What will happen, if you don't pay taxes on your poker winnings

Как ни парадоксально, запрет в РФ азартных игр на деньги не отменяет обязанности участников декларировать выигрыши для целей НДФЛ и платить налог.

Если не платить НДФЛ, то при значительных суммах выигрышей недоимка может повлечь уголовную ответственность. Tax debt is considered large, equal:

- 900 тысячам рублей, если это превышает 10% от величины налогов к уплате за три года;

- 2,7 млн рублей без привязки к годам и процентам.

Минимальное наказание — штраф в 100 000 rubles, максимальное — тюрьма на год.

Если же недоимка по НДФЛ не дотягивает до уголовки, то налоговый штраф — 40% from the sum. Отдельно оштрафуют за непредставление деклараций по НДФЛ: начислят 5% от неуплаченной в срок суммы налога за каждый полный или неполный месяц просрочки, but not more 30% величины недоимки и не менее тысячи рублей.

Сам НДФЛ взыщут в любом случае: that in criminal prosecution, what with tax. You can avoid punishment, voluntarily paying arrears, пени и штраф.

true, according to judicial practice, пока в опасности только игроки, которые участвуют в крупных легальных офлайн-турнирах. Отечественные и зарубежные организаторы оглашают как ФИО счастливчиков, так и величину выигрыша. Дальше — дело техники.

Громкий и единственный на сегодня случай был в Чувашии. Tax officers, finding a player among the winners, потребовали от него доплатить около 4,5 млн рублей НДФЛ и пеней. Не дождавшись денег, ИФНС передала материалы в следственный комитет, he opened a criminal case, а потом и вовсе объявил покериста в федеральный розыск.

А еще игра в покер на деньги без декларирования выигрышей может стоить госслужащему должности. Так случилось в Димитровграде Ульяновской области: одного из муниципальных начальников уволили за то, что он не показал в служебной декларации выигрыши от участия в официальных офлайн-турнирах по покеру. Проверка узнала об этом легко: все было на сайтах соревнований.

FAQ on paying taxes on winnings at online casinos

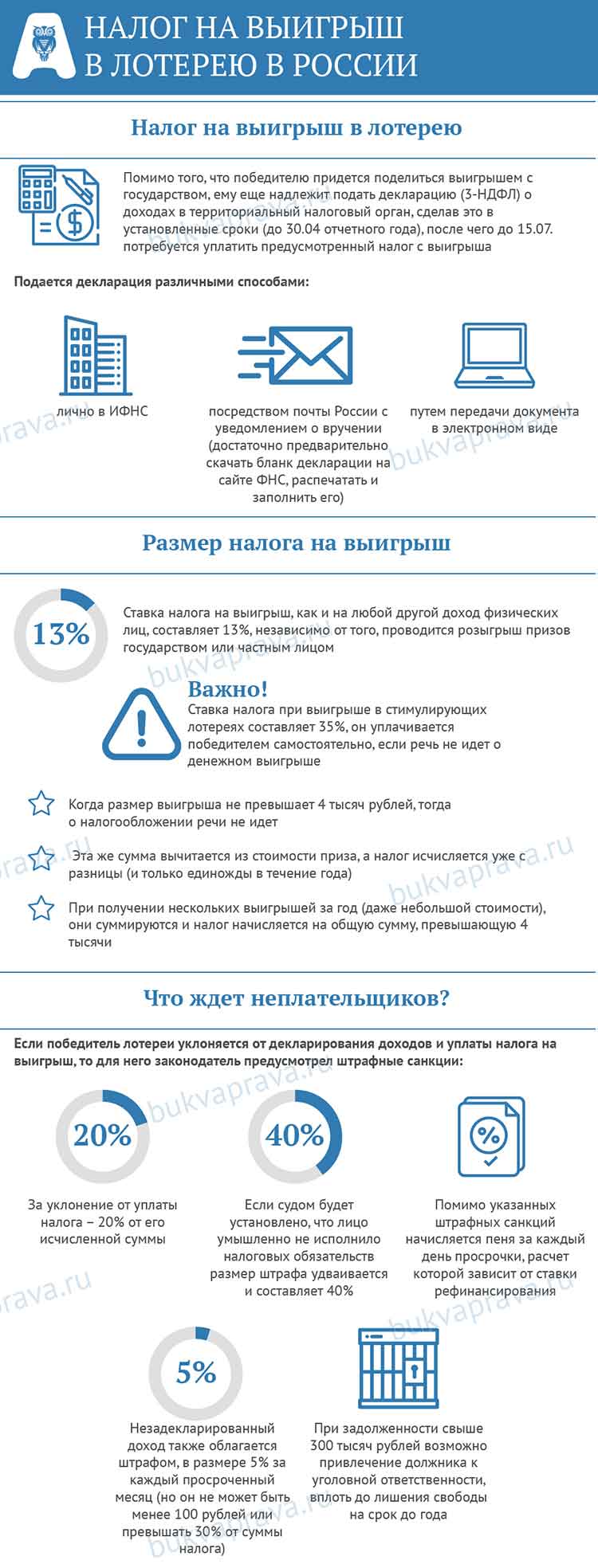

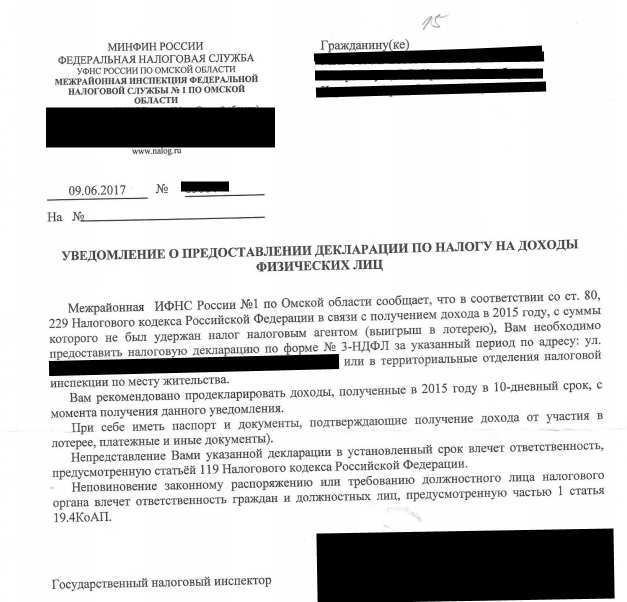

HOW TO SUBMIT A DECLARATION?

- in person at the department;

- through the electronic reporting system;

- by mail, by sending a letter with a 3-NDFL form.

WHEN TO PAY?

The declaration must be submitted before 30 April * this year (by income for the last year), and pay no later than 15 july.

* Due to the pandemic, the Government of the Russian Federation extended the deadline for accepting reports in 2020 year before 30 july.

WHAT TO CONFIRM?

Bank statements.

IS IT POSSIBLE NOT TO PAY?

You are required by law to pay taxes. If you deviate from these obligations, this will entail first the accrual of fines and penalties, and then - confiscation of property and criminal liability.

VD_1

Some online casinos themselves "take the initiative" and take the tax levy in advance, deducting a specified percentage from the account balance. Know-how of today - account replenishment including taxes. Caution: tax on winnings is payable only ex post. Also, online casino is not a tax resident and is not eligible for such activities.

If an online casino is going to take money from you to pay tax, this is 100% fraud.

HOW FTS LEARNS, WHAT I AM DAVIDING TAXES?

Banks collect information on absolutely all receipts to your account and, if requested, immediately transfer it to the tax authorities. If you use a card to play in an online casino, you can be sure, that you already have a profile.

VD_2

The same goes for payment systems, which are tied to the state bank (QIWI, Yandex money, WebMoney).

ARE THERE ELECTRONIC WALLETS, WHICH DO NOT TRANSFER INFORMATION TO THE CONTROLLING BODIES?

Yes, these include Skrill and NETELLER. They work according to European law and do not transfer information to third parties.

WHAT IS THE PERIOD OF TAX CRIMES IN THE RF?

De jure - three years, but in fact there is no statute of limitations. It's just that the classic statute of limitations is the time since the offense was committed., and in the Russian Federation - from the moment of detection. In other words, the inspection can raise the history of transactions on your account for 20 years, find offense, and only after that the three years will start to count.

and is the perfect solution for players of any suit

Never mind, do you while away the evenings at the minimum rate, hunt for a clearing of crystals in “Space Wars” or sit down to “just try” - e-wallets will bring you a lot of benefits:. 1

1

Do not transfer information to regulatory authorities.

2

Guaranteed instant cashouts and deposits. Won, and no need to wait.

3

Provide maximum safety: every dollar in the wallet, as in the safe.

4

Payment systems are represented almost everywhere, where is the money game.

5

They have a VIP program, allowing to reduce commissions to zero.

Our loyalty program gives you access to special privileges:

- VIP statuses on favorable terms;

- verification in just a day;

- online help 24/7;

- individual analysis of cases of any complexity.

How to calculate gambling tax?

Equipment tariff rates can be fixed or dependent on the amount of taxable equipment. In each case, you should familiarize yourself with the current legislation of the country.

The last topic of discussion on the global gambling market was the legalization of betting in the USA. Law, acting with 1992 of the year, overturned the Supreme Court. The market is now open to local and foreign operators, and American residents will be able to legally make bets with bookmakers.

What lotteries are held in Germany, who is their owner, what are the winnings.

Lotteries in Germany very popular and have been held for the last 400 years. Every now and then in special kiosks "Totto" you can see, how people buy lottery tickets. Besides, tickets are sold around the clock at gas stations. Seniors especially like to play. I have seen more than once, how elderly burghers buy tickets for a hundred euros and go home happy.

What the law says?

As mentioned above, when calculating the amount, obligatory for payment of winnings, are guided by certain articles of the law and rates.

Normative base

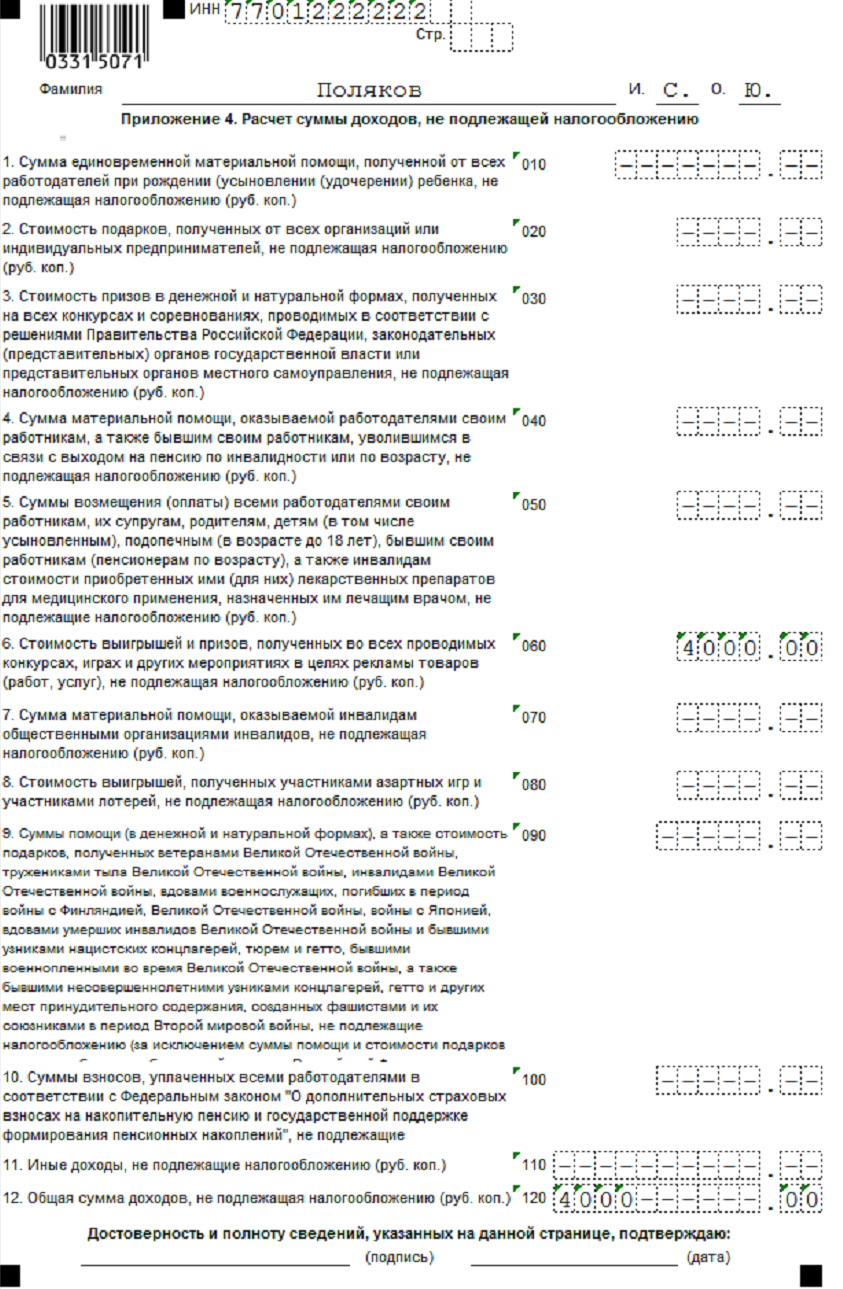

In calculating taxes, the following articles of the law and orders are used:

- Article 214.7 of the Tax Code, ст.217 НК РФ, Article 224 of the Tax Code;

- Letter of the Federal Tax Service of Russia from 17.04.2018 N БС-4-117321@ – содержит основы определения налогооблагаемой суммы.

These are the main summaries, used in determining the amount of tax on the winnings received by individuals.

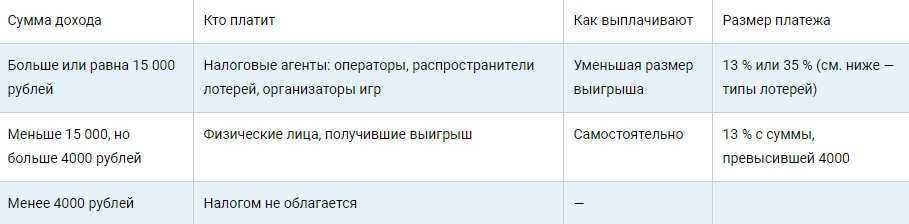

Is subject to?

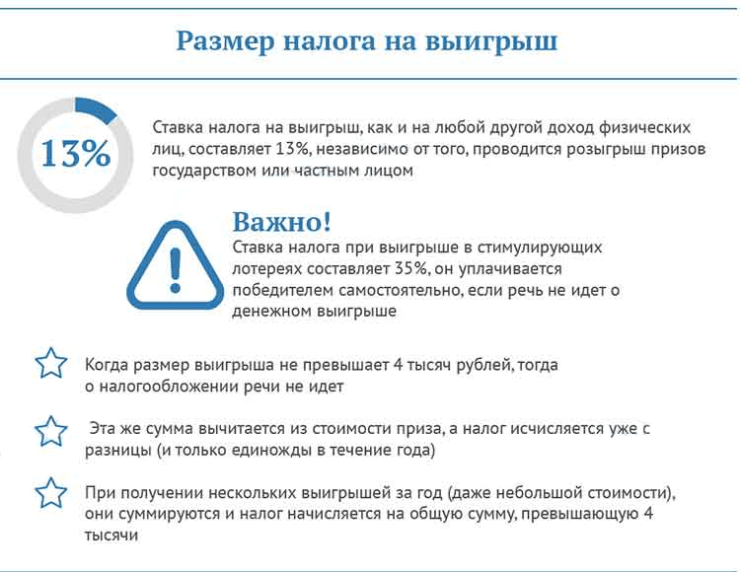

All winnings in Russia are taxed - this follows from the chapter 23 NK RF.

In this case, anyone can take part in the absence of a cash contribution or other actions - the lottery is not related to the payment of a fee from the participants of the drawing (such a win is regarded as a gift).

But at the same time, if you win more than 4 thousand. rubles, individuals are required to pay tax in the amount 13%.

Individuals

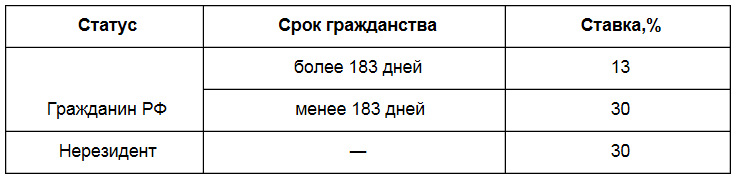

Individuals must pay tax on winnings in accordance with the current legislation of Russia. The requirement is noted here - obligations are imposed on the residents of the country (citizens, living in Russia more than 183 days a year).

If an individual is not a resident of Russia, the tax percentage is fixed at 30%.

Retirees

The pensioner does not have any benefits in relation to the payment of tax on the received winnings. Usually, here are guided by the main provisions of the Tax Code of the Russian Federation.

Minors

The legal representatives of minors under the Constitution of the Russian Federation are their parents., guardians. this implies, that adult representatives must receive the winnings and manage the funds. They make payments based on the presented clauses of the legislation.

An exception for adults is participation in contests or promotions., which are arranged upon the fact of a stimulating lottery - any competitive events from the local administration, school quizzes at city level and others.

The winnings in the form of a gift or offered free services are given to the minor, who can dispose of it at his own discretion without involving official adult representatives.

Disabled

People with disabilities do not have any tax benefits on winnings. Standard rates and other requirements are used here, on timely payment.

FAQ

-

When the Powerball lottery draws take place (date and time)?

Powerball lottery draws take place on Wednesday and Saturday nights, in 22:59 (North American Eastern Time).

-

When the Powerball ticket purchase is closed?

Closing sales varies by state, but in most cases they end an hour or two before the start of the print run.

-

How to win a Powerball prize?

There are nine prize tiers in Powerball. Cash prize can be won, from just matching the Powerball number to the jackpot, for which you have to match all five main numbers and the Powerball. See the Powerball Prizes page for information on all nine Powerball prize categories.

-

What is meant by the term Power Play (Power play) in Powerball lottery game?

Power Play is a special feature of the Powerball lottery game, which allows you to increase your winnings several times. The option is valid at all prize levels, except for the main prize. If you win the jackpot, then your Power Play feature does not apply to it.

-

How to participate in the Powerball lottery, being in the USA?

Each lottery player has the opportunity to purchase a ticket, unless they live in Alaska, Hawaii, in Alabama, Mississippi, Nevada or Utah. Participants from these states are not allowed to purchase Powerball tickets. Residents of all other states America can buy a ticket absolutely free.

There is a way out of this situation - buying a ticket in an authorized state. To do this, players had to go to another state and make a purchase there.

-

In case of winning, how long can you receive payment?

90 days from the date of the draw, in which the player won.

-

Is there an age limit for participants in the Powerball lottery game??

According to the rules of the Powerball lottery, the player must be of legal age. For some states, enough 18 years, others do not allow persons to play, not reached 21 of the year. Before starting the game, this point should be clarified.

-

What are the taxes on American Powerball prizes?

No tax on winnings - California, Florida, New Hampshire, Pennsylvania, Puerto Rico, South Dakota, Tennessee, Texas, US Virgin Islands, Washington State, Wyoming.

The rest of the states assume the payment of taxes from 2,9% to 8,82 %.

-

What is the chance of winning a Powerball prize??

The probability of winning any Powerball prize is 1 to 24,87. The probability of winning the jackpot is 1 to 292 201 338.

-

What is the minimum Powerball main prize?

40 million dollars.

-

Whether the number of accumulations of the main prize or its size in Powerball is limited?

No. If none of the participants can guess the whole winning combination, then the main prize accumulates indefinitely. That is why Powerball has such record jackpots.

-

What is the size of the largest grand prize, received in the Powerball lottery game?

Biggest Powerball jackpot ever won 13 january 2016 r. Main prize in size 1 580 000 000 $ was split in three ways following the sale of winning California tickets, Florida and Tennessee.

-

What is the price of a Powerball lottery ticket?

Tax by type of win

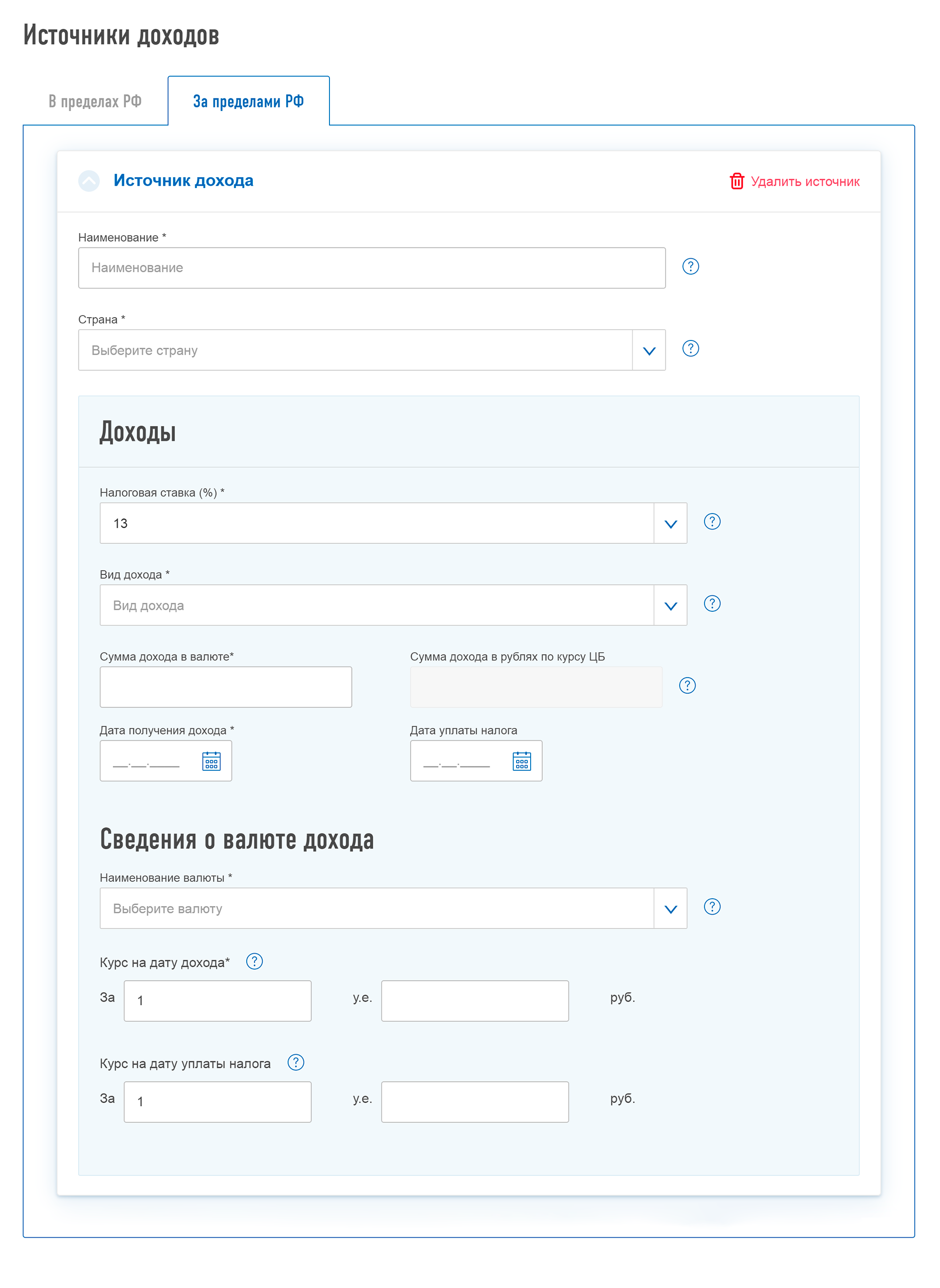

Foreign Lottery Tax

If a resident Russia is lucky in a foreign lottery, then there may be one not very pleasant moment. Namely double taxation. You will give part of the winnings to the treasury of that country, which holds the draw, and then the tax service of Russia will bill you.

In order not to be left without most of the winnings, there are two points to be clear:

- At first, there is a list of countries, with whom an agreement was signed on the elimination of double taxation, that is, you pay tax only once.

- If fortune smiled at you in that country, which is not included in this list, in this case, many companies offer their clients to remain incognito. Doing so or not will depend on your honesty.. You must always remember, что уклонение от налогов может понести административную или уголовную ответственность.

Tax on winnings at the bookmaker's office (phonbet, league bets and others)

Over the past year, bookmakers have become very popular in the country, such a surge was largely due to the, that bets have entered the online space. And of course, in Russia there is a tax on winnings at the bookmaker's office.

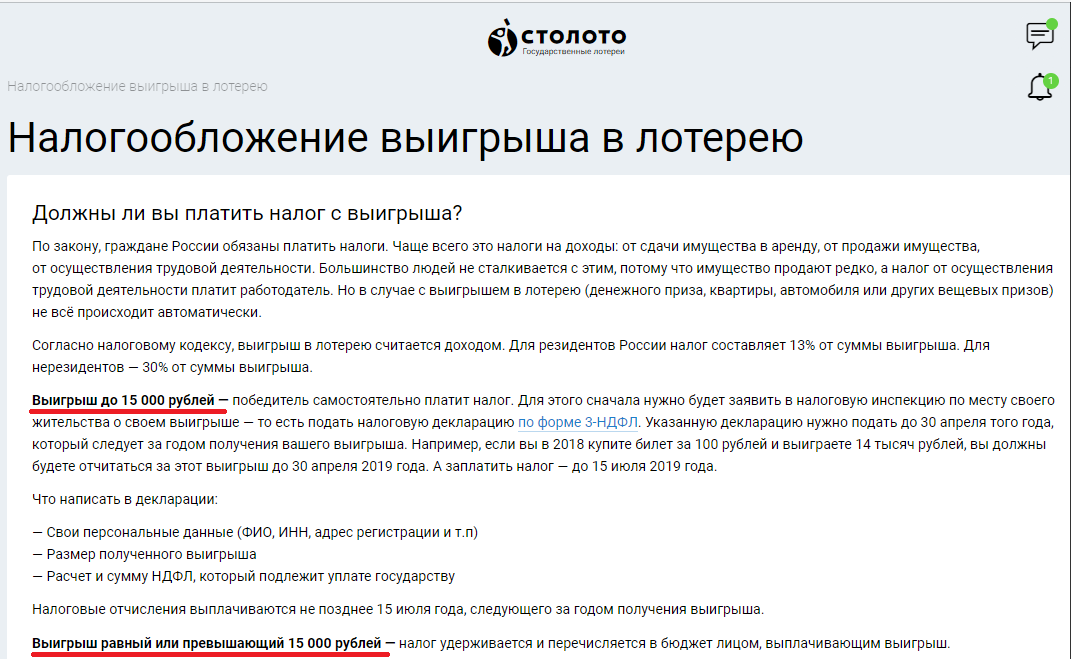

IN 2019 year, changes were made to the Tax Code, according to which, winnings at the bookmaker's office are taxable, if the sum is 15 thousand. rub. and higher. In this case, the person will receive the won amount already minus 13%. If the winning amount is less than 15 thousand, the bookmaker pays it to the client in full, well, at the end of the year, this citizen will have to independently make a deduction to the tax service.

Casino winnings tax

And although on the territory of our country the casino is prohibited, except for specially designated play areas, there are online roulettes and sweepstakes, and so far no Criminal, neither the Administrative Code significantly affects their activities. Most online casinos are registered offshore, and the money turnover is in the billions.

Tax on winnings at casinos in Russia as well 13%, but the payment is on the player's conscience, and more often than not people go for all possible tricks, just not to give the due part to the State. If you take legal machines, then here the amount is less than 4000 rubles are not taxed. If the size of the plucked jackpot is larger, then with the state you must share and separate the 13%.

Car winnings tax

How to pay tax on winning a car or apartment, after all, you cannot separate part of the living space and give it to strangers? Here, the same rate applies as for a cash win, is it or 13 or 35% from the value of the win.

The cost of the prize won is reported by the organizer of the drawing and of course confirms this information with documents. If the owner of the lucky ticket does not have the amount to pay the tax, he can put his prize up for sale, and then get the amount minus tax contributions.

Tax on prizes in promotions

Washing machines are very often raffled off prizes, TVs, computers, fur coats and other "clothing" lots. In this case, you will not be charged tax., but the organizer conducting this drawing will notify the tax office of the income you received and the impossibility of withholding tax. After that, all responsibility and obligation to pay tax falls on your shoulders..

By law, the bet on promotional draws is 35%. To clarify the amount, you must also contact the organizer, ask them for a check or any document confirming the value of the prize. When, if you agree with this amount, there is always an opportunity to contact independent appraisers.

What to do, if the prize is too expensive?

For example, you won a studio apartment, and the organizer provides you with documents, where its cost is indicated in 10 million rubles. Although the market value does not exceed two. There is no time for joy and celebration of victory., because you need to pay tax on property gains in the amount of 35 %.

There are several options here:

- Conduct an independent appraisal and try to prove in court the fact of an illegal increase in the value of the prize.

- You can also pay this amount, well, or refuse to win at all.

What income does the bar apply to??

The Tax Code provides for a number of grounds, at which the bar acts in 4 thousand. rubles. Among them it should be noted:

- Gift cost, received from individual entrepreneurs or companies

- Winnings value, received through the competition

- Winnings value, received in the lottery, gambling

- The amount of material assistance from the employer to the employee

- Prize value, received within the framework of competitions and contests under the auspices of the state

There is a very important detail here.. Plank c 4 thousand. rubles, which exempts a citizen from paying income tax, applies to each of these grounds. Simply put, then for a certain tax period a citizen can receive a gift for 4000 rubles from the company, win more 4000 rubles in the competition, acquire 4000 rubles thanks to the lottery, get rich on 4000 rubles, using the help of your employer. And he won't have to pay taxes, since in each case the amount does not exceed the established bar.

By the way, if you look at the conditions of the draws from various companies, then often the potential gain per person does not exceed 4000 thousand. rubles. In this way, companies protect potential participants from having to give away part of their legal winnings.

Who runs lotteries in Germany

German lotteries are monopolized by the state. It means, that there is only a state in Germany or, to clarify, every single land, can run a lottery. There are also private lotteries, but the rally itself is still held by the state. The basis for such rules is quite weighty.: in this way the state is trying to protect gambling burghers from fraudsters. Besides, the state guarantees, that the proceeds from the lotteries will only go to social needs, and not in the pocket of their founders. Half of the income goes to the winners, the rest is spent on sports, art, environment.

There was also a lottery in the USSR., similar to german. Draws were held on Sundays, and it was called "Sportloto". Each number corresponded to a particular sport. You could play "5 out of 36" or "6 out of 45".

There are also sites, through which you can participate in the German state lottery. But for this you need to have a German residential address.