённостей, to avoid double taxation.

В качестве примера рассмотрим налоговые ставки с выигрышей на территории разных стран:

- Италия — 6%;

- Чехия — 20%;

- Болгария — 5%;

- США — в среднем 25%, но в разных штатах могут действовать свои ставки.

Promotions

These are stimulating lotteries, которые проводятся различными компаниями для продвижения своих товаров и услуг на рынке. Above mentioned, что для таких выигрышей установлена ставка в 35%.

Cash prizes

Такие выигрыши могут быть в стимулирующих и обычных лотереях. Поэтому налоговая ставка составляет 13 and 35% respectively. If the winner is a non-resident of the country, он оплачивает 30% of the winnings.

How to be punished for illegal gambling

Первая же запрещенная азартная игра превращает физлицо — организатора или владельца помещения — в уголовного преступника

It doesn't matter at all, whether the person received income or not, а если получил, то как много. The very fact of gambling outside the gambling zone is criminally punishable.

Максимальное наказание — тюрьма на два года.

If there are several organizers, то это уже преступление, совершенное группой лиц по предварительному сговору. Тогда каждый может оказаться за решеткой на четыре года.

Фирме-организатору или владельцу помещения выпишут административный штраф от 800 тысяч до миллиона рублей. А ее директора, remind, will be prosecuted.

Equipment for gambling, а также все найденные в «банке» деньги конфискуют в любом случае, кому бы они ни принадлежали. Besides, if the investigation establishes the exact amount, which went through the game organizer or the owner of the premises, her, likely, взыщут в пользу государства отдельно.

Receiving prizes at bookmakers

Gambling is a popular activity today. It brings the organizers a solid profit, so, this business line continues to expand and grow.

A lottery prize can be more than money, but also property

Companies, being one of the organizers of such leisure, called bookmakers. In these offices, visitors determine and make monetary contributions - the so-called bets. They guess results or nuances, related to any competition. Usually it is about sports. Football betting is very popular today, Horseback Riding, basketball and esports.

As this leisure destination is very popular, from 2014 year bookmakers acquired the status of tax agents. It turns out, what winning cash prize, the taxpayer must not contribute any funds to the state treasury, as he should not fill out the declaration form. All these obligations are assumed by the bookmaker.

Since bookmaker bets are related to games, risk-free, taxation of cash prizes is carried out at the rate in standard 13% (or 30% for non-residents).

A feature of calculating the tax deduction in this case will be a decrease in the taxable base by the amount of the monetary rate, which the player made earlier.

An example of receiving a win from a bookmaker

Gambling Sidor Petrovich is a regular client of the bookmaker organization, named "Best Bet". In summer 2017 Sidor Petrovich put money in the amount of 324 Russian rubles for, that in the match between the national team of Russia and England "our" will win. The bet was played and Mr. Gambling won 32 thousand 400 Russian rubles.

Let's try to calculate the amount of tax collection, taking into account the rules for its determination known to us.. so, first you need to deduct the amount of the bet from the prize amount. 32 400-350= 32 050. Now we multiply the resulting tax base by the rate in 13% and get: 32 050*13%= 4 thousand 166 rubles. The bookmaker will pay this amount to the treasury, and Sidor Petrovich will receive it: 32 400-4 166=28 тысяч 234 Russian rubles.

What is the tax on lottery winnings in Russia?

Taxation of lottery prizes

There is a tax on lottery winnings in the Russian Federation, which is 13 percent of the winnings. When, if the winner does not have resident status, then the tax amount increases to 30 percent. An interesting fact in this matter is that, that the tax on winnings is not paid by the winner, and the lottery organizer. Naturally, he does it not from the funds of the organization.

Material prize

Tax payment is made directly from the amount of money put as a prize. As a result, the lottery winner receives his winnings minus 13 percent government tax.. If material value was declared as a prize, not a sum of money, then the winner must pay 13 percent of the tax value. The process of paying tax is, to indicate the specific value of the prize on the tax return and pay the proper portion.

Tax amount on winnings in various lottery world famous

United States citizens must pay 25 percent of the winnings to the state, if their prize is more than 599 dollars in monetary terms. Citizens of other countries are taxed, which is 30 percent of the total prize. In addition, recipients of the prize pay state tax, component 3,75 percent. All tax fees are borne by the organizer in terms of execution. The winner receives a cash prize with tax deduction.

This lottery game, like the previous, assumes 25 percent tax on US citizens and 30 percent on foreign players. This amount of tax takes place if you win more than 599 dollars. Additionally also paid 3,75 %.

If you win more 599 $, the participant is obliged to pay the state 25 or 30 percent of the total (depends on citizenship or lack thereof). There is no state tax, since this lottery is California. Another condition of this lottery game is that, that you can only take part in it with 18 years.

The peculiarity of lottery taxation is, what the prize, whose sum is less than 2,5 thousand euros, does not oblige to pay a dime. Tax takes place when you win, exceeding the indicated amount. It composes 20 percent of winnings. Age of participants - from 18 years.

If you win more than 449 euros, the participant is required to pay 29 percent tax. Players, whose age is less 18 years, not allowed to play. For, to take part in the lottery, you must have European citizenship.

How you can avoid paying tax on your winnings?

Taxation of the Russian Federation in some cases has exceptions, which also applies to lotteries. These exceptions are as follows:

No tax

An exception to the general rules of taxation are the so-called "incentive" lotteries. They are often held in large shopping and entertainment centers and act as a kind of marketing tool to attract new customers.. Usually, the prize fund of these drawings cannot boast of the scale, therefore, the winnings cannot be stunningly large. Prize is not taxed, whose cost does not exceed 4 thousand rubles. If the winning has exceeded this bar, then the tax fee is not paid on the entire value of the prize, but only with the difference between the total amount and four thousand.

No tax

Exception from exceptions

It is worth paying attention to the fact, that the interest rate on incentive lotteries in the Russian Federation is 35 percent. It should also be noted, that the winner pays the tax on the winnings himself

After receiving the prize, he must request from the accounting department of the shopping center a receipt on the real value of the prize and contact the tax office to pay the corresponding tax.

Together with the state

Conclusion

The taxation system of various countries in some cases dictates certain conditions to citizens, which are legally binding. Cash prizes, obtained by participating in lottery games, also have their own tax rate. The amount of tax is different in different games, so before playing, you should read the conditions of the drawing for more details.

In Ukraine, state lotteries are not taxed up to a certain amount. The disadvantage in this case may be a small prize fund of this type of games and, accordingly, a small jackpot. Lottery games, non-governmental, offer larger amounts as prizes. The choice is definitely up to the participant

One has only to take into account, that sometimes the winnings after deducting taxes can be an order of magnitude higher, than a deductible state prize

What will happen, if you don't pay taxes on your poker winnings

Как ни парадоксально, запрет в РФ азартных игр на деньги не отменяет обязанности участников декларировать выигрыши для целей НДФЛ и платить налог.

Если не платить НДФЛ, то при значительных суммах выигрышей недоимка может повлечь уголовную ответственность. Tax debt is considered large, equal:

- 900 тысячам рублей, если это превышает 10% от величины налогов к уплате за три года;

- 2,7 млн рублей без привязки к годам и процентам.

Минимальное наказание — штраф в 100 000 rubles, максимальное — тюрьма на год.

Если же недоимка по НДФЛ не дотягивает до уголовки, то налоговый штраф — 40% from the sum. Отдельно оштрафуют за непредставление деклараций по НДФЛ: начислят 5% от неуплаченной в срок суммы налога за каждый полный или неполный месяц просрочки, but not more 30% величины недоимки и не менее тысячи рублей.

Сам НДФЛ взыщут в любом случае: that in criminal prosecution, what with tax. You can avoid punishment, voluntarily paying arrears, пени и штраф.

true, according to judicial practice, пока в опасности только игроки, которые участвуют в крупных легальных офлайн-турнирах. Отечественные и зарубежные организаторы оглашают как ФИО счастливчиков, так и величину выигрыша. Дальше — дело техники.

Громкий и единственный на сегодня случай был в Чувашии. Tax officers, finding a player among the winners, потребовали от него доплатить около 4,5 млн рублей НДФЛ и пеней. Не дождавшись денег, ИФНС передала материалы в следственный комитет, he opened a criminal case, а потом и вовсе объявил покериста в федеральный розыск.

А еще игра в покер на деньги без декларирования выигрышей может стоить госслужащему должности. Так случилось в Димитровграде Ульяновской области: одного из муниципальных начальников уволили за то, что он не показал в служебной декларации выигрыши от участия в официальных офлайн-турнирах по покеру. Проверка узнала об этом легко: все было на сайтах соревнований.

How is the German lottery held?

In Germany, the lottery is very similar to that Soviet, only Germans choose 6 numbers from 49 possible. You need to choose them on a lottery ticket, crossing out numbers, which in the opinion of the player will fall out in the next drawing. In addition, there is also a Super number (Super number). This figure is from 0 to 9, which is the last in the serial number. It's not hard to count, that with such a system there is about 15,5 millions of possible variants of dropping numbers. And taking into account the last Super-number - about 140 million. So the chances of maximizing your win are negligible..

Of everything exists 10 payout levels. The lowest one is 5 € and it drops out in case of guessing the Super-number and two numbers from the six main ones. Further, the size of the win depends on, how many people guessed the combination, how many tickets were purchased and what is the size of the jackpot. Here is a list of theoretical prize sizes based on the number of matched numbers.

- 2 numbers + Super number - 5 €

- 3 numbers - 10 €

- 3 numbers + Super number - 21 €

- 4 numbers - 42 €

- 4 numbers + Super number - 190 €

- 5 numbers - 3300 €

- 5 numbers + Super number - 10000 €

- 6 numbers - 575,000 €

- 6 numbers + Super number - 8900000 €

Draws are televised on Wednesdays and Saturdays. Pour into a large glass sphere 49 small balls with numbers. The balls are mixed, a damper opens in the sphere, and one by one they roll out of it 6 cherished numbers. Another, additional, taken from a separate drum.

Counted, that only 2 percent of those participating in the lottery win at least the minimum prizes. By itself, what all 6 numbers are rarely guessed. Then the winning amount is carried over to the next draw, accumulating jackpot. The largest jackpot in the history of the German lottery accumulated by the end of 2007, and he made 45,3 million euros. It was shared by three players at once, which all matched 6 numbers and even Super-number.