Who will be punished for illegal gambling

По умолчанию участникам ничего не будет за сам факт запрещенной игры на деньги. Ответственность грозит только организаторам и владельцам помещений, которые предоставляют их для азартных игр.

Организатор — это фирма, ИП или обычный человек, который собрал игроков в одном месте, equipped everything for poker or other gambling, взимал ставки и выплачивал выигрыши с удержанием процента или без.

There can be several organizers: one friend called potential participants, другой готовил квартиру к их приходу, the third was the stickman.

С владельцем помещения понятно. for example, человек сознательно разрешил провести в своем коттедже игру в покер на деньги. Или фирма — собственник кафе заранее знала, что в нем будет проходить такая игра.

Физлиц — будь то руководитель фирмы, ИП или самый обычный человек — за все это преследуют только уголовно. Компании — административно.

Ordinary players, не вовлеченные в организацию азартной игры и не имевшие прав на помещение, обычно проходят в таких делах как свидетели, which is also unpleasant.

Bookmaker offices

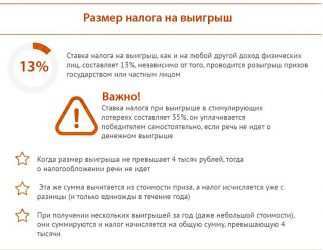

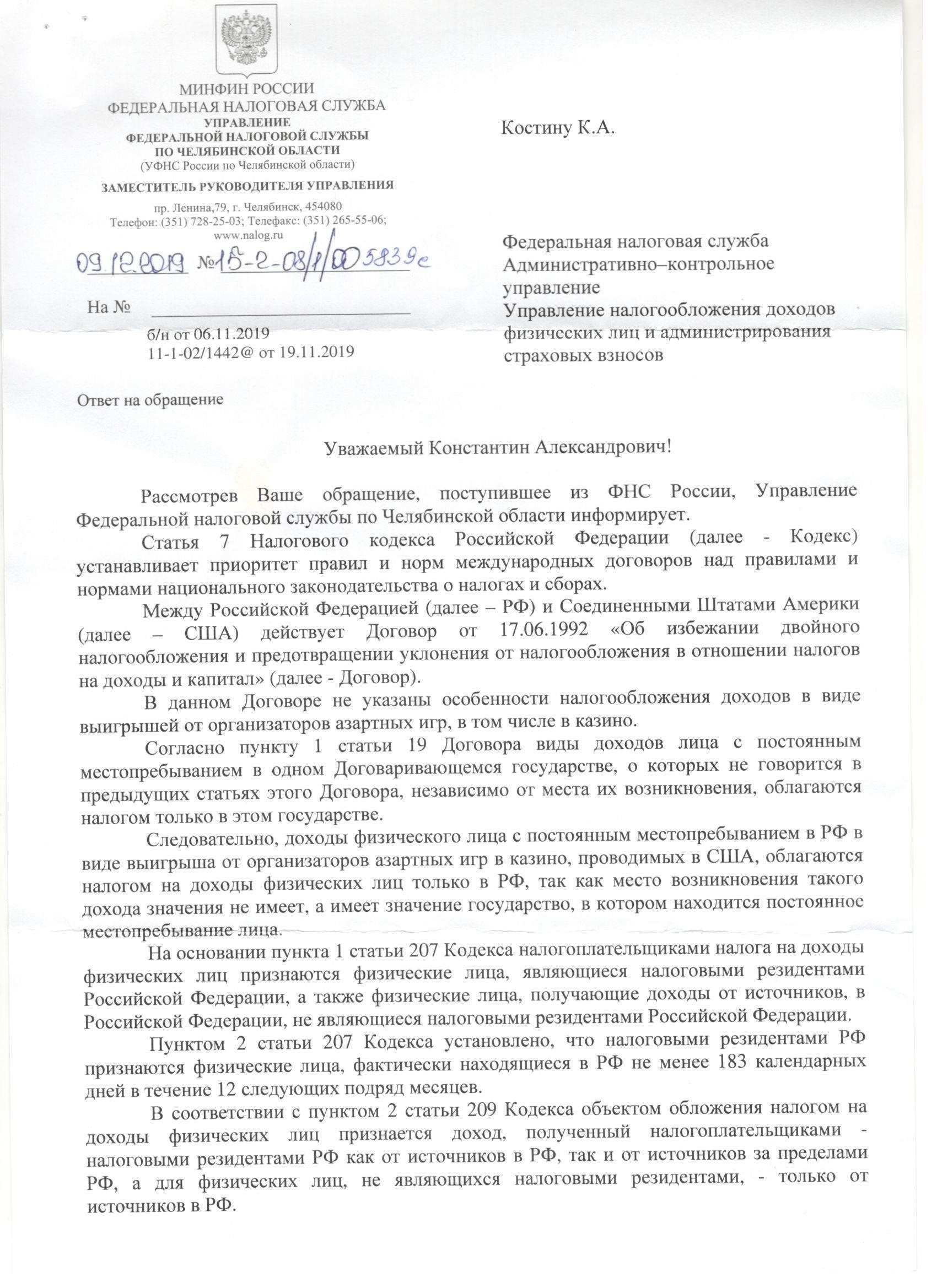

One of the organizers of gambling are bookmakers. Их посетители могут сделать ставку на результат тех или иных спортивных состязаний. Winning sports betting, You do not have to burden yourself with filling out the declaration and transferring the fee. The bookmaker withholds and transfers funds to the budget from the amount 15 thousand. rub. and more. You get "net" income minus deductions. If the size of the win is less than 15 thousand. rub. the winner declares income and pays tax on his own. Since sports betting belongs to the category of risky games, winnings at the bookmaker's office are subject to a fee in the amount of 13%.

A feature of the taxation of such income is that, that the tax base is reduced by the amount of the rate made – this is the deduction. I.e 13% fees are not calculated from the total winnings, but from the difference between the bookmaker's winnings and the previously made bet.

Example №3: Vorobiev F.D.. is a client of the "Sport Game" bookmaker. In June 2019 r. Vorobiev made a bet on the result of the football match Russia - Wales in the amount of 324 rub. The result of the match was predicted by Vorobiev correctly, the poet he won 32.400 rub.

Let's find out, from what amount of winnings the tax will be calculated and how much Vorobyov will receive as income. Since not the entire amount of money won is taxed, and minus the rate, then 13% need to calculate from 32.076 (32.400 – 324). The Sport Game office will pay the tax in the amount 4.169 (32.076 * 13%). Vorobyov will receive 28.231 (32.400 – 4.169).

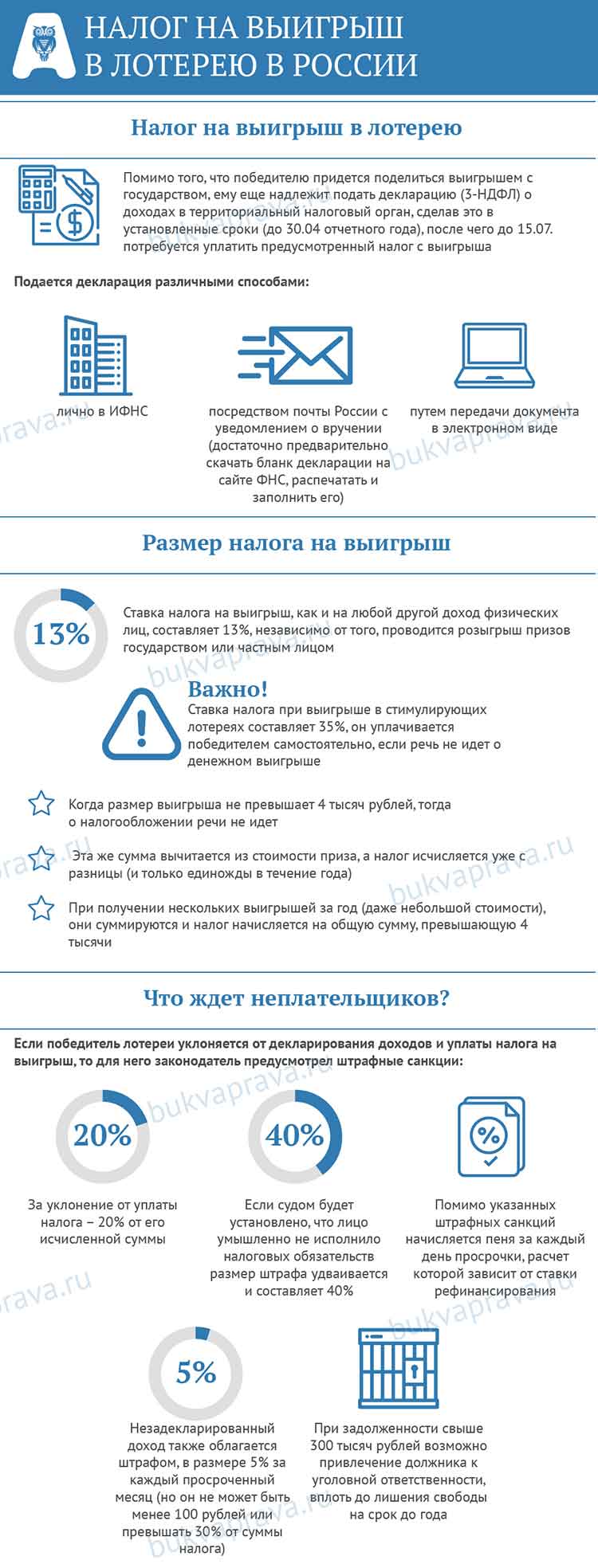

Responsibility for tax evasion

If a citizen does not have time to make payment on time, then penalties are charged in accordance with the provisions of the Tax Code of the Russian Federation:

- for late payment is charged 20% of the tax amount additionally;

- if through the court it is possible to prove, that the citizen deliberately evaded responsibility, you have to pay before 40% from winning;

-

accrual of interest 5% from the sum, if the winner does not declare his income by the end of April of the following year after receiving the prize (the fine cannot exceed 30% of the tax amount).

FSSP employees also have the right to impose sanctions, if the citizen continues to refuse payment after a court decision. So, it is allowed to impose a ban on leaving the country, seizure of accounts and property. In case of malicious evasion of payment, the debtor is judged under article 199 UK RF (tax evasion). It provides for a fine up to 300 thousand rubles, imprisonment for up to two years and deprivation of the right to hold certain positions.