Dividend tax

Dividend, received in the USA, subject to tax. They can be taxed as part of the Income Tax return, ie. as part of income. The tax rate is up to 37% в зависимости от общей суммы валового дохода и от семейного статуса налогоплательщика.

However, there is an option to tax dividends at reduced rates.. This is only possible in cases, when it comes to qualified dividends (this includes, eg, company dividends, whose shares are freely traded on major American exchanges). The tax rate will be 0, 15 or 20% depending on the amount of income.

The situation should be considered separately., when dividends are not paid in a traditional way (in the form of funds), and by additional issue of shares. In this case, the shareholder has two options.: sell additional shares or leave them counting on the growth of quotations. Upon sale, you will need to pay income or asset gains tax. But in the case, if the shares will be added to the securities portfolio, they will not be taxed at all.

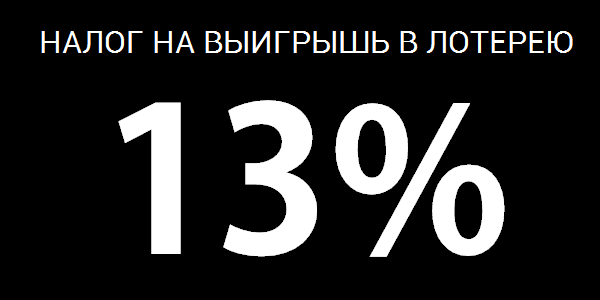

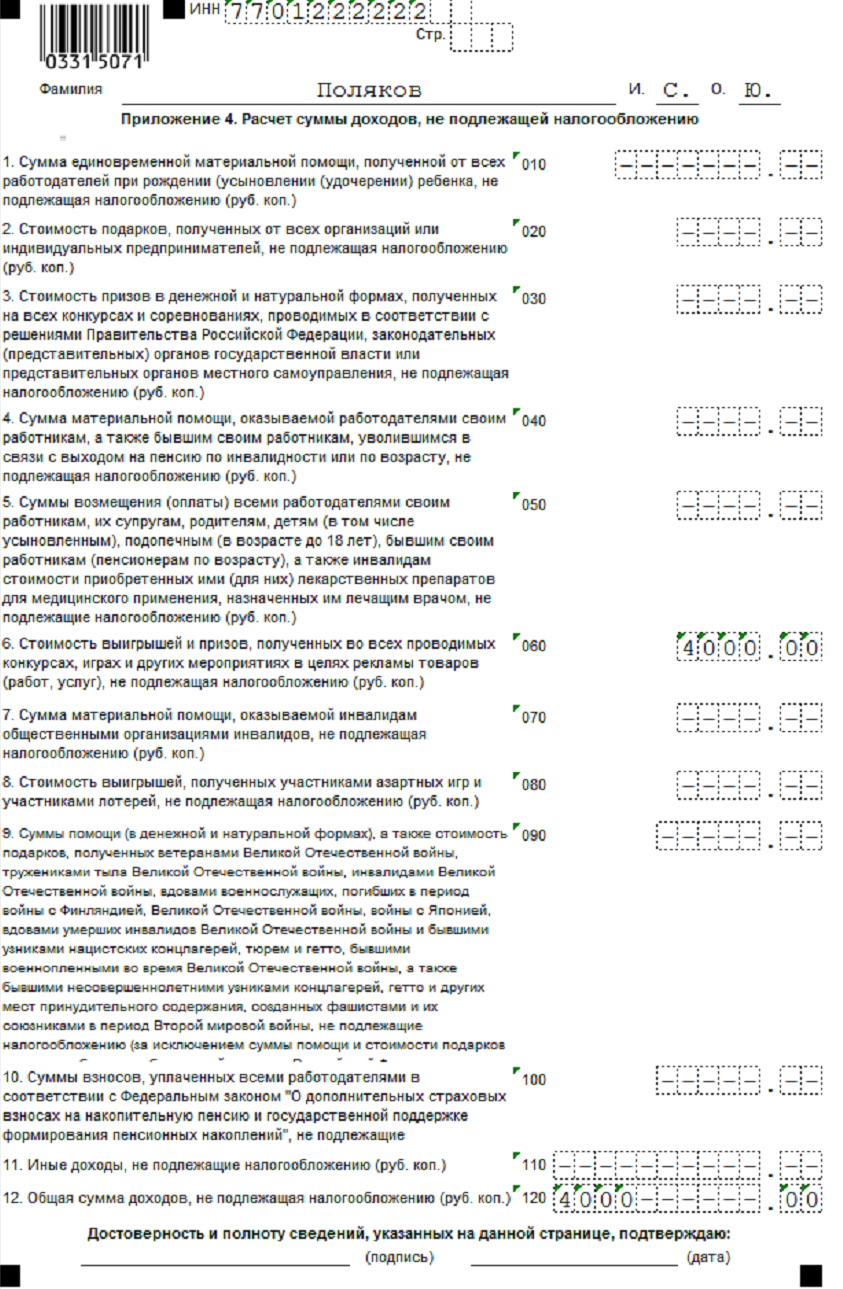

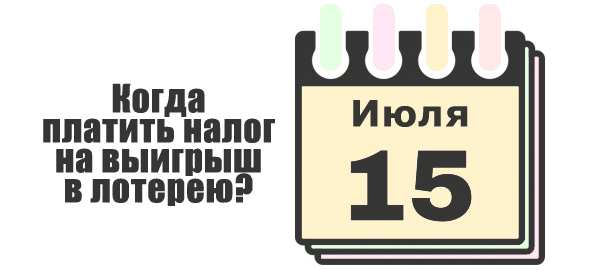

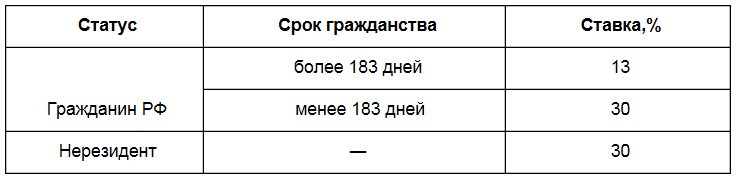

Pitfalls of player taxation in Russia

- How the transfer of chips between players will be controlled. Obviously, that "home gamblers" with negative bankrolls should appear in the casino, ready to exchange chips for money, чтобы избежать уплаты 13% tax. In this regard, the "deferred" taxation of players in Russia (in comparison with Belarus, where the tax is withheld immediately at the casino cashier) looks more thoughtful for players, but not under the state.

- Will Russian tax authorities transfer player information to tax authorities of other countries? It is beneficial for players to travel to Sochi from abroad, since the casino (game organizer) does not withhold tax at the cash desk. But will the tax authorities pass on information about winning players upon request or not?? Вопрос открытый.

Tax on winnings in other countries

USA (USA)

By the number of different lotteries and prize draws, The United States of America is ahead of the rest. The country has a huge number of lotteries and casinos, both public and private. All these entertainments are not prohibited by law., Besides, compliance with the rules is strictly monitored and the chance to hit the jackpot of ten million. $ absolutely every citizen has.

USA is known for its peculiar taxation system, each state has its own rate for everything, including winning the lottery. There is a basic tax, which spreads throughout the country is 25% of the won amount, well, an additional tax for each state. It could be 5, 10 or 15 %. But here comes the limitation, the totality of taxes cannot be more 40%. And in California, Texas and Nevada no additional tax at all.

US tax takes effect, if the winnings exceed 600 dollars. If the lucky one does not want to share his winnings with the state, then after that, how the tax office finds out about the fact of evasion, the entire amount won will be forfeited. If the winner was a non-resident of the country, then he may face deportation.

Las Vegas casino tax

Las Vegas, he always attracted the most desperate and gamblers with his lights. Thousands of roulettes, gaming tables and machines, million dollar bets, all this is like shots from expensive Hollywood movies. And how is it really going on there and is it possible to arrive there with ten dollars in your pocket, hit a huge jackpot?

For all the popularity of Las Vegas, in fact, this is just a created image of paradise for adventurers, because playing in a casino in the United States is not profitable. Tax rate on winnings 35%. 25% will be withheld immediately, still within the walls of the casino, but this is in the event that your winnings exceed 5 thousand. dollars. By the way, there is one more feature - 25% deducted if the player has named his data. If he decides to collect the winnings incognito, then you will have to pay to the treasury already 28%.

There is also a small indulgence for residents, they can keep a "player diary", where all wins and losses are recorded. Tax will be issued at the end of the tax period, and that, provided that the sum of all winnings is greater, than losses. But Vegas casinos are often filled by foreigners., and they cannot afford such a bonus.

In this context, the capital of the casino can be called, how strange it is, Belarus. There is no taxation on this type of income. And in your hands you will receive the entire amount you won.

Countries that do not tax winnings

But in Canada, neighboring to the USA, there is no such tax at all. This also applies to a number of other countries.: Australia, Great Britain, France, Austria, Finland, Germany, Belarus, Japan, Турция и Ирландия.

Taxation system in the USA

As in any other federal state, US taxes are divided into separate steps:

- federal level;

- individual states;

- local.

America's tax return is filed with the competent authorities between 1 January to 15 April.

It can be sent by mail, in electronic format or use the services of services, which offer services of registration and filing of declarations.

For a better understanding of everyone, even the thinnest, the nuances of individual fees, необходимо знать и учитывать уникальные особенности налоговой системы Америки:

Like the federal government, and the government of individual states, may at its discretion, change the taxation system, practically without limits

The only limitation is only the Constitution., restrictions can be anything, but must not violate the constitutional rights of citizens.

Для федеральных сборов присуща прогрессирующая шкала. It means, that the bulk of the fees are paid by the wealthiest part of the population.

Not only residents are required to pay income tax, living in America, but also non-residents, которые покинули территорию страны. Wherein, it doesn't matter at all, how long ago did the person leave the country. Even, let's say, man 10 years ago will leave America and have no plans to return there, but is also American by citizenship, he still has to pay.

Taxation in Bulgaria: ban on private lotteries

In Bulgaria tax liabilities are imposed exclusively on the organizers of gambling. The tax rate is currently 15%. For the mobile gambling market, the figure is the same. The license maintenance fee reaches 20% from GGR. Also, the amount of taxes for specific activities has been determined.:

- 500 BGN per quarter - for slot machines in the respective halls;

- 22 000 левов в квартал за каждый игровой стол – для рулеток;

- 5000 levs per unit - for any other gambling equipment in the casino.

According to article 242 (2) APPOINTMENT, activity, related to slot machines and online casinos, subject to corporate tax, which is also billed quarterly. Despite rather strict regulatory conditions and a precarious economic situation, gambling in Bulgaria still works and brings results.

Also, according to the latest data, due to underpayment of taxes by private lotteries in the amount of $118 million over the past six years, a bill was developed to ban private lottery operators. Probably, publicity of this fact is a demonstration of one of the reasons, on which legislators make their decisions. In this case, rather stringent regulatory measures followed in response to a gross violation by the operator..