What to do, if the win is too big

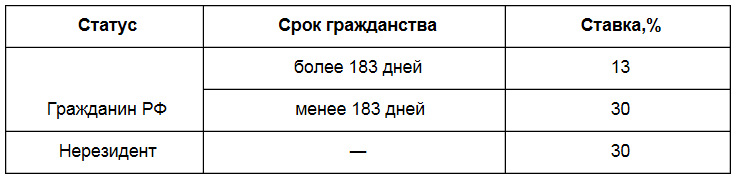

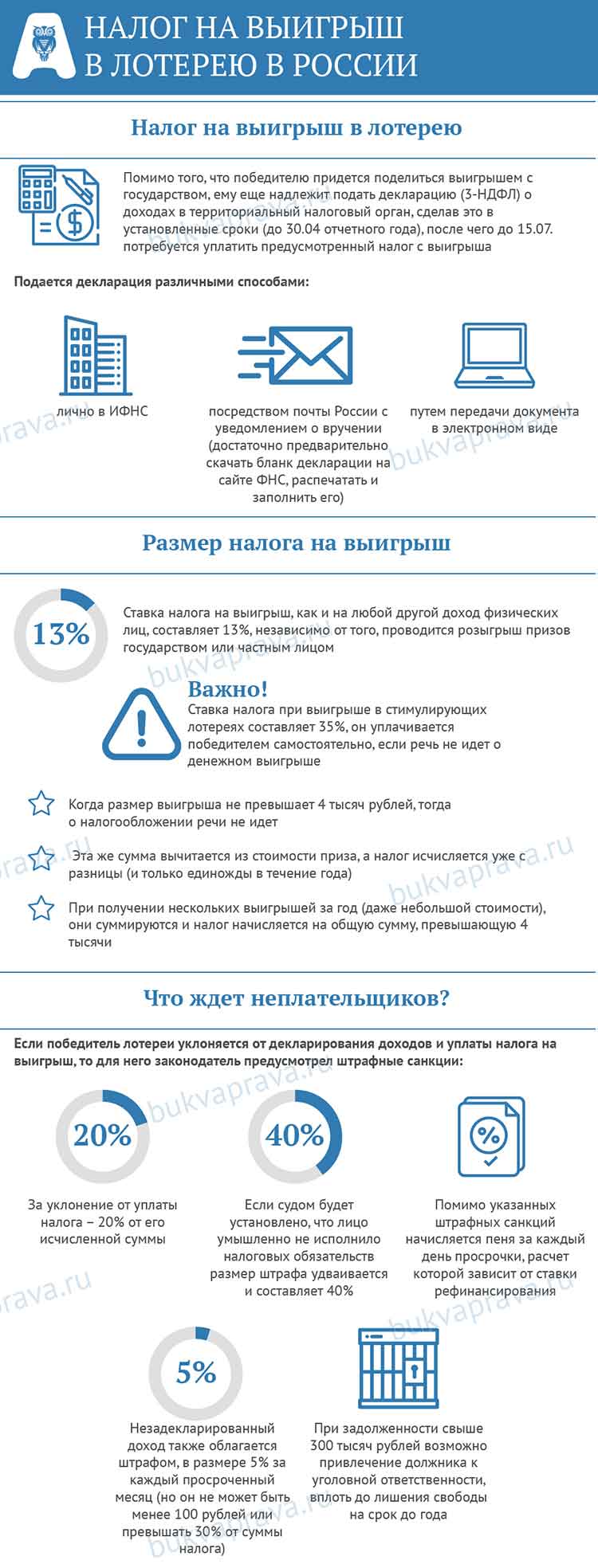

Налоговая ставка не зависит от размера выигрыша.

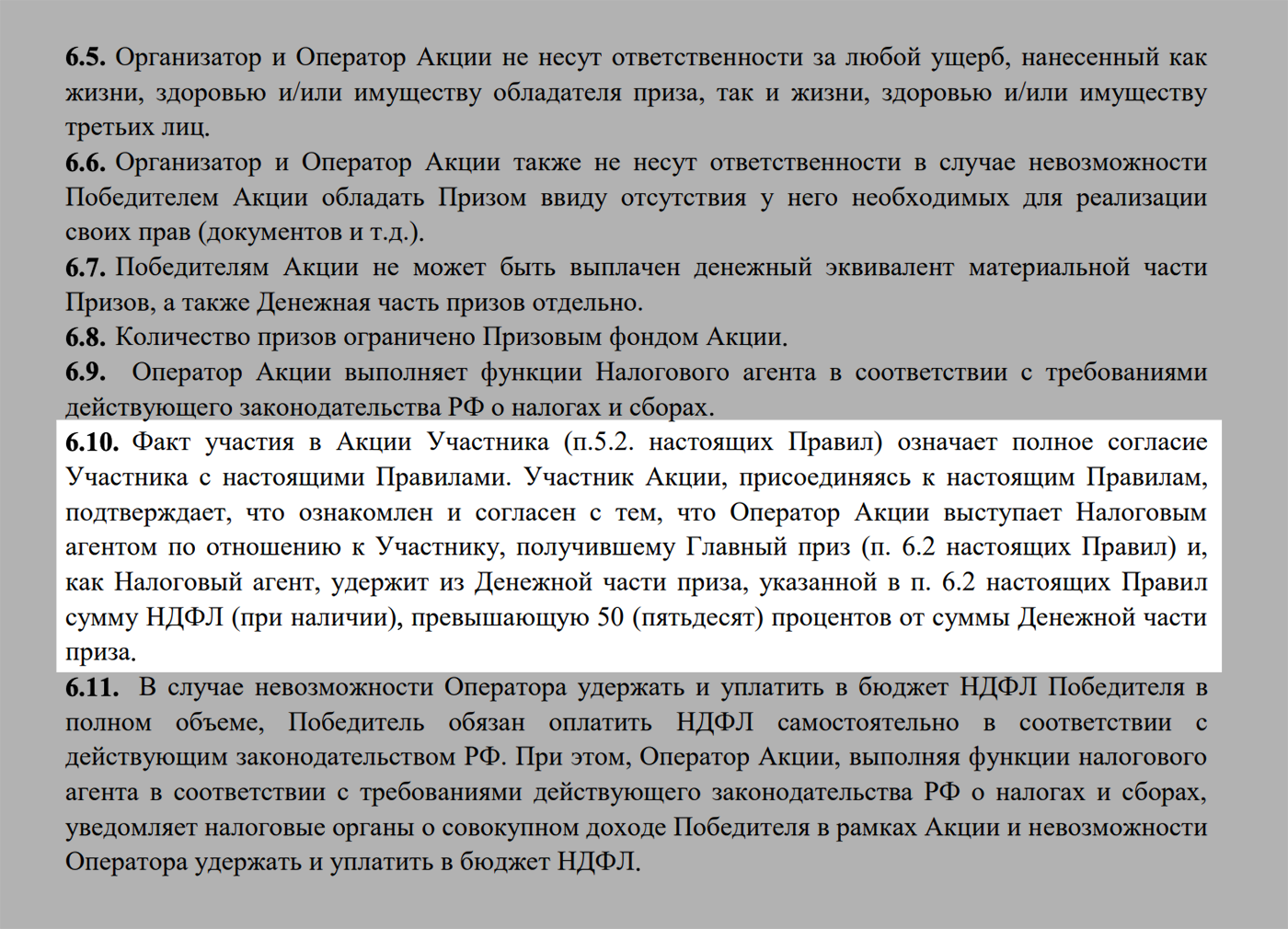

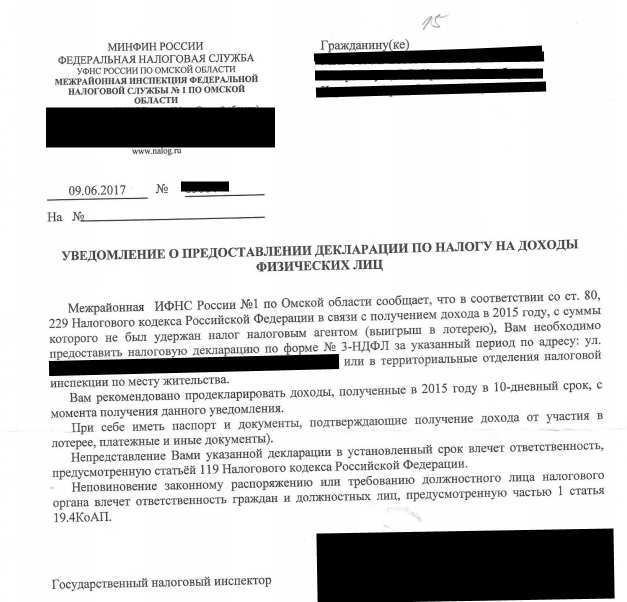

But, если выигрыш свыше 15 000 Р, perhaps, вам не придется за него отчитываться и платить налог самостоятельно. За вас отчитаются и заплатят, если вы выиграли в российскую лотерею или в легальной букмекерской конторе. Организаторы рекламных акций отчитаются и заплатят за вас независимо от размера выигрыша.

Вы выиграли в лотерею 1 000 000 Р. Сдавать декларацию и платить ничего не придется. В этом случае организатор лотереи является налоговым агентом. Он выплатит вам 870 000 Р и отчитается перед налоговой.

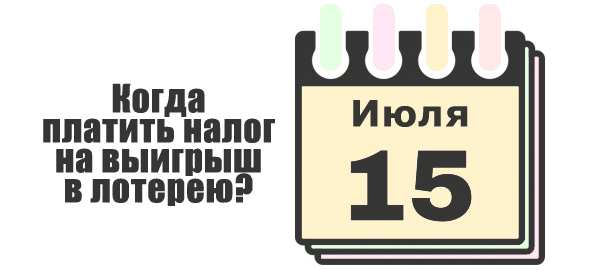

Вы выиграли джекпот в казино — 10 000 000 Р. To 30 апреля следующего года вы самостоятельно их декларируете, а до 15 июля платите 1 300 000 Р. Если проиграете деньги обратно — останетесь должны государству. Поэтому лучше сразу откладывать суммы налогов и не трогать до момента оплаты. for example, open a savings account: тогда еще подзаработаете на процентах.

Is it possible not to pay tax or reduce it

If your winnings or the value of the prizes received is less 4000 R for yr, You do not need to pay personal income tax - this is the amount, which is tax-free. If you got more, you can subtract these 4000 Р.

Do I need to pay tax on winnings over 4000 Р, depends on, where and how much did you win. Sometimes tax agents pay for you - they will deduct personal income tax upon payment. But in some cases, you need to pay the tax yourself.

When you can not pay personal income tax for winnings yourself

| Where did you win | You have to pay yourself | Tax agent pays |

|---|---|---|

| Russian lotteries | 1. Won 4000-15 000 R for yr. 2. Win over in total 15 000 R for yr, but each one-time win was less 15 000 Р. |

Won over 15 000 R for raz. Tax agent - lottery organizer. |

| Foreign lotteries | Won over 4000 R for yr | There are no such cases |

| Legal bookmakers are members of Russian SROs | 1. Withdrawn from accounts 4000-15 000 R for yr. 2. Withdrawn in total over 15 000 P for a year from different bookmakers, but every single withdrawal was less 15 000 Р. |

Withdrawn from the bookmaker's account over 15 000 Р. Tax agent - office. |

| Illegal bookmakers | Withdrawn from accounts over 4000 R for yr | There are no such cases |

| Casino | Won over 4000 R for yr | There are no such cases |

| Promotions and other sources | You received a written message, that the organizer is unable to withhold tax | To 1 March you were not informed, that they cannot withhold tax |

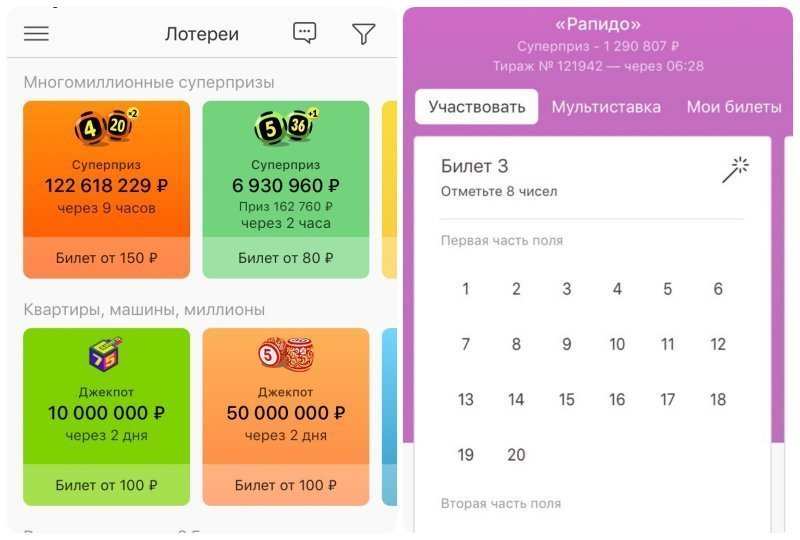

Russian lotteries

You have to pay yourself

1. Won 4000-15 000 R for yr.

2. Win over in total 15 000 R for yr, but each one-time win was less 15 000 Р.

Tax agent pays

Won over 15 000 R for raz. Tax agent - lottery organizer.

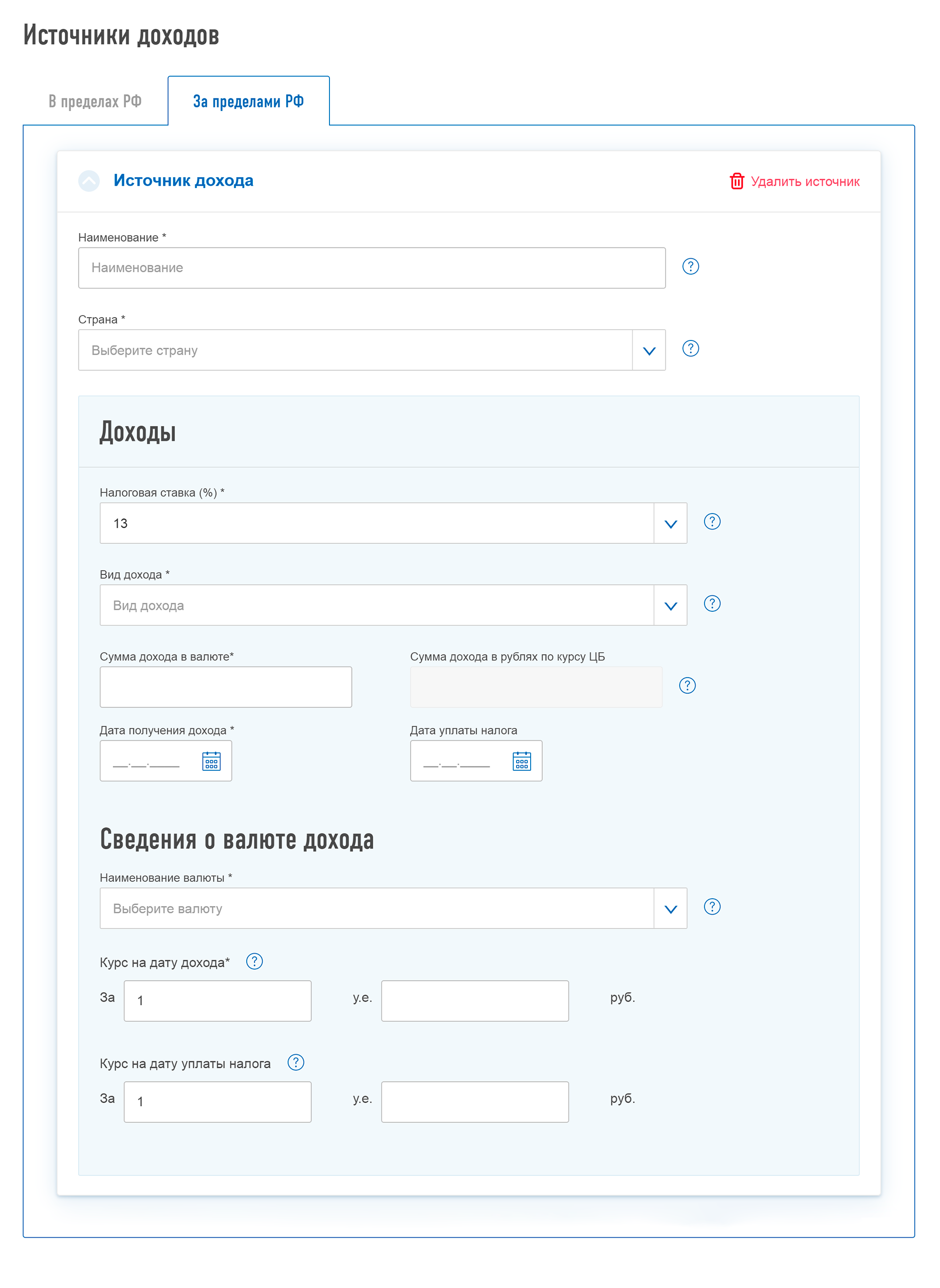

Foreign lotteries

You have to pay yourself

Won over 4000 R for yr

Tax agent pays

There are no such cases

Legal bookmakers

You have to pay yourself

1. Withdrawn from accounts 4000-15 000 R for yr.

2. Withdrawn in total over 15 000 P for a year from different bookmakers, but every single withdrawal was less 15 000 Р.

Tax agent pays

Withdrawn from the bookmaker's account over 15 000 Р. Tax agent - office.

Illegal bookmakers

You have to pay yourself

Withdrawn from accounts over 4000 R for yr

Tax agent pays

There are no such cases

Casino

You have to pay yourself

Won over 4000 R for yr

Tax agent pays

There are no such cases

Won Promotions and other sources

You have to pay yourself

You received a written message, that the organizer is unable to withhold tax

Tax agent pays

To 1 March you were not informed, that they cannot withhold tax

Winnings in casinos and lottery cannot be reduced by the amount of bets, the ticket price and even more so for the amounts lost in the same year.

Oleg bet at the casino 100 000 P and received 200 000 Р. The tax he must pay with 200 000 Р, although in fact only got rich by 100 000 Р. If you have not won anything else during the year, he will pay: (200 000 − 4000) × 0,13 = 25 480 Р.

Nikita spent a year on lotteries 10 000 Р. I won several times, in total it turned out 5000 Р. Although in reality he is in the red, he still has to pay the state: (5000 − 4000) × 0,13 = 130 Р.

Standard, property and social tax deductions are not applied to winnings from gambling and lotteries.

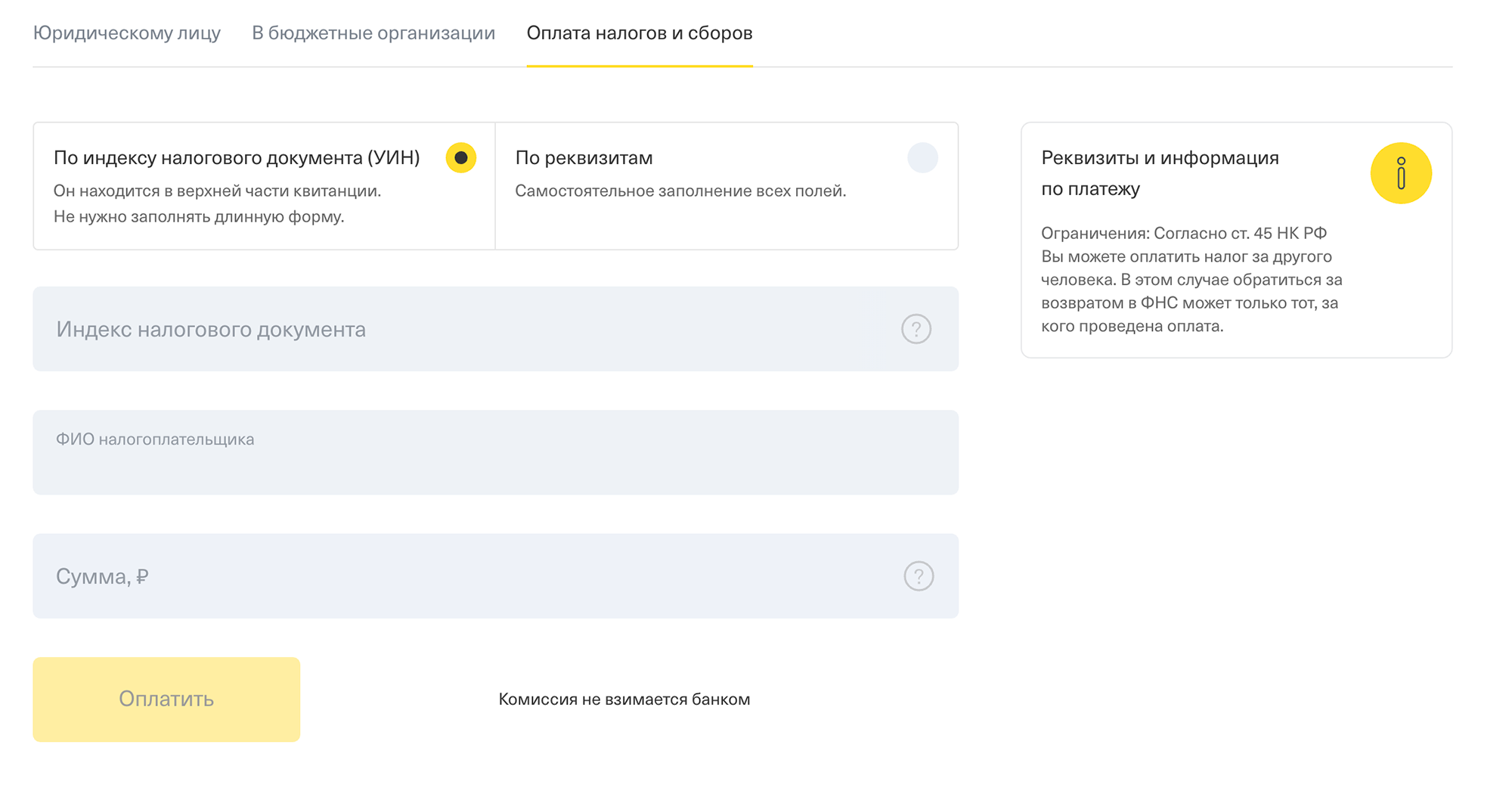

How to pay lottery tax - step by step instructions

There are different ways to do this.: Internet bank, operators in bank branches, special terminals and so on. Worth considering, how to pay tax correctly, if a citizen won an apartment, since there are no problems with receiving a cash prize.

-

Step. Registration of a real estate object for yourself in Rosreestr.

-

Step. Contacting an appraisal company, to clarify, how much is the apartment.

-

Step. Home sales (if the citizen does not have the required amount to pay). Better to contact the staff of the real estate agency, to make the implementation happen quickly. When you urgently need to sell your home, then you can talk with the realtor. Real estate agencies carry out the purchase of apartments on 15% — 20% below their market value.

-

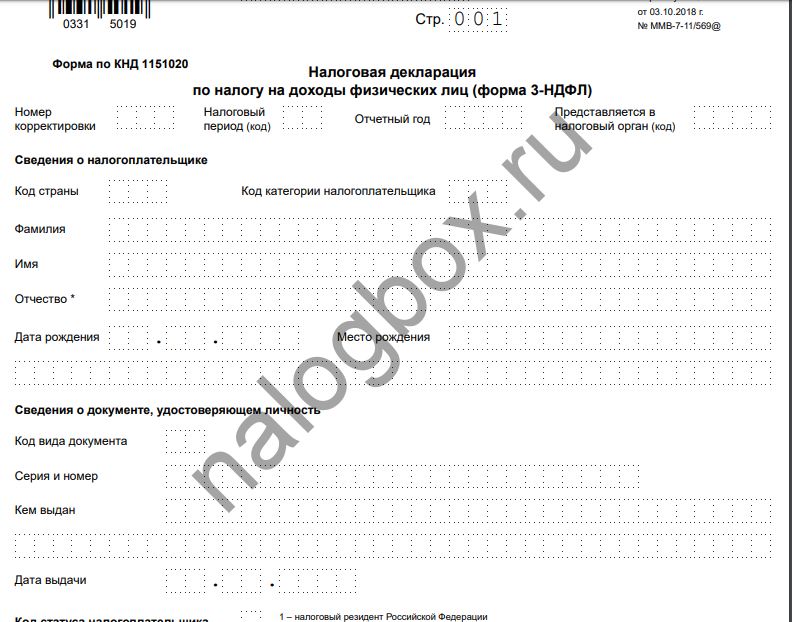

Step. Filling in a tax return in the form 3-NDFL. It's easy to do it yourself, by downloading the corresponding program on the FTS website. She is simple, you only need to follow the instructions.

-

Step. Provision of documents to employees of the Federal Tax Service and payment of tax in any convenient way.

In this way, tax payment process is not a problem. But often citizens are interested in reducing the amount, which needs to be given to the state. Ways to consider, which are allowed to use for this.