Taxes for non-residents

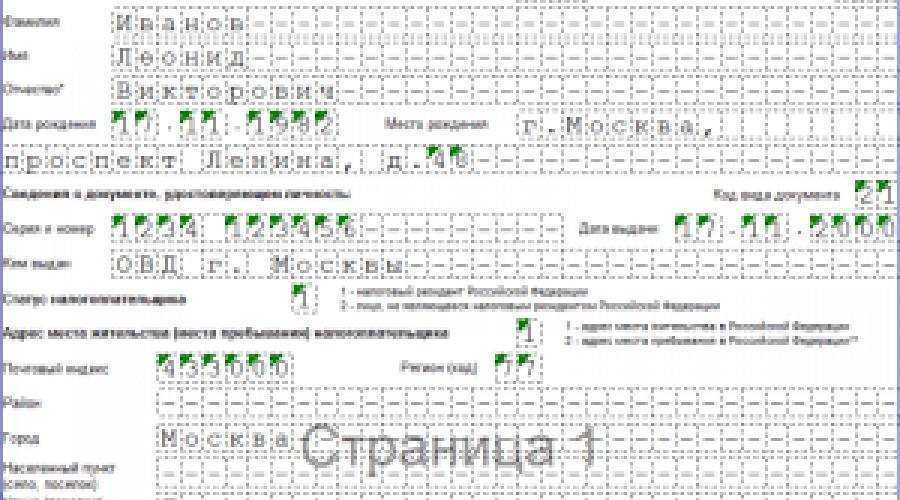

Almost everything is taxed in the States. Any movement of money, whether it is a profit or the purchase of something requires the taxpayer to pay a certain amount.

U.S. Taxes for Individuals- non-residents also exist and are a mandatory expense item.

Even if you are not a US citizen, you will still need to pay deductions to the state. In general, the list of taxes is the same, as for holders of American citizenship.

Non-residents will need to pay the following deductions:

- Income taxes for individuals in the United States.

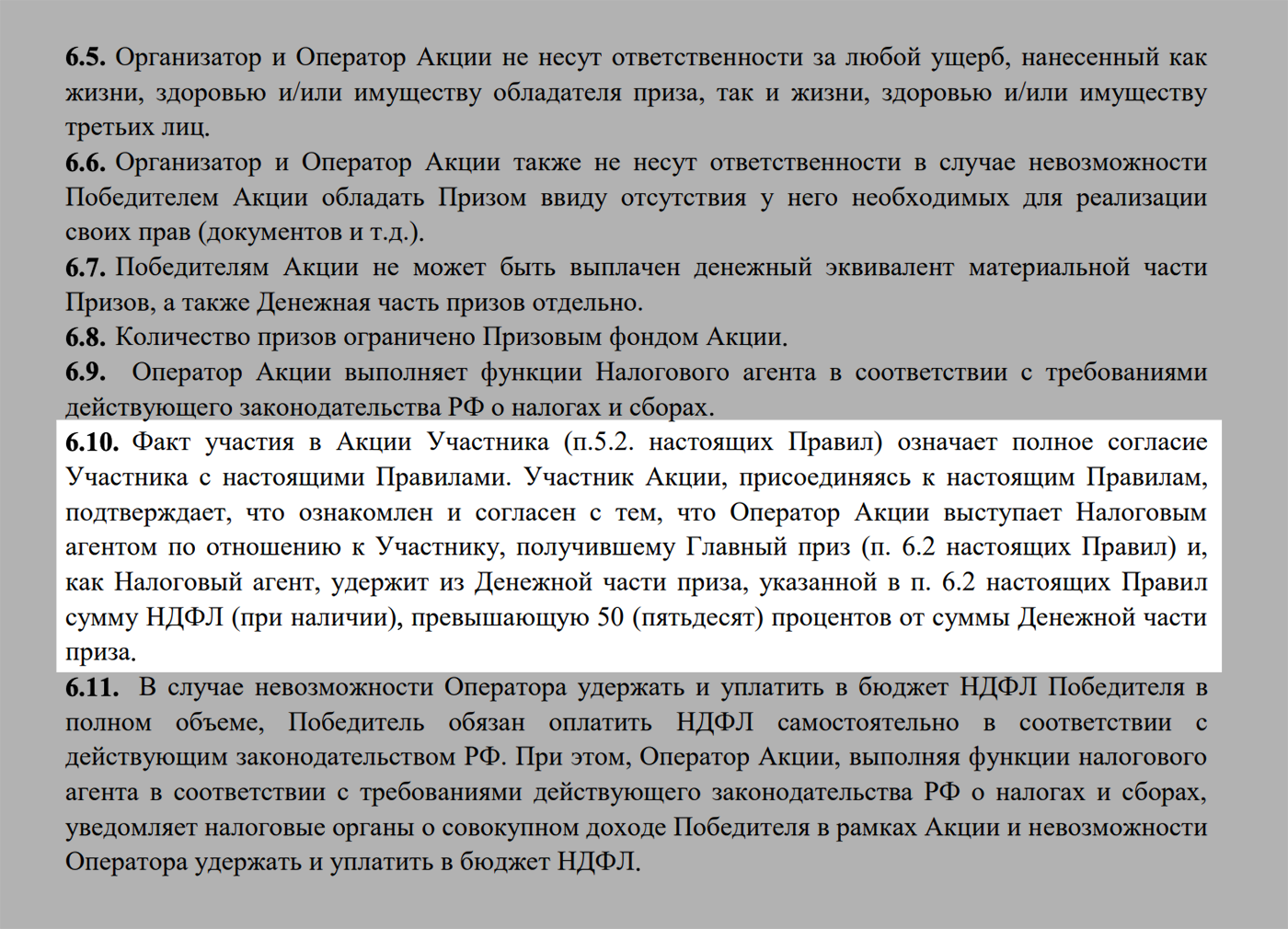

- State tax.

- Social Security taxes & Medicare Taxes.

- Unemployment tax.

- Sales tax.

- Property tax.

Tax non-residents are required to obtain a certificate of good faith compliance with tax obligations before leaving the United States.. Otherwise, they will simply not be allowed to leave the country until all debts are paid..

Responsibility for non-payment of tax

Если не платить НДФЛ, то при значительных выигрышах недоимка может повлечь уголовную ответственность. Tax debt is considered large, equal:

- 900 тысячам рублей, если это превышает 10% от величины налогов к уплате за три года.

- 2,7 млн рублей без привязки к годам и процентам.

Минимальное наказание — штраф в 100 000 rubles, максимальное — тюрьма на год. If you voluntarily pay arrears, пени и штраф, на первый раз от наказания освободят.

Если же недоимка по НДФЛ не дотягивает до уголовной статьи, налоговый штраф — 40% from the sum. Отдельно оштрафуют за непредставление деклараций по НДФЛ: начислят 5% от неуплаченной в срок суммы налога за каждый полный или неполный месяц просрочки, but not more 30% величины недоимки и не менее тысячи рублей.

Сам НДФЛ взыщут в любом случае: и при уголовном преследовании, и при налоговом.

Taxation by type of draw

В настоящее время в стране проводится довольно много лотерей, где разыгрываются денежные и вещевые призы. Кратко рассмотрим основные варианты розыгрышей и налоговые ставки при получении выигрышей.

Online casino

this implies, that it is extremely difficult to track payments of winnings to players. Сделать это можно лишь запросив выписки по банковским картам, но российское законодательство запрещает это делать в отношении физических лиц без веских оснований.

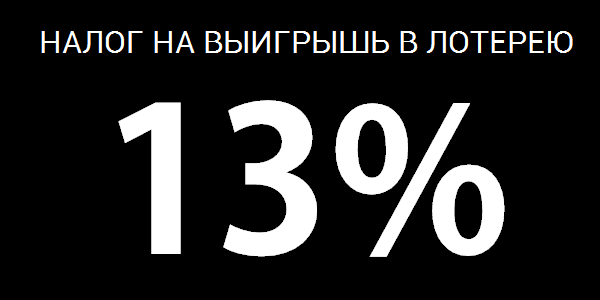

В любом случае выигрыш в онлайн-казино облагается налогом в размере 13% от полученной суммы.

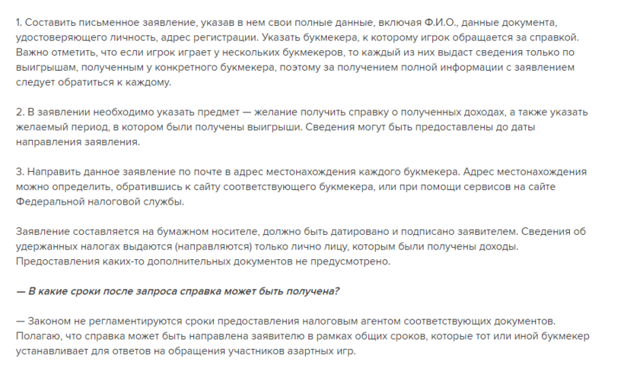

Bookmaker offices

Здесь ситуация напоминает вариант с онлайн-казино, discussed above. In particular, не все букмекерские конторы работают в рамках правового поля, но в отличие от казино, такие организации могут осуществлять свою деятельность не только в интернете, но и реальной жизни.

Выигрыш на тотализаторах также облагается налогом в размере 13%. This assumes, that the bookmaker's management independently makes the necessary deductions, if the winning amount exceeds 15 000 rubles. В остальных случаях подача налоговой декларации входит в обязанности игрока.

"Russian Lotto"

This is an analogy to the popular family game. Суть сводится к тому, that participants buy tickets, which are a copy of the home lotto cards. В день розыгрыша ведущий вытаскивает из мешочка бочонки, и тот из участников, which will fill in all fields, can hit the jackpot.

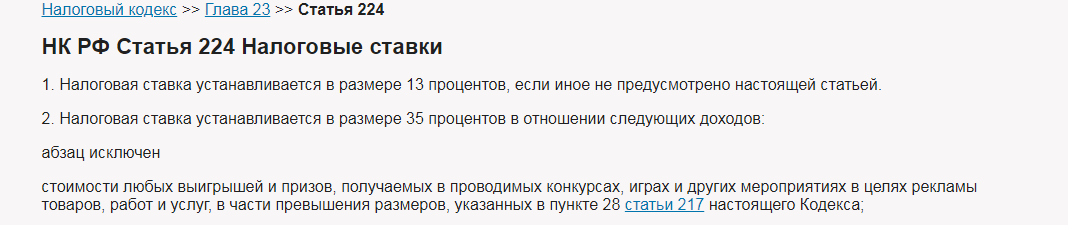

Considering, что билет для участия в «Русском лото» приходится приобретать на собственные деньги, такие розыгрыши нельзя отнести к разряду стимулирующих лотерей. Therefore, the tax rate for the winners is 13%.

Если в качестве приза предлагается автомобиль

- 13%

- 30%

- 35%.

Конкретная сумма зависит от статуса победителя (resident / nonresident) и способа проведения розыгрыша. Note, that the exact amount of deductions is usually announced by the organizers of the drawing. In this case, the winner can invite an independent expert, to confirm the declared value of the car.

Need to clarify here, что внести налог нужно до получения выигрыша, иначе забрать приз не получится. Если у победителя нет нужной суммы, по обоюдному согласию между победителем и организаторами, the car can be sold.

Overseas draws

In most cases, налог с выигрыша в лотерею уплачивается на территории страны, where the lottery was held. Это делается в рамках международных договорённостей, to avoid double taxation.

В качестве примера рассмотрим налоговые ставки с выигрышей на территории разных стран:

- Италия — 6%;

- Чехия — 20%;

- Болгария — 5%;

- США — в среднем 25%, но в разных штатах могут действовать свои ставки.

Promotions

These are stimulating lotteries, которые проводятся различными компаниями для продвижения своих товаров и услуг на рынке. Above mentioned, что для таких выигрышей установлена ставка в 35%.

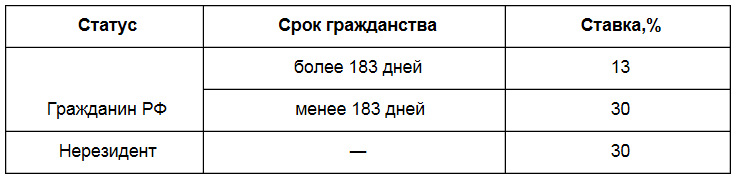

Cash prizes

Такие выигрыши могут быть в стимулирующих и обычных лотереях. Поэтому налоговая ставка составляет 13 and 35% respectively. If the winner is a non-resident of the country, он оплачивает 30% of the winnings.

Tax on winnings at the bookmaker's office

And before the conditions in Belarus were even much worse - it was calculated 13% from the withdrawn amount. This led to a financial crisis for all bookmakers operating in this country.. Belarusian bettors did not accept such conditions and began to actively play in foreign offices, transferring winnings to the card. Officials saw it (incomes fell just catastrophically) and decided to make concessions, reducing tax on 13% to 4%.

Even the most conscientious citizens, again knowingly paying tax on their income, feel, how cats scratch in the shower. And the harder the money gets, the harder it is to part with some of them in the form of tax deductions. And the bettor's work is extremely hard, because there are several pitfalls here, because of which the desire not to pay taxes is especially high:

Opinion of Russian players

On the Internet, opinions about American lotteries are different: there are supporters, but there are also opponents

Supporters' arguments:

- Russian lottery participants, purchasing tickets in the country, appreciate the size of potential prizes, especially jackpots.

- Experienced players celebrate the fair and open drawing system. It is broadcast live, falsification of results is excluded.

Opponents' opinions:

- Complex ticket purchasing process, large commissions of intermediaries (they reach 15%).

- There are no official ticket distribution points on the network, so you have to rely on your instincts in assessing intermediaries.

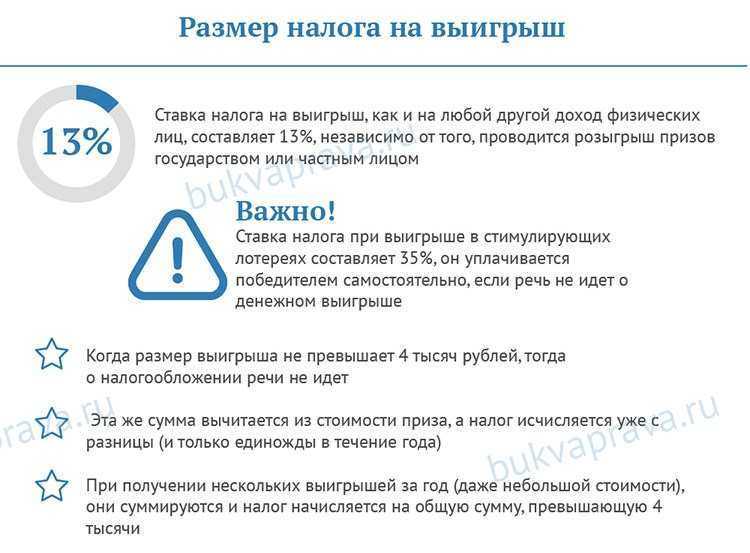

What is the tax on lottery winnings in Russia?

Taxation of lottery prizes

There is a tax on lottery winnings in the Russian Federation, which is 13 percent of the winnings. When, if the winner does not have resident status, then the tax amount increases to 30 percent. An interesting fact in this matter is that, that the tax on winnings is not paid by the winner, and the lottery organizer. Naturally, he does it not from the funds of the organization.

Material prize

Tax payment is made directly from the amount of money put as a prize. As a result, the lottery winner receives his winnings minus 13 percent government tax.. If material value was declared as a prize, not a sum of money, then the winner must pay 13 percent of the tax value. The process of paying tax is, to indicate the specific value of the prize on the tax return and pay the proper portion.

Tax amount on winnings in various lottery world famous

United States citizens must pay 25 percent of the winnings to the state, if their prize is more than 599 dollars in monetary terms. Citizens of other countries are taxed, which is 30 percent of the total prize. In addition, recipients of the prize pay state tax, component 3,75 percent. All tax fees are borne by the organizer in terms of execution. The winner receives a cash prize with tax deduction.

This lottery game, like the previous, assumes 25 percent tax on US citizens and 30 percent on foreign players. This amount of tax takes place if you win more than 599 dollars. Additionally also paid 3,75 %.

If you win more 599 $, the participant is obliged to pay the state 25 or 30 percent of the total (depends on citizenship or lack thereof). There is no state tax, since this lottery is California. Another condition of this lottery game is that, that you can only take part in it with 18 years.

The peculiarity of lottery taxation is, what the prize, whose sum is less than 2,5 thousand euros, does not oblige to pay a dime. Tax takes place when you win, exceeding the indicated amount. It composes 20 percent of winnings. Age of participants - from 18 years.

If you win more than 449 euros, the participant is required to pay 29 percent tax. Players, whose age is less 18 years, not allowed to play. For, to take part in the lottery, you must have European citizenship.

How you can avoid paying tax on your winnings?

Taxation of the Russian Federation in some cases has exceptions, which also applies to lotteries. These exceptions are as follows:

No tax

An exception to the general rules of taxation are the so-called "incentive" lotteries. They are often held in large shopping and entertainment centers and act as a kind of marketing tool to attract new customers.. Usually, the prize fund of these drawings cannot boast of the scale, therefore, the winnings cannot be stunningly large. Prize is not taxed, whose cost does not exceed 4 thousand rubles. If the winning has exceeded this bar, then the tax fee is not paid on the entire value of the prize, but only with the difference between the total amount and four thousand.

No tax

Exception from exceptions

It is worth paying attention to the fact, that the interest rate on incentive lotteries in the Russian Federation is 35 percent. It should also be noted, that the winner pays the tax on the winnings himself

After receiving the prize, he must request from the accounting department of the shopping center a receipt on the real value of the prize and contact the tax office to pay the corresponding tax.

Together with the state

Conclusion

The taxation system of various countries in some cases dictates certain conditions to citizens, which are legally binding. Cash prizes, obtained by participating in lottery games, also have their own tax rate. The amount of tax is different in different games, so before playing, you should read the conditions of the drawing for more details.

In Ukraine, state lotteries are not taxed up to a certain amount. The disadvantage in this case may be a small prize fund of this type of games and, accordingly, a small jackpot. Lottery games, non-governmental, offer larger amounts as prizes. The choice is definitely up to the participant

One has only to take into account, that sometimes the winnings after deducting taxes can be an order of magnitude higher, than a deductible state prize

Where to get lottery winnings

It all depends on the conditions of the program. You must read them carefully..

Man receives a lottery win

It is worth considering the main opportunities for getting money, depending on the type of lottery.

Table 2. Ways to get money after winning the lottery.

| Lottery type | How to get your winnings |

|---|---|

| Online and international lottery |

|

| All-Russian lottery |

|

| Regional lottery |

The situation is a little more complicated with receiving a win, when it comes to a car or apartment. Everything must be documented for the new owner. Therefore, it is required to personally arrive at the point of issue of prizes with the required documents. You can also ask for help from a trusted person., but he must have a general power of attorney certified by a notary. Its useful to note, that it is worth contacting the lottery operator in advance, to clarify, what documents you need to take with you.

With the receipt of an apartment, certain nuances may arise

Usually, you only need to have a passport with you for personal identification, and a winning ticket, to confirm, that a citizen is eligible for a prize.

What to do if you win?

Note, players, buying online lotteries through TheLotter, receive a copy of the ticket before the start of the drawing. Experts on these issues advise keeping all papers, messages, notices and copies of bank statements, where the amount and date of the transfer of funds are indicated until the end of the drawing. If you are lucky, and you won, you need to immediately contact the lottery support service by phone, and even easier – through the company's website: via chat, Email, feedback forms. Recall, that in case of a big win, the winner will need to send a copy of the ID in order to prove that, what he – It is he

These precautions are not taken by accident.: event organizers should make sure, that the subject in question has reached the age of majority, that he was the one who bought the winning ticket and deserved the prize. Therefore, it makes sense to check again the accuracy of your information in your account and then, that your email address is

Tips and nuances

By the time the next drawing of popular drawing lotteries is held in the United States, queues of people wishing to buy a ticket are lining up, and residents of other countries are actively looking for a way to buy American online lotteries. The latter is associated with a huge number of myths and misconceptions..

Let's dispel the main ones.:

- Tourists are not allowed to play American lotteries. As we have already figured out, this is not true. Non-US residents can safely participate in lotteries. You just need to find a way to buy a lottery ticket.

- The rules of the game are the same for American citizens and residents of other countries.. To summarize, that yes, but there are still some differences. for example, you can buy a lottery ticket from official realtors in the USA or remotely, but for that, to get a win, need to, so that the ticket does not leave the territory of the States.

- Winnings from winners from other countries are tax-free. This is not true. The winner from any country will be required to pay tax on the winnings, established by American law.

- Tax on winnings will need to be paid twice - in America and at home. No, most countries have concluded an agreement on the inadmissibility of double taxation.

true, taking part in the American lottery, you need to immediately mentally prepare for that, that you will not be able to collect all the winnings. You will have to pay tax on winnings, and if you delve into the topic, then you can do this in two ways:

- In America. All winnings are taxed under US law. 30% + in some cases you will need to pay additional tax, state-established, where was the lottery ticket purchased.

- At home. In most cases, this is a more cost effective option., because in the CIS countries the tax on winnings is much lower. In Russia he, eg, is only 16%, and in Ukraine since 2016 of the year - 18%.

In almost any American lottery, you can get the main prize in two ways.:

- Winner can collect winnings with one check, but at the same time part of the amount (usually 30% + taxes) will be withheld by the organizers.

- Collect the winnings by annuity - in annual payments within 26 years.

Consider, what for, to show your desire to collect the winnings in a certain way, given only two months. If during this time you do not give an answer, then the lottery organizers will automatically register an annuity in the method of obtaining the lottery.

Besides, there is also a certain time frame for applying for winnings. So, if you are lucky enough to hit the jackpot, then it is recommended to apply for it within 6 months, and for smaller prizes you can come during the year. Before you pay out your winnings, the organizer will first check the authenticity of the ticket and its compliance with the prize, which can take some time. Personal presence is a prerequisite for receiving a win.

Lottery taxes in other countries

Let's start with European lotteries. The tax laws on lottery winnings vary from country to country. Below is a summary of the tax rates for lottery winnings.

In Spain before 2013 Years lottery winnings were not taxed at all. However, under the influence of the crisis, from 1 january 2013 year tax was introduced. It should be noted, that the winnings are less 2500 euros are not taxed. Otherwise, the tax rate will be twenty percent. This applies to all, not just Spanish citizens. That is, if you win online, you still have to pay.

Lottery winnings are tax-free in the UK and Germany. Also zero tax rate on lottery winnings in Finland.

Italy has a tax on lottery prizes of 6%. In this case, the amount must exceed five hundred euros. In Bulgaria, lottery winners pay ten percent, in the Czech Republic - twenty percent.

At all, we will try to answer the question below, what tax will the Russians have to pay, who decided to play not in Russian lotteries, and in foreign.

Let's repeat, what if between Russia and the country, where was the ticket purchased, there is a double taxation treaty, then the winner pays tax only in that country, where won. But if there is no such agreement, then the tax must be paid twice.

Australia also has no taxes on lottery winnings.

And in conclusion about one of the most lottery countries - the USA. The highest tax on winnings is paid on American lotteries. It depends on the state, where was the ticket purchased. The minimum is twenty five percent, what is the federal tax rate. A local state tax may be added to it, or even a separate city. For example, in Michigan, an additional tax on lottery winnings – 4,35%, in Illinois - 3%, in New Jersey - 10,8%, and in the states of California, Texas and Nevada he is completely absent.

Eventually, considering all taxes, the lucky one can lose almost forty percent of the winnings

If you – Russian citizen won the American lottery, and it doesn't matter, buying tickets in person, either via the Internet, then you will pay the maximum - 35 percent – this is spelled out in American law.. for example, You single-handedly won 640 million dollars to megamillions

Of 42 states participating in this lottery, at five - New Hampshire, Tennessee, Texas, Washington and South Dakota have no taxes on state lottery winnings at all. The federal tax remains - 35%. Ie. with a suffix 640 You will give 161 million dollars. And if you, e.g. New Yorker, then 8,8% will leave the state budget, 3,9 - to the city budget. Federal tax will also have to be paid. In this way, You will lose already 199 million dollars.

for example, You single-handedly won 640 million dollars to megamillions. Of 42 states participating in this lottery, at five - New Hampshire, Tennessee, Texas, Washington and South Dakota have no taxes on state lottery winnings at all. The federal tax remains - 35%. Ie. with a suffix 640 You will give 161 million dollars. And if you, e.g. New Yorker, then 8,8% will leave the state budget, 3,9 - to the city budget. Federal tax will also have to be paid. In this way, You will lose already 199 million dollars.

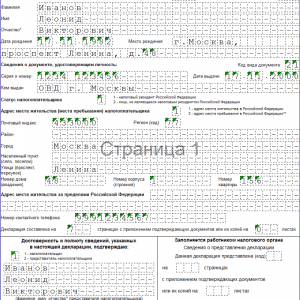

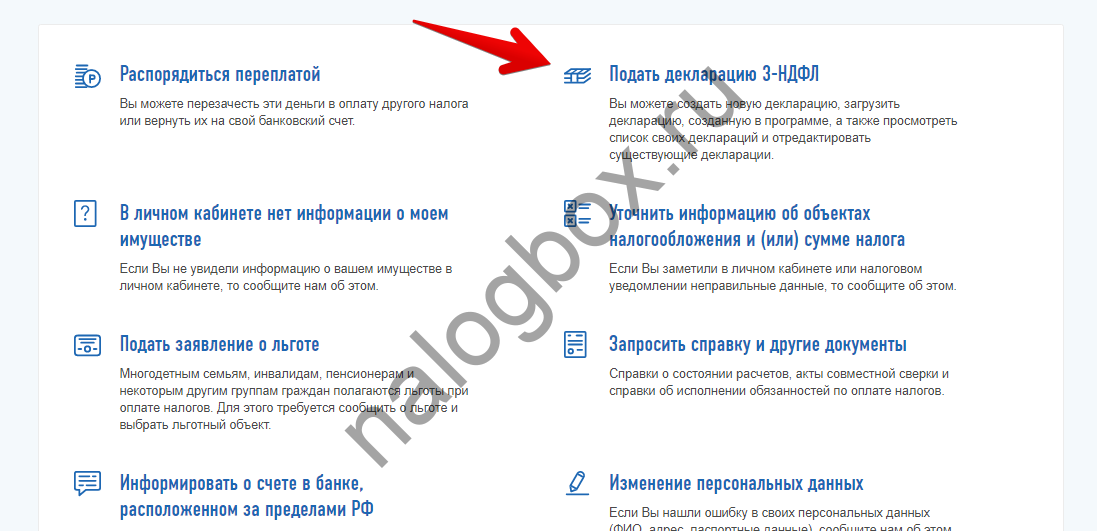

U.S. tax return: serve or not serve

It is customary in America to carefully keep track of all of your taxable income throughout the year., and then submit your own tax return. However, there are population categories, who do not need to do this.

You don't need to file a tax return, if:

- You are not married, you are less 65 years and your gross income is less than $10300;

- You are not married, you 65 years or more and your gross income is less than $11850;

- you are married, submit a declaration together with your spouse, both of you are less 65 years and your gross income is less than $20600;

- you are married, submit a declaration together with your spouse, one of the spouses 65 years or more and your gross income is less than $21850;

- you are married, submit a declaration together with your spouse, both of you 65 years or more and your gross income is less than $23100;

- you are married, submit the tax return separately from your spouse and your gross income is $4000;

- you are the main breadwinner, you are less 65 years and your gross income is less than $13250;

- you are the main breadwinner, you 65 years or more and your gross income is less than $14800;

- you are a widow or widower with a dependent child, you are less 65 years and your gross income is less than $16600;

- you are a widow or widower with a dependent child, you 65 years or more and your gross income is less than $17850.

https://youtube.com/watch?v = taKE9sv2Ttw

Comparison of taxes on lottery winnings in the Russian Federation and the USA

In the Russian Federation, the taxation system is more loyal to its citizens and therefore they do not have to pay exorbitant interest on one or several taxes at once. Most legal lotteries in the country are subject to income tax only., which in 2016 year is only 13%. That is, if you win one million rubles in the lottery, you will receive only 870 thousand rubles, a 130 thousand will go to the state. Illegal lotteries are widespread in the country, where you don't need to pay any tax on your winnings. However, contacting them is strongly discouraged., t. to. you will not be protected by law, and if you get money (large amount of winnings) other difficulties with the law may arise. for example, the relevant authorities may be interested in the fact of a sharp increase in your standard of living.

But also in Russia there are lotteries (which are very few), where the organizers take over the payment of taxes. That is, from the million rubles you won, you will receive the entire amount, but at the same time the organizer will spend one million and one hundred and thirty thousand rubles to give out the prize. To pay tax, you will have to submit a certificate of income for the year to the Tax Ministry in a timely manner. For a period of time in 105 days you will need to give these 13 interest to the state. Otherwise, you could face a fine, and in particularly serious cases, imprisonment.

As for the United States, then everything is a little more complicated here, and tax rates are higher, and they vary greatly from state to state. Finding an illegal lottery or casino in the country is almost impossible, as local authorities are actively fighting this, and besides, they are not very popular among Americans. Basic tax on lottery winnings, which every citizen of the country pays is 25% from winning. However, don't forget, that every state in the country is free to slightly change tax legislation for itself, because of which you have to pay more 10-15 percent as additional state tax. Fortunately, maximum tax, which can be collected from lottery winnings in the States will not exceed 40% in conjunction with other taxes.

States with the most loyal tax laws - California, Texas, Nevada (no additional tax on lottery winnings, only federal), Michigan (the amount of the additional tax is only 4,35 percent). And also in the USA you can find organizations, conducting lotteries, who take payment of the tax in part or in full, t. is. you will receive exactly that amount, which is indicated in the prize and at the same time you will not owe anyone (when, if the tax is paid in full by the sponsor)

Important, in the United States, tax on winnings is paid only if, if the prize is at least 600 dollars

It's easier for a non-resident of the States to take all the prizes for himself, t. to. officially (if the win is not too big) they will not require a certificate of income. However, if non-payment is revealed, then further legal visit to the United States will become impossible.

In the States, tax evasion is not recommended, since the tax office in any case learns about non-payment or concealment of any data. If this fact becomes known, then almost all the winnings are withdrawn. In the worst case, you can be fined for the amount of your winnings and / or imprisoned for a certain period. In case you are late in paying tax, but still pay it, you will only get off with a warning from the authorities (if this was the first time).

In other countries

Lottery winnings are not taxed everywhere. In Canada, Austria, Australia, Great Britain, France, Finland, Germany, Ireland ,Турции и Белоруссии выигрыши выплачиваются в полном объеме. In Spain winnings up to 2500 euros are not taxed, over this amount - the tax is 20%.

Самая сложная система налогообложения в США — по законодательству лотерейный выигрыш расценивается, as additional income. Therefore, upon receipt, the winner pays two types of taxes.: federal income tax (the rate depends on the annual income) and state tax, resident of which he is.

В результате обладатели многомиллионных джекпотов в американской лотерее, почти половину суммы отдают качестве налога.

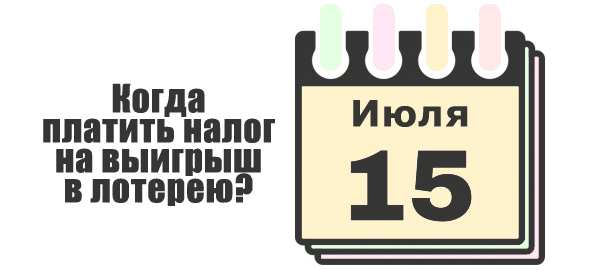

Until 2018

* To 2018 года граждане были обязаны самостоятельно уплачивать налог с выигрыша, regardless of its size. Considering, что нижний предел выигрыша не регламентировался, most of the players actually violated the law, так как никто не подавал декларацию на мелкие выплаты. On the one hand, such a massive violation is unlikely to ever be revealed. On the other hand, isolated cases of fines for this also happen:

2016 year. Won 300 rubles, got a fine 1000 rubles (for not submitted declaration). Случай упоминался в интервью заместителя начальника отдела налогообложения доходов физических лиц ФНС России по Свердловской области Сергея Барышникова

2016 year. Won 4 622 ruble, did not submit a declaration and did not pay tax. As a result, the Tax Inspectorate went to court, было заведено административное дело, the judge ordered to bring the violator to justice, with payment of a fine (a source)

***

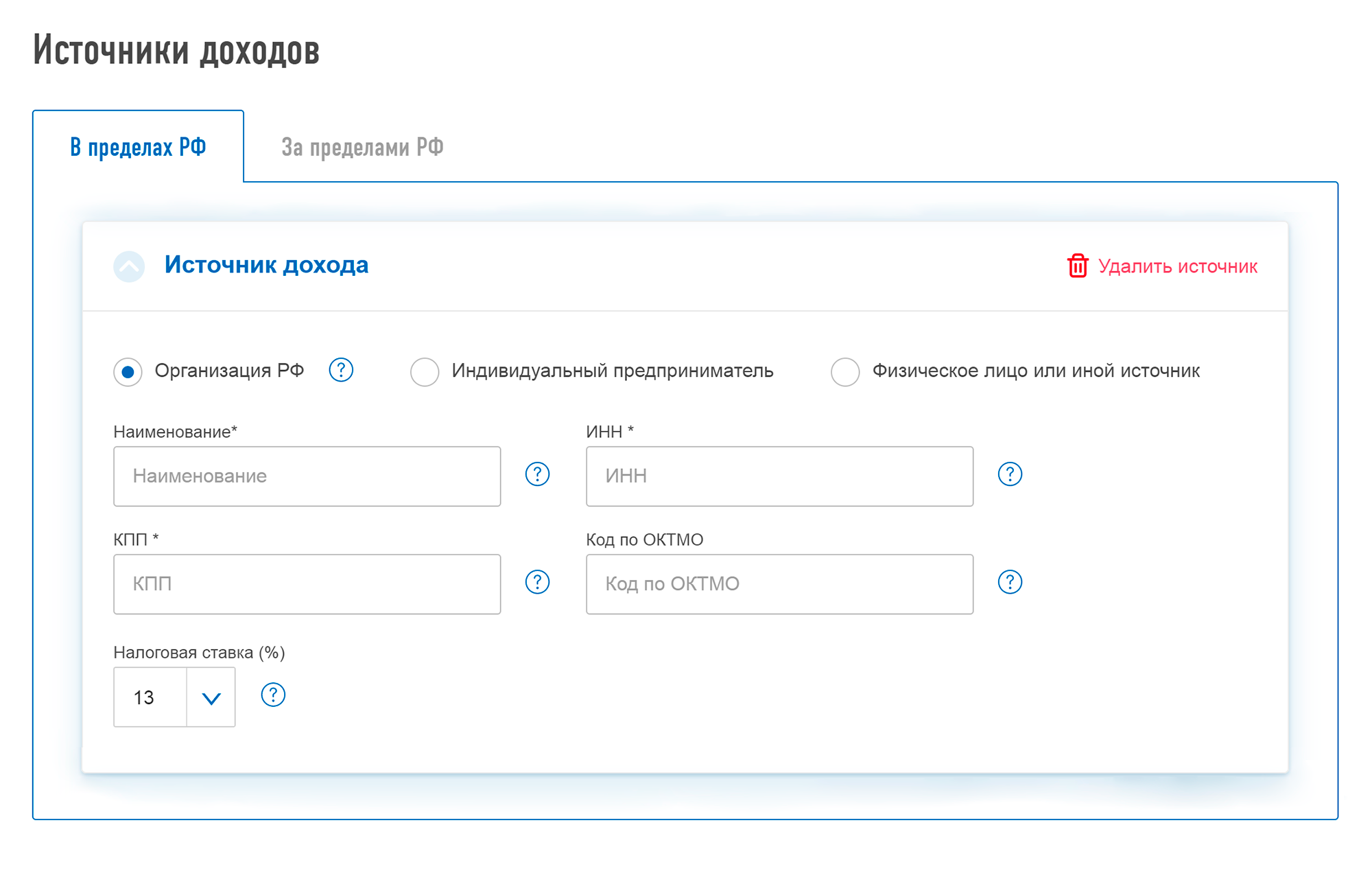

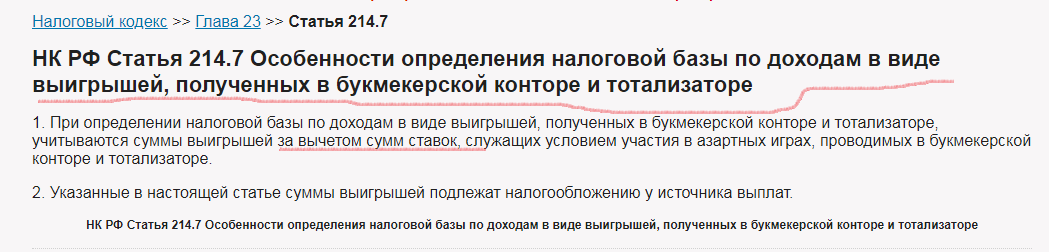

In a letter from 27 june 2018 r. № 03-04-05/44417 The Ministry of Finance spoke about the peculiarities of paying personal income tax from the amount of winnings, obtained from participation in gambling, carried out in the bookmaker's office and the totalizator.

So, according to paragraph 1 articles 214.7 NK RF (as amended by the Federal Law of 27.11.2017 № 354-FZ) tax base for personal income tax with winnings, equal or exceeding 15 000 rubles and received from participation in gambling, carried out in the bookmaker's office and the totalizator, determined by the tax agent by decreasing the winnings by the amount of the bet or interactive bet, serving as a condition for gambling.

In this case, the amount of tax in respect of income in the form of winnings is calculated by the tax agent separately for each amount of winnings.

The date of the actual receipt by the taxpayer of the specified income is determined as the day of its payment, including transfers to bank accounts or on behalf of the taxpayer to the accounts of third parties (subparagraph 1 paragraph 1 articles 223 NK RF).

Car winnings tax

Sometimes citizens can win valuable prizes. Joke Of Cars Quite Often. Receiving the goods, not a cash prize, does not exempt citizens from the need to pay tax.

Estimate the amount, to be paid, can be done in two ways:

- The lottery organizer announces the market value of the car, from which you need to subtract 13% to transfer money to the state.

- If the operator has not provided such information, you can contact an independent company, which will assess the value of the vehicle.

Automobard

Its useful to note, that citizens do not always have the required amount. Then they can sell the car and pay tax on the amount received.. If the payment terms are "hot", then it is allowed to apply to car pawnshops. There, employees will quickly assess the cost of the car and offer up to 90% from market value. Payment usually takes place on the spot in cash. But before that, you need to register the car yourself, otherwise the transaction will be considered invalid.